Most entrepreneurs know about the enormous three money related reports:

Benefit and Loss (Income) Statement

Income Statement (or projection, when utilized for spending arranging)

Asset report

Those announcements are ordered month to month, quarterly and yearly and every give valuable knowledge into the monetary strength of the organization. The brilliant entrepreneur counsels these announcements every month, coaxes out the story that is uncovered and settles on choices appropriately.

Presently assume that your organization intends to dispatch another item and you'd get a kick out of the chance to know when the costs related with item improvement and dispatch will be recovered result deals at a given cost. For that examination there is a fourth monetary report, the Break-Even Analysis, to give essential determining data.

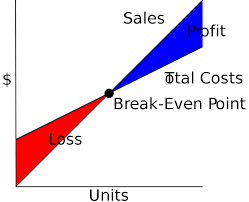

A Break-Even Analysis is directed when another item or administration will be presented, or a capital change will be made. The Break-Even shows the point in time when deals incomes created by the new item or benefit, or the result got from the operational effectiveness that takes after the capital change, measures up to the costs related with the dispatch or change.

Run a Break-Even Analysis to figure out how items and administrations must be evaluated to recover your organization's speculation, inside a given timeframe and realize when the choice to contribute will be situated to procure a benefit. The Break-Even enables leaders to foresee to what extent misfortunes must be managed and how to suspect income.

Earn back the original investment is accomplished when incomes = costs; the business neither profits. Costs of doing business are of two kinds, Fixed and Variable. Settled Expenses are the standard month to month working expenses. These incorporate office space lease, protection, utilities and finance. Variable Expenses are to a great extent fixing to deals: showcasing, deals and promoting costs boss among them.

While computing costs, it is standard to decide the relationship of Variable Expenses to deals incomes. The Variable Expenses sum is separated by the quantity of item units sold, yielding the Variable Cost per Unit.

At the end of the day, Variable Costs = units sold circumstances variable cost per unit. To calculate Break-Even, Total Expenses = Fixed + Variable Expenses (communicated as units sold circumstances variable cost per unit). As usual, deals incomes = unit value times number of units sold.

The Break-Even Point is achieved when:

Value times Units Sold = (Units Sold circumstances Variable Cost/Unit) + Fixed Costs

The distinction between offering cost per unit and the variable cost per unit sold uncovers the sum that can be connected to Fixed Costs each time a unit is sold. Consider it along these lines: if month to month Fixed Costs are $2000 and the normal cost of your item units sold is $2, with a normal Variable Cost of $1 every, when you offer a unit, you procure $1 to apply to Fixed Costs. With month to month Fixed Costs of $2000, Break-Even is achieved when the business offers 2000 units for each month.

Knowing what number of units must be sold every month to accomplish Break-Even is fundamental for viable money related administration of the wander. One can likewise compute Break-Even as far as dollars that must be produced every month. In this case, Break-Even Revenue is accomplished at $4000 in month to month deals, since the business cost is $2/unit and 2000 units must be sold every month to cover costs.

An essential learning of the procedure of business money related computations and the capacity to translate the information produced are must-have aptitudes for all entrepreneurs and Solopreneur specialists. While doubtlessly one's clerk or bookkeeper will play out the Break-Even Analysis on Quickbooks by connecting to numbers got from the P and L Statement, it is dependably to your greatest advantage to see how the estimations are comprehends what the money related records uncover.

When it is suggested that another item or administration may be sold, which may be the improvement of another workshop to propose and educate or some other elusive administration, a Break-Even Analysis will demonstrate what number of units must be sold, billable hours created, or classes must be instructed before the creation expenses will be recovered and the new offering will be situated to produce ROI.

A debt of gratitude is in order for perusing,

Very good article about finance managment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit