#SMB, an abbreviation for Small & Medium Business, is a major economic actor around the world. Statistics from OECD conclude that 99% of the enterprise within the OECD is comprised of SMB. The United States told us the same thing, 97% U.S. enterprises are firm with fewer than 500 employees. Furthermore, SMB has a major role in developing countries and emerging market, in which they account for 60% total employment and up to 40% national income. From here, we can conclude that SMB account for more or at least up to 50% of economic across developing and or developed countries. This means that if they fail, the country could fail too.

SMBs is the majority. Source: ISO

We can look at how SMB play an important part when a country was facing a crisis, by looking at Indonesia post-Soeharto era. The failure of the #Soeharto government around '98 cause many businesses to go bankrupt, mainly those enterprise whom capital came from foreign investment. Because investor didn't trust the government & the situation is very bad for business (according to their judgment), investor take out their money and made those big companies crumbled with no capital to run their business. Inflation was too high, many people start to lose their job.

However, SMB still ran pretty smoothly[1]. Of course, they are affected too, but because they're independent of foreign investment, and because most of the time they do business independently, most SMB didn't go bankrupt. They simply adjust their production, cost, a partnership with a local seller and so on. Because of this, the Indonesian economy can recover quite quickly, thanks to those who ran a small & medium business before the crisis, or after the crisis.

Small & medium business is also known for its innovation in their industry, compared to larger or well-known enterprise. According to the #Payblok whitepaper, they have more patents per employee than large corporations. It is understandable because SMB is forced to be creative and innovative to survive, competing with those big players around the world.

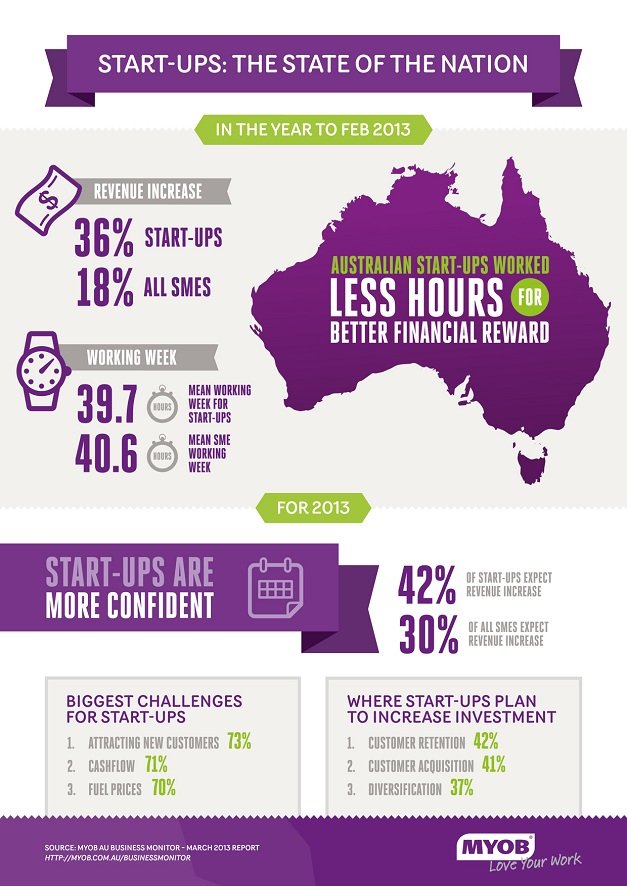

Another statistics about SMBs potential, in Australia region. Source: MYOB

Despite its important role in the country economy & innovation for the future, ironically, SMB face many problems that make them vulnerable to bankruptcy, and other financial crisis right now. These problems are quite complex, without any solution that is effective & efficient to be implemented.

The Problems in the SMB Business

Late Payment

The first problem in the SMB business lies in the payment process of B2B transactions. B2B transactions happen between a business where one of them act as the buyer/seller, to acquire or provide things that other or they need to continue producing their goods or services. When this transaction takes place, it usually neds days or months to be processed, and it means around that time the companies, especially the seller, don't receive the money yet.

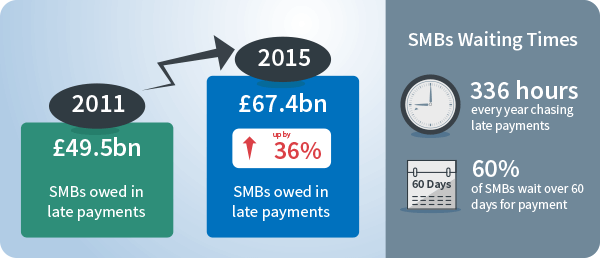

Late payment is considered as a culture, which shows how problematic it is in the industry. Source: Accesspay

A B2B transaction is important for SMB, because it allows them to acquire the necessary materials for production, and then gain profits. Because of its importance, there is some business which focuses solely on supplying goods and services for other business production. However, B2B is only beneficial for both parties if it processed according to the agreement.

According to the statistics in the PayBlok whitepaper, more than 30% SMB business thought late payment processing as a major problem, where around 47% of business deals are paid late. In 2017 in America, around 48% B2B invoices were paid late, in Western Europe, the number is 41.9%, in the Asia Pacific was 44.6%, while in India it reached up to 56.4%. Nearly half of B2B payment around the world were paid late, which is disastrous for SMB because they can't run their business smoothly because of financial problems. Logically speaking, nearly half SMB was in danger of financial problems because of late payment of B2B transactions.

Difficulties on Financial Access

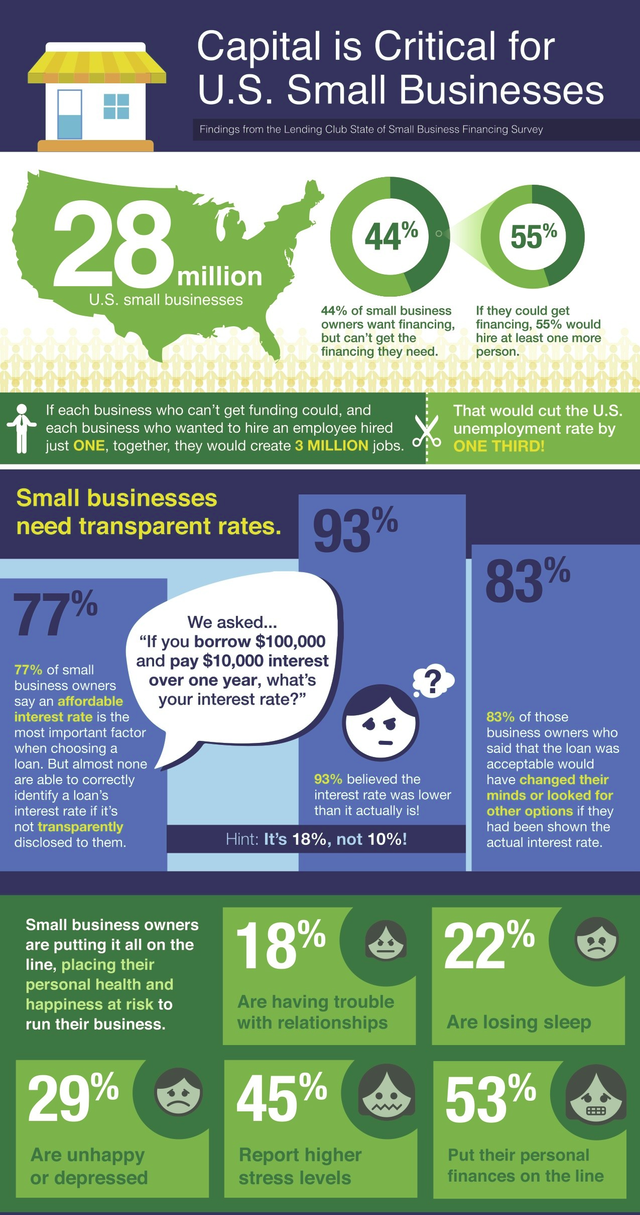

Another problem of SMB business nowadays is the difficulties to obtain capital. Banks tend to avoid lending or giving credit to SMB because the risk is judged too great. After the financial crisis, banks only wanted to give their money to the big business that produces many profits annually, so that they won't lose their money. Because of this, SMB doesn't have a source to gain additional funds to expand their business, they tend to borrow money from friends or family or even their own saving. Eventually, they'll run out of money and therefore the full potential of SMB isn't reached.

Financial access difficulties for SMBs is real. Source: Lending Club

Because the potential of SMBs is big, we have to help them overcome those problems with the necessary solution. Luckily, PayBlok is there.

PayBlok & InstaSupply

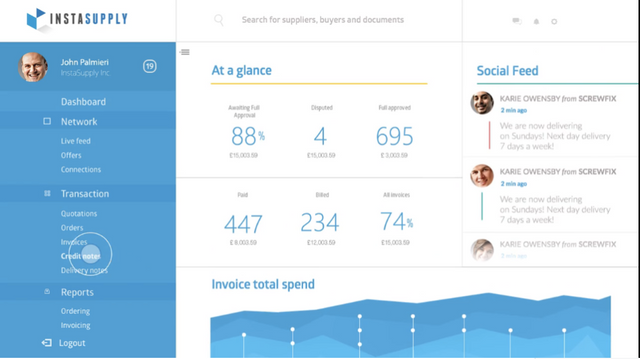

PayBlok is actually a product of InstaSupply. InstaSuplly is a working company that provides a solution for buyers & suppliers to manage their payments and collections. They've processed more than $60 million worth of invoices and servicing more than 2,000 business on the platform. It creates a business network between buyers and suppliers, where they can create, manage, track, and match orders to corresponding invoices and therefore help users to control their spending. By opening up PayBlok, InstaSupply will deliver a new solution to tackle the problems faced by SMBs above.

Decentralizing SMBs

The basic solution (in its simplest sense) offered is by making SMBs financing decentralized. They'll create a blockchain & token to make a further solution possible, which is an integrated payment solution, supply chain financing & asset-based lending. There will be 4 actors on the platform, each acting on their own purpose that will eventually create an ecosystem where SMBs financing become more transparent & removes the risk of late payment or loss.

The 4 actors, or as PayBlok called, a decentralized community on the platform, will participate together on the profit sharing, as a way to incentivize their contribution to the ecosystem. The first is the buyer community, which acts as the parties who raise purchase orders, approve invoices and makes payment in the platform. They have to purchase a monthly subscription package to use the platform. The second is the seller community, that consist of all business connected to #InstaSupply, who receive orders from buyers and/or send invoices to buyers.

The next actor is the investor, who fund invoices at InstaSupply and then get interested for this fund. Investors have to stack tokens (just like sellers) on the platform to access more invoices. The next one is the validator. They have a role in confirming if a purchase order is related to an invoice or not, therefore removing the possibility of a mismatch. Both the seller or buyer can be a validator, and they'll get a reward for their work.

By using the above scenario, PayBlok will be able to make the transactions of B2B between business to be more transparent, liquid, profitable and at the same time removing the risk of late payment. Every transaction will be possible on the platform, without the need to use third-party payment services so that validation of the payment can be done instantly.

Profit Sharing

Some screenshot of the current InstaSupply platform. Source: Capterra

Profit sharing will be calculated using possible routes of activity on the systems, which is based on the buyer's subscription or supply-chain financing. In both routes, participants will be rewarded based on stakes/activity that they did on the system. Not only that, InstaSupply will also increase the speed of invoice approval by using automation policies, so that the chain can run as soon as possible after it was proposed to the network.

Asset-based Lending

Asset-based lending will help business to loan money using PayBlok as a collateral. InstaSupply will lend applicant money, with PayBlok tokens as a collateral, therefore if they can't repay the money lent, InstaSupply will take the collateral. This will be a great solution for SMBs because the process is quite simple compared to the lengthy, difficult and time-consuming process when they loan from the bank or other institutional actors.

Bottom Line

SMBs undoubtedly has many potential and practical benefits for the society, if and only if they're provided with the necessary support for financing. The current platform available is not yet effective & efficient to support SMBs, they also can't depend on institutional figures. Integrating blockchain and tokenizing how SMBs can gain capital and process B2B transactions, is one alternative that's worth to try. PayBlok will be the first one to do so. With the experiences from InstaSupply and the working product, success won't be that far.

[1] http://marketeers.com/mengapa-umkm-jadi-harapan-besar-e-commerce-indonesia/

This is a promotional article. I'm writing this article as part of my contribution for Bounty0x PayBlok bounty. My Bounty0x username is joniboini16. Readers are suggested to read PayBlok whitepaper by themselves to ensure the validity of data written here.

Important links that you should check: