$484K in debt and a plan. My name is Jerry Banfield and I have $484K in debt right now at 35 years old. This post is my plan to erase the debt along with my experience as to how I got in this much debt.

I hope this will be really useful for you if you are in debt yourself and looking for some hope.

I'd love to hear your story on the blog/video. Please share a comment and tell me where you're at today so we can help each other.

If you want to see as the debt drops, subscribe to my YouTube channel and you will love following the journey that we go on together showing you how I have faith and what actions I take to get out of $484K in debt and a plan.

First, in this post, we'll do the following:

My story: How did I get this far into debt from $0 in debt at age 18? How much are my monthly payments? What's my credit history? What are the interest rates?

I'll show you all of that because you're getting debt-free, a key part of the process is getting transparent, talking, and asking for help. Right now, I have $484K in debt and a plan.

I'm leading by example here and this is what really works. I will show you the ways out. What I'm doing here is part of the way out by just getting honest, being open about this and asking for advice.

If you've got any suggestions, please leave a comment. I am valuing your opinion and whatever you think I can do. That's how I've been able to have faith and certainty that there is a way out.

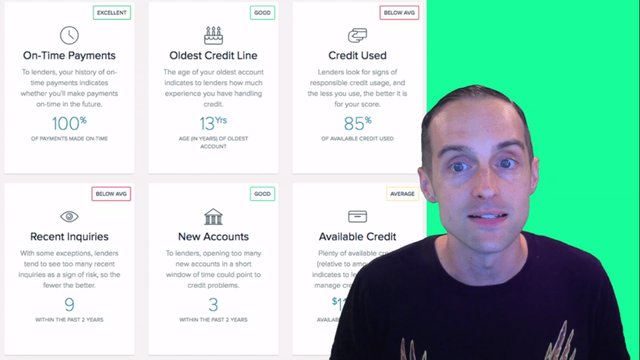

What I'm most proud of in regards to all this debt is that for the last 13 years, I've made 100% of my payments on time. $484K in debt and a plan.

I've never missed and do not intend on missing any payments for my debt. $484K in debt and a plan. I honor my agreements and I think it's important if you're going to borrow money to pay it back.

What are the 3 steps to freedom that I am taking myself in this post and committing to you going forward?

#1 is Taking Inventory.

I did not realize how much debt I had until about an hour ago when I went and added all this up.

#2 is to Ask For Advice

Asking for advice instead of asking for money is one of the top lessons I've learned out of this.

#3 is to Get Into Action.

Just sitting around, praying, and asking people for advice is not going to fix it. Fixing it involves taking some action and this post is a part of my action.

Let's look at the story here as to how I got into this position which I hope you can relate to and it will be interesting to leave you feeling better with a little bit of hope if you are thinking your debt situation is hopeless.

$484K in debt and a plan.

Also, there's a blog I recently made that will help you know How to Succeed at Everything Online!

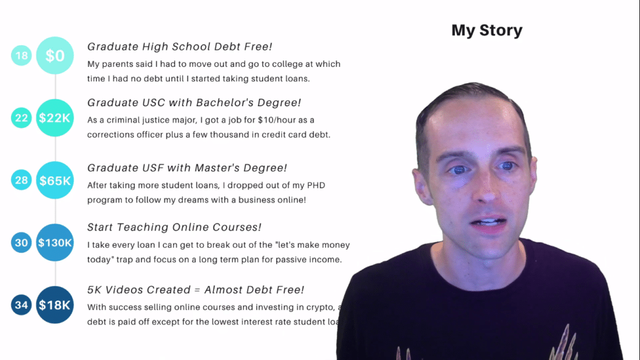

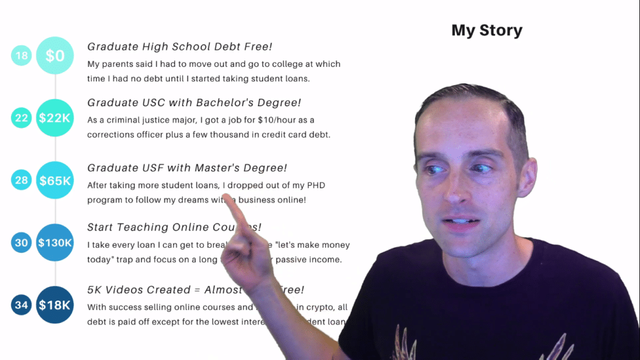

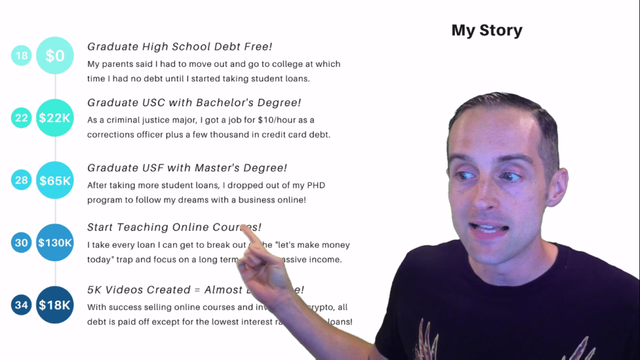

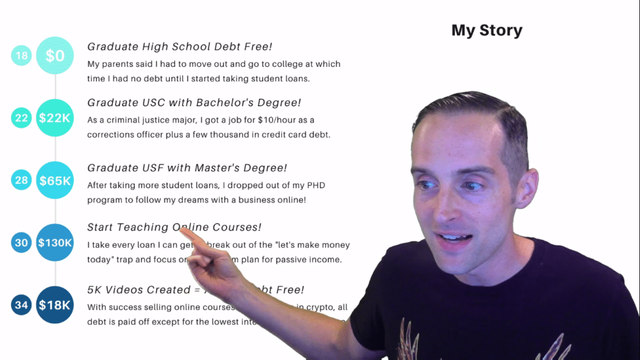

At 18 years old, I graduated high school debt-free, only operating in cash, no credit cards and I followed advice from other people. My parents, family, and friends said, “Go to college. You've got to go to college”.

My parents said I had to move out and go to college. I found scholarships in financial aid but they weren't enough to cover everything. Therefore, I started borrowing student loans. I bought very conservatively and did everything I could to reduce the amount of money I spent in college.

I lived broke, ate broke and was all a part of that. I didn't have any money or lifestyle and I graduated from USC in South Carolina with $22,000 in student loan debt. I ended up risking my life as a correction officer for $10 an hour and racking up some credit card debt.

After getting in and out of that I became a police officer, leveled up my earnings, went kind of crazy, quit my job, moved home with my parents and went to graduate school because I thought, “Well if I really want to earn better money, I need more schooling”.

$484K in debt and a plan. I borrowed more money to go to graduate school and I also started my business online. When I was 28 years old, I graduated with a master's degree from USF in South Florida and Tampa.

I took out more student loans and I dropped out of my Ph.D. program including quitting my job that was making the only money I was getting consistently because my business was not profitable.

I quit following my dreams to build a business online with mounting student loans and credit card debt. Right now, I have $484K in debt and a plan.

As I got to 30 years old, life started to look pretty hopeless for me both personally in terms of my marriage, health, business, and my relationships. Everything I cared about was falling apart.

That's when out of desperation I prayed to God to do anything to get sober which I could see was my biggest problem. I went to Alcoholics Anonymous after the thought came that “That’d be a part of anything” and I started to get my life together across the board.

What I saw is that if I didn't stop thinking long-term, if I didn't keep focusing on making money today and instead switched my thinking to the long-term, I could make some passive income.

You can also read the blog Fastest Path To Full Time Income Online or watch the video below.

What I'd been doing with my business was just hustling and getting clients. I'm always focusing on how much money I can make this month and what I saw is that if I could teach online courses, I'd had a lot of validation on that already and some potential.

I saw an opportunity to transform my life as I've never seen it. Thus, at 30 years old, I had $150,000 in debt including student loans, credit card debt, and personal loans. I finally got out of transforming my personal life by praying, getting very inspired, and starting to meditate.

I focused on making a long-term plan which was to teach courses online. I bought all the money I could get my hands on so that I could sit down and take the time to film all the online courses.

I did not make any money in the beginning and spent a whole bunch of money to advertise those courses and literally, when I spent about the last dollar I borrowed, the money started to come in. $484K in debt and a plan.

Over the next 4 years, I created 5,000 or so videos online with over 3,000 online courses and I used the money I made to pay down the debt, buy a car, buy a house and to pay most of the bills for that time.

I also did some crypto investing which ended up getting me into burnout. I went so crazy with all the stuff I was doing. I hustled and worked so hard that in 2018, I got burnt out.

I took a year off for paternity leave for the birth of my son, to stop making online courses, stop pitching cryptos, just have some fun, mess around, make some music, and play some video games. I had a lot of fun at that time.

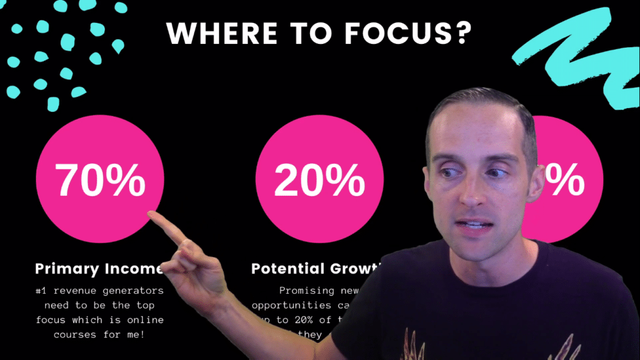

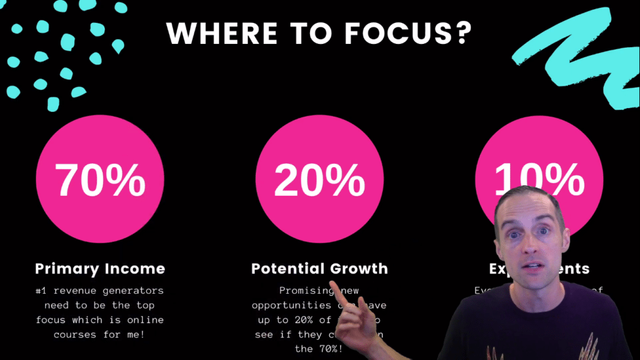

Where To Focus?

However, there was one key problem and it's "Where to focus?". I was going to show you this later in the post but I'm just so excited. This is very important and this is a huge thing if you want to get out of debt and make money, especially if you're an entrepreneur online, this “Where to focus?” graph is essential.

As an entrepreneur online, I don't get paid time off. I've got to set up business systems that are so good. I can afford to work less at various times but the one thing I do not get to do is deviate from my primary income sources for very long and this is what I did for about a year.

I just dropped all my primary income sources. The number one revenue generator needs to be getting 70% of the time, energy, and attention per year. $484K in debt and a plan.

I got these numbers from some Google presentation that the CEO Eric Schmidt in a podcast gave me and I found these exactly match to what I need to do.

I dropped this and all I was focusing on were the other areas. I was focusing on potential growth areas like playing video games and music streaming.

These were potential growth areas. Music will qualify more as an experiment. I spent all my time and energy on potential growth and experiments. $484K in debt and a plan.

The idea with this is for maximum return, you need to focus most of your energy and time on the places that are earning the most money. You've then got free time to explore other areas but if you drop the 70%, everything is likely to get into the situation I'm about to show you.

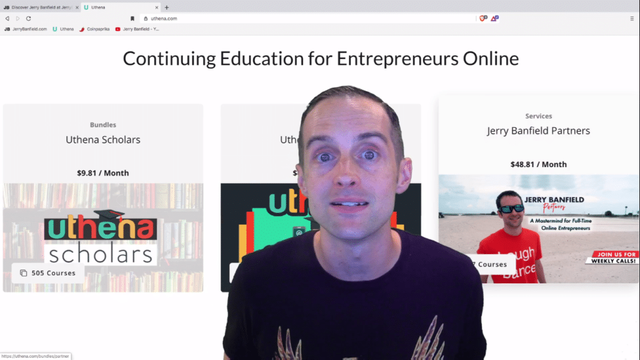

In 2019, I started Uthena in an effort to make a continuing education platform. This was the consistent advice I had gotten from followers to make an online education platform and make your own version of Udemy.

You can take a look at the homepage here. The main value propositions we have are course bundles and a comprehensive continuing education program for entrepreneurs online.

$484K in debt and a plan. We have 505 courses for $9.81 a month and I've got a Partner Program which is a membership program for $48 a month where I've got private label rights to my courses. I've got coaching, group calls, a private Facebook group, etc.

This is a must-read eLearning Networking, Webinars, Mastermind, Coaching — Earn More on Udemy, Skillshare, Thinkific!

That's what I've poured my time and energy into starting this in 2019. This has been a huge learning opportunity. This has been how I've racked up a massive amount of debt getting this started. $484K in debt and a plan.

I'll show you some of the key points to racking this up.

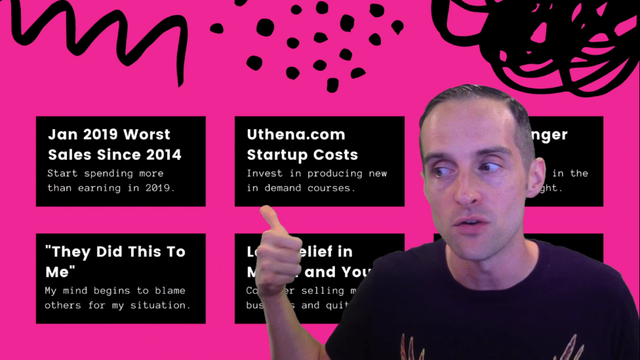

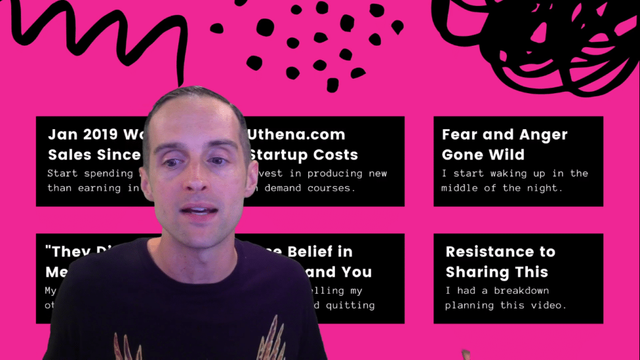

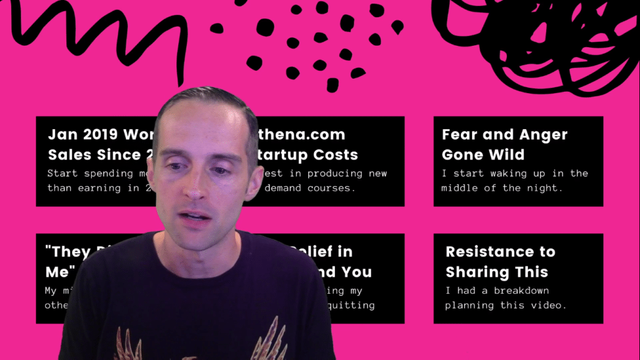

In January 2019, before I started Uthena, it was the worst in sales I'd seen since 2014. For the first time in years, I started spending more money than I was earning and this was a very subtle and quick thing that happened.

All of a sudden, I was spending in cash and very quickly I was spending on credit.

Uthena’s start-up cost was much bigger and took a lot longer than I thought it would and my fear and anger started to go wild for the first time in years. I woke up in the middle of the night sweating. I felt like I had to go to work at 3:00 in the morning. I was crazy about my finances.

All kinds of stories went around in my head like “They did this to me”. If Udemy hadn't suspended my account in 2016 and messed up my whole business when I had everything set up perfectly then this wouldn't have happened.

I wouldn't be in this position. I started to lose my belief. If you look at one of my income reports before, I started to lose my belief in myself and in your ability to help me. $484K in debt and a plan.

I considered very recently selling my business and literally quitting using money at all. I came to that after having a breakdown about making this post’s video. I was praying and asking for guidance and thinking “What's the very best video I can make?”.

What video can I make that makes a huge difference in your life and the thought came is “Why don't you tell them about your debt and all your financial struggles you've had this year” and I'm like “No. Not that. I'll tell people what I've learned about how to make money, not my debt, not this”.

On that day, I decided “Okay, I'm going to do this $484K in debt and a plan video and show everybody in clear detail what's going on and my whole process”.

I had a breakdown. I went crazy. I'm like, “I'm not using money. I'm done. I'm done using money. I hate money. Money is stupid. I'm not playing this game anymore. I'm just gonna close all of my accounts and be done with it”.

My wife listened through that idea. She was very understanding and then like 2 hours later, I'm like, “Okay, it's gonna be fine” but here are the key lessons I've learned and then I'll show you exactly how much the debt is, the interest and my plan out.

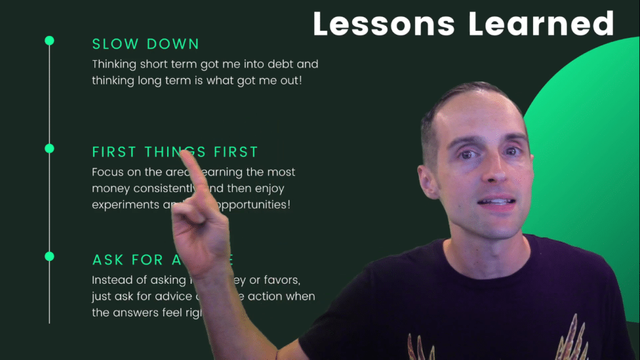

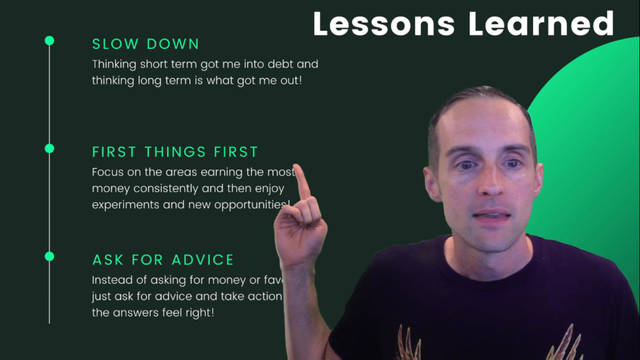

Slow Down

The key lesson that I've learned is to slow down.

$484K in debt and a plan. Thinking short-term got me into debt every time. Even thinking about going to college was really short-term thinking. I wasn't considering my entire life and that if I really wanted to make money, I might need to just learn some life skills.

To get networking and connected with employers instead of just generically throwing myself into school and hoping for the best and borrowing money to make that happen and taking 4 years of not working that much.

First Things First

Never drop those 70% areas unless you're willing to do so without the money that those provide.

That means limit experiments and new opportunities to the minority of time and perhaps most important is to “Ask for Advice”. I just blundered into this borrowing money and I didn't ask for advice.

Ask For Advice

I googled, looked and tried to do it myself and here's an example of “Where asking for advice would have been really helpful?” I hope this is helpful for you. I may have caught you before you've gone as far into this as I have.

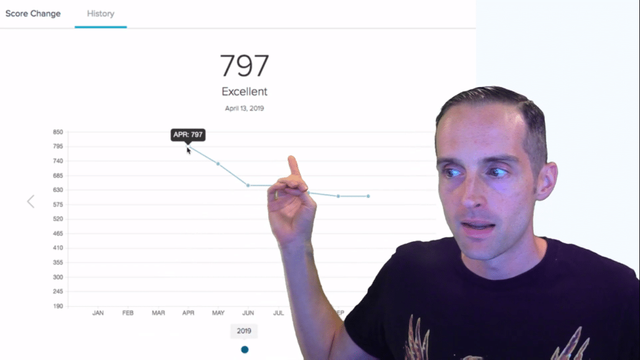

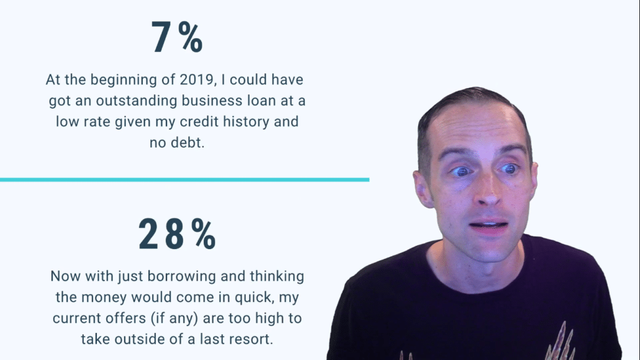

I had an over 800 credit score at the beginning of the year. When I was operating completely, I only had those little bits of student loan debt, making the payments had wide-open credit, and then I started applying to things like 0% interest credit cards.

$484K in Debt and a Plan

I got one for $20,000 at 0% interest and I kept applying for these cards. They gave me the first one. So, I applied for another one. I have another one for $10,000 at 0% interest. So, I applied for more. Then they started rejecting it. My credit score went down as I used more of my score up.

At the beginning of 2019, I was perfectly qualified for something like a Small Business Administration loan or a personal loan. I could have got a hundred or two hundred thousand I estimate at 7% interest.

Instead, I blundered my way through just borrowing a little bit at a time, opening up new credit cards, not asking for advice until now I am in the position. 28% interest was the last offer I got and the current offer I'm getting is 28% interest. It is only reasonable as a very last resort.

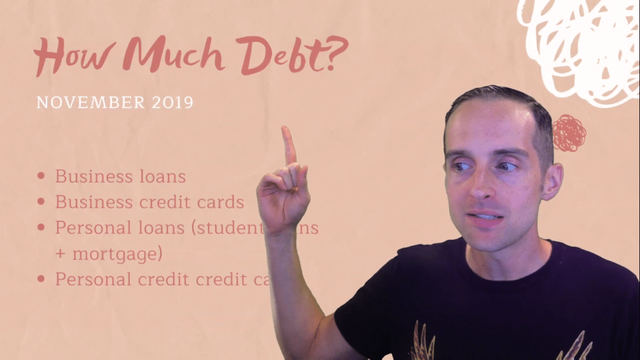

Therefore, you might want to see as you've watched this far “Well, how much debt do you have?”. This is the total debt I had in November 2019. I did not know about this until an hour or so ago. I think a key step if we want to get out of debt is to look at it.

$484K in debt and a plan. I hadn't looked at my debt. I just had these vague estimations by “Why look at all the statements? I just have the payments on time and I won't look at all”. This is what it looks like.

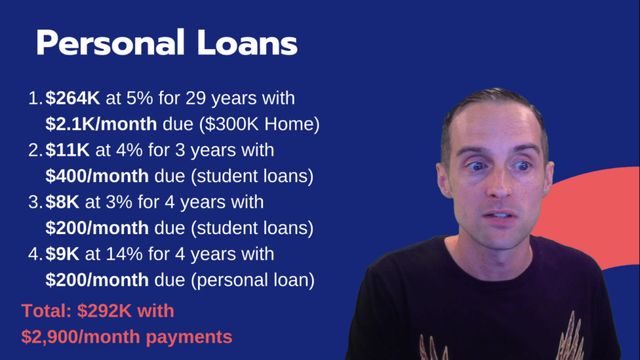

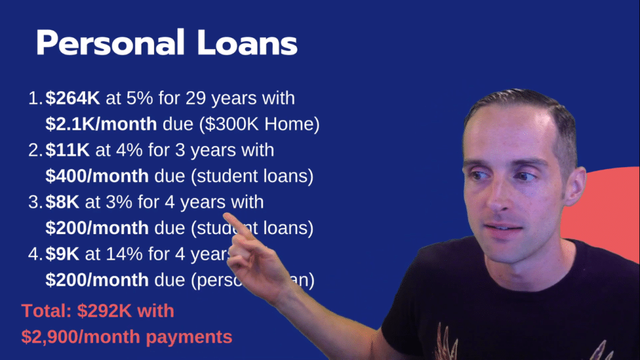

Personal loans

I've come on a mortgage as a personal loan for simplicity because it's a loan specifically to me, not to my business and it does have an asset. We'll add all this up then.

My mortgage is $264K at 5% for 29 years with $2.1K a month due. The home's value is about 300k. So, if you'll notice, this loan is much different than the others. This loan, if I sold the home, will be wiped out by selling the home.

Therefore, this loan is significantly different than others but it is a part of my debt and therefore, I've included it. $484K in debt and a plan.

The rest of these are personal loans via either student loans or student loan rate consolidations or this one is a personal loan. I still have student loans. I didn't repay the student loans because the interest was so low.

I was paying my wife's student loans instead of paying my own off because hers were higher and now hers are in forbearance. I'm not making the payments on them anymore. She's got plenty of bills to pay since I'm not paying any of the other bills outside of this and health insurance either.

If you look at this, my student loan is at $11K with 4% left now. That's less than $20,000 out of over $50,000 of student loans. That's still a lot of progress. I just got a personal loan of $9,000 at 14%. I am very grateful to get that one for 4 years for $200 a month.

Therefore, $292K in personal loans with $2,900 a month in payments.

Personal Credit Cards

This is what really knocked my credit score down is running these up. Again, you can see the short-term solutions I started with here. I have a $12.5K credit limit at 0% interest until something like November 2020.

I went ahead and grabbed it right away. That’s one of the first things I did in this debt. $12K on debt now at 0% for $200 a month. I also took a balance transfer offer at 6% for quite a while at $9K on a different credit card but now these other ones that have higher interest have got run up.

$9k at 16%. $3k at 16%. Two of them are a bit lower at 11% and then one at 17%. Total $48K in credit card debt with $1,000 a month in minimum payments.

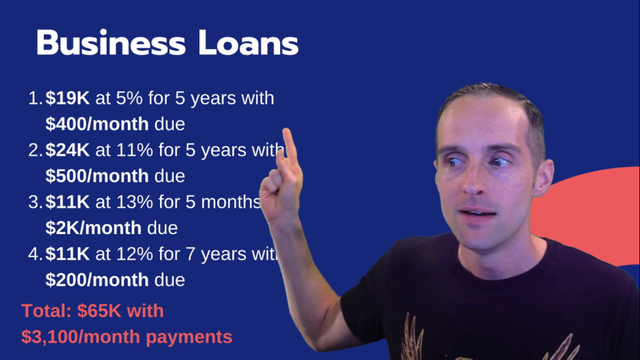

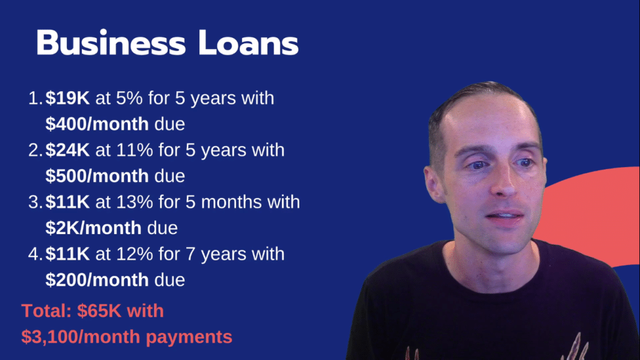

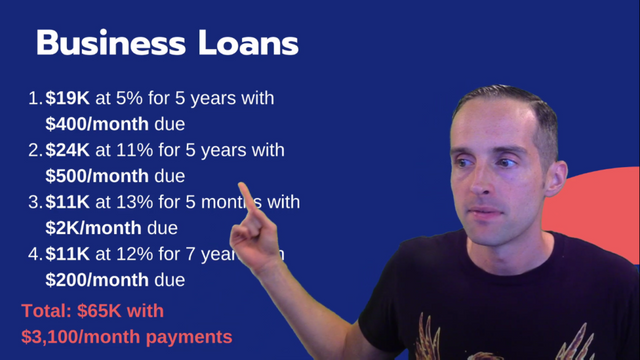

Business Loans

I have a business. We separate your business and personal in the USA.

However, I've co-signed all of my business “BS” so to speak. Therefore, these business loans are not something I can get out of by just discharging or doing some kind of cute business bankruptcy and I don't even like saying that word.

I avoid even saying that word. I'm not interested in not manifesting in that. Thus, for all intents and purposes, business loans are just like personal loans essentially but business loans. Let's look at these. $484K in debt and a plan.

$19,000 at 5%. This one is secured with my car. I’ll definitely make sure to pay that one no matter what happens, right? 5%, very grateful for the bank down the street. I ended up getting this loan due to advice.

I asked one of my partners at my partner's program jerry.tips/partners. I asked “What do I do?” and he said, “Go to your local bank and see” and the best business loan I got was following advice from someone I took.

I just walked in the local bank and they said, “Yeah, we'll take your car title. We'll give you a 5% loan for 20k”.

I'm like “Nice”. 5 years left on that one. I got another loan from the same bank which is 24k at 11% for 5 years. Two bank loans towards the beginning of the year.

I also made the mistake of taking a PayPal loan at 13% interest with huge payments. It would have been ideal to take the bank loan first. $2,000 a month due on a PayPal loan. Fortunately, this has nearly paid off.

Then there's $11,000 due on another business loan. This was made directly to the contractor I work with. $200 a month payments on these consistently and that's a 12% interest for 7 years as of payment terms.

But since that's direct to the contractor and he wants to earn interest in it, that one's the most flexible. $65K in business loans with $3,100 a month in payments.

Business Credit Cards

$11K at 0%. However, that will expire soon with another $20,000 at 0%.

You can see I got really cute and smart initially. I just wasn't thinking about how long this might take to do something like starting up a new online course platform.

Then, $48K at 12% with $800 a month payments. Total of $79K with $1,100 a month in payments.

Are you ready? Here's the total. $484K I did mention that upfront but you can see how it adds up now. $8,200 a month in minimum payments on the debt. $484K in debt and a plan.

I do have about $330K in assets. These are liquid assets that almost anyone would agree on. Now, you can debate the value of my business. Is it worth noting? Is that worth a million? Is it worth 10 million? It's debatable.

However, these are the hard numbers for you. This is a critical step as I've learned from Alcoholics Anonymous.

If you want to figure out why you drink, stop drinking and have a happy sober life, the first real step is to speak besides being willing, open-minded, trusting, and having some faith, the first real step is taking inventory like “What's going on with me?”.

That's what is essential also for getting out of debt and I know this because I already went through and did this once and I'm going to do it again. I'm certain this is all going to work out. I'm going to do it again.

Therefore, this inventory step was absolutely critical on my way out. Now that I've taken full inventory, I'm ready to fully execute my way out. Now, I have hardly talked at all about cutting expenses here because this to me is kind of obvious.

This is something that you can do and I've cut expenses drastically. It's difficult if your income changes widely, you're used to spending more money and your income drops a lot. I've already cut a ton of expenses and yet it's not practical to just stop spending money either.

I run ads to get more people to come to Uthena to build my following: It's not practical to just cut out all expenses. Thus, my way out is by earning my way out. Focus on teaching amazing online courses and sharing more for free than I've ever done before.

I have a plan to step my business up to a higher level than it's ever been to and this is my way out to earn my way out and I've known that I'd be earning my way out of this since I started borrowing the money and now it's gotten more clear.

I appreciate you almost getting to the end. Please let me know if you have gotten this far and what you think of the plan.

This is my plan and I've got this plan based on asking for a lot of advice from people saying, “Hey, what would you do if you were in my position?” Shout out and thank you to my friend Tomas George.

This is the plan that he got me on talking to me the other day. I'm like, “Dude, what would you do if you were me?”. He's like, “Get back to teaching online courses, especially the digital marketing courses that we're selling so well”.

As the Facebook courses sold over a hundred thousand i.e. all kinds of marketing courses that have sold a lot online, I'm going back to focusing on online courses. I have tried a business model of just putting everything out for free on my YouTube channel but that is not working for an income.

That's not working at all for income because

(a) people like taking and paying for online courses.

(b) If I'm just going to put it up on YouTube then I can't put it up on some of these other sites.

(c) There's something really awesome I can do with my courses to see which course I want to put them on Kickstarter.

Where I can say, “Look, I'm going to make this course and pre-sell it before I've even filmed the videos” and one of the biggest misdirections I've taken on filming courses is filming courses people aren't interested in and now I haven't done this before but I'm just about to do a Kickstarter.

I've submitted it for review. I'm going to start putting up Kickstarter projects for my new online courses and releasing my rough drafts on YouTube. What I can do to make the materials I need for the courses and because my filming setup is so efficient, it's very easy for me to just do a video like this.

If you want to know How to Live Stream Like Jerry Banfield, read this blog or watch the video below.

As soon as I hit the record button, the video is done and ready to upload. I don’t have to render it. Thus, I've been wondering “Well, how do I give people the most for free and to have an online course?” and I just found a solution to that.

Just prepare everything for the online course, run through it once and essentially do the whole course in one take as a rough draft for a YouTube video.

