TESCO - A REVIEW ON 2014 BAD ACCOUNTING PRACTICES COMMITTED BY THE UK RETAILER

In October 2014 Tesco faced a formal criminal investigation regarding their accounting practices launched by the Serious Fraud Office leading to £263m profit overstatement. The allegations consists of the first six months figure for the current year of £118 to which £145m were added from previous years. This was committed in order to overstate the performance of Tesco creating a flattering picture if its finances.

Conflicting Interests

Shareholders demand a positive corporate image and high dividend as a consequence to high profits however, this investigation creates a highly negative image for Tesco which the shareholders don’t welcome. The fact that this investigation has drawn such a major attention from the public and the media means that shareholders were inevitably upset about the scandal. Furthermore, the fact that the financial figures we’re forged means that profits were not as high as published and Tesco was trying to hide very low profits; this can further enrage shareholders because their dividend were lowered.

The state demands that Tesco complies with laws and regulations which means that in this instance Tesco committed an illegal action, although CEO Dave Lewis dismissed suggestions that this was a fraud, as there was no financial gain as a consequence of this business decision.

Former CEO Dave Lewis photo credits IBTimes UK

Change of Operational Approach, Aims and Corporate Objectives

Tesco chairman Sir Richard Broadbent stated in 2014 that he will step down the following year as a result of this investigation added to the plunged profits for 92% for the first-half year. Five more executives were suspended regarding this investigation.

Tesco also withheld bonus payments to former finance director Laurie McIlwee and former chief executive Phil Clarke throughout the investigation which shows that the approach which the company is taking is to save money.

Furthermore, (merely as a symbol gesture) CEO Dave Lewis informed the staff that he wants to see effective change in the culture at the company by substituting his limo for public transport (train) in order to save money. The company is also reviewing bonuses and long-term incentives for senior executives which also includes the CEO.

Tesco decrease in market share 2013-2014

Impact on Other Aspects of Business

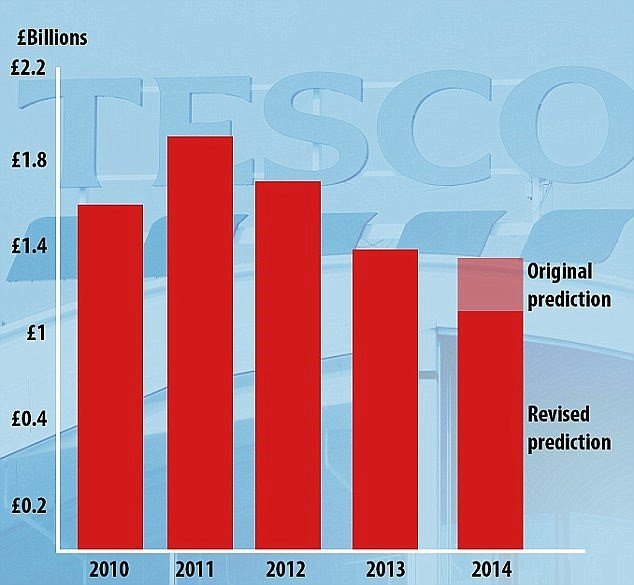

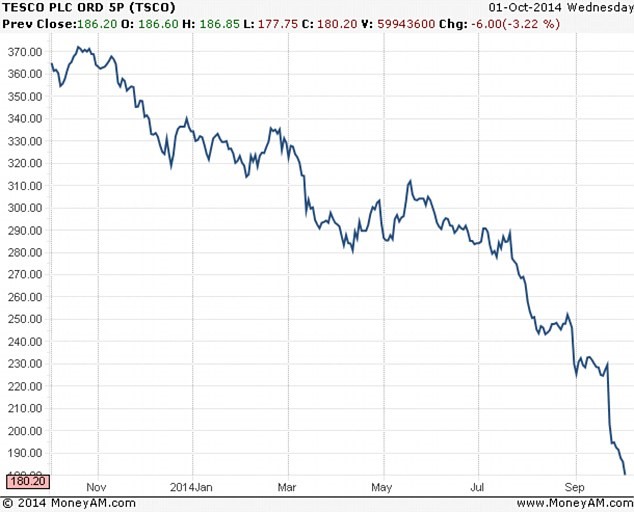

The sale figures for the company plunged by 92% for the first-half in 2014 which means that Tesco is struggling very hard, especially a year after the horsemeat scandal which also caused a significant decrease in profits. Furthermore, the share price of the company dropped dramatically over this investigation.

The public image of the company has been affected dramatically in the period of 2013-14 as a result of these scandals. Tesco will have to work very hard to regain the trust of the public and customers as well as the trust of potential and actual shareholders in order to rebuild their success. The company still holds one of the highest market shares in the country as a result of their previous performance however, in order to maintain this status and to improve it, the company needs to review its actions.

Tesco's half year profits for the last five years, including this autumn's revised prediction

Tesco's share price in the previous year