Then say, “Look, if you want to take the full YouTube video, go to jerry.tips/partners. Sign up and join my membership group to get access to all of my courses. There's coaching, if you want it, and then for people who want to spend money and buy the online courses, I've got the online courses filmed in a higher quality than I was doing before.

Thus, a huge advance in my business is to be able to give more value for free and still do online courses. Then I upload my courses everywhere that I can. For example, Uthena, StackCommerce, Skillshare.

This post will help you understand in detail how to Start Teaching on YouTube, Udemy, Skillshare, StackCommerce and Uthena Today!

These are the ones that are making the most money. If you are working on Udemy and you want to invite me back, I'd be happy to upload them to Udemy if I'm invited back to Udemy. Upload the courses everywhere and optimize for each specific platform.

For example, Skillshare. Short courses tend to work best. StackCommerce, I'm working with their team to see if I can update some of my most comprehensive courses and just put my new stuff in the old courses and then essentially give them a 25-hour course to sell instead of a 1-hour course to sell.

Once I've got the courses pre-sold, got the Kickstarter and rolled people into the courses, I'm in the perfect position to convert to clients. Unfortunately, I've discovered the hard way by just doing my business on YouTube that people need some kind of step in the middle.

Just putting all my videos out for free on YouTube is not resulting in very many people joining my partner program. It is resulting in some but compared to how I was doing it by selling online courses before, it's much easier to step up to something like a partner program or to sell the value of it based on the courses.

Having clients then allows me to earn a lot more in addition to the courses. I've got a mastermind which is my partner group. I have one-on-one coaching and private label rights in my partner group.

Thus, this gives me the ability to earn much more in addition to just the courses and allows those most needing helping enthusiastic with more money to help me earn more.

Finally, be open to more help. I've noticed the better things went from me before I started closing down to more help and getting this “Jerry is all-powerful and God and everyone should learn from me and I don't need to learn from everyone else”.

I am specifically being prepared for things like sponsorship.

I'm also preparing to become a speaker and an author with Hay House. I have booked a conference in March to go there and this is my plan to get out of all this debt and it's important if you want to get out of all your debt to make a really good plan.

I've made a bunch of plans already and a lot of them have failed and what I'm excited to do is just show you what happens next.

Thus, I ask you to please subscribe to me on YouTube, hit that subscribe button and turn those notifications on so you can see what happens next if you haven't subscribed already.

You can also follow me on Facebook. I put some things on Facebook that aren't on YouTube. So, I encourage you to go to Facebook, hit follow and put “See First” on.

You can also sign up for Uthena. If you want to get emails from me, just create an account on Uthena, and you'll get links to the Kickstarter project.

If you want the very best experience, get into the Partner Program. That is a big way you can help me and that I can help you. I've paid more money to my partners collectively than they've paid to me.

I've seen the question “Well, Jerry. Why don't you have more money since all the money you've made online?” I've paid a lot of other people who helped me with my business. I've helped and given away a whole bunch of money and if I’d put it into videos, maybe they’d gone viral but I love giving people money.

I love helping people out. In my partner program, I've collectively paid much more to my partners than I've collectively received. Therefore, the partner program is where I look to hire people. I get to know people and help people.

I appreciate you reading all the way to the end of this post. I'd love to hear your story in the comments. I'm amazed at how many people around me are silently struggling with debt. People who are 10-years older than me and 15 to 20 years older than me still have student loan debt.

Still feeling like they're in basically the same spot I'm in now as there's too much debt, not enough money, not sure what to do. Let me know in a comment and don't worry about anyone saying anything.

I will remove all the comments and hide anyone from the channel who has nasty things to say. It's a safe place to share and help each other and one more thing.

I intend to make lots more videos and courses about this subject and when you subscribe, you'll be able to see these and you will love it. So, thank you very much for giving me the opportunity to serve you today.

I love you. You're awesome. I'm honored you've spent so much time with me.

If you find this helpful, I trust you'll leave a like on it and share it with a friend who might need it.

Love,

Jerry Banfield

Posted from my blog with SteemPress : https://jerrybanfield.com/35-with-484k-in-debt-and-a-plan/

Wow i do not know what I'd do with that much debt. I'm lucky I couldn't afford college so I joined the military and they paid for my bachelors degree, then My civilian employer paid for my Masters degree. So i graduated debt free. I currently have some CC debt that i am working on, been watching a lot of Dave Ramsey to help with that. good-luck and have been following your channel since the DASH days.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am still watching the video, but as you itemised your loans, with all interest rates noted, my first thought was, do not look at getting more loans, instead, try to increase the loan on your property, if you can, at the same interest rate, and use those funds ONLY for getting rid of loans with higher interest rates - the highest first, obviously. It will not reduce the total you owe, but it will reduce your monthly payments, hopefully making life a little easier for you.

I'm going to spend some more time on your post tonight....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good content

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @jerrybanfield! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit