As you are going to buy for the first time, there are many things to fear. Most people do not have proper knowledge in buying & selling properties so it may be difficult to choose the perfect property that could possibly enjoy growth and fit within affordable budget. Mostly the first time buyers number one choice is either the next BTO or a resale flat close to their families and they think of their future and consider that they can afford of the public housing. Is this the right choice.

If all you want a peaceful life, this is the right choice. But if you want earn more for a better future and lifestyle, then you have to consider other options. Let’s have a look.

Mostly the young buyers do not consider lengthy timeline, one have to realise their first fortune you made in your life.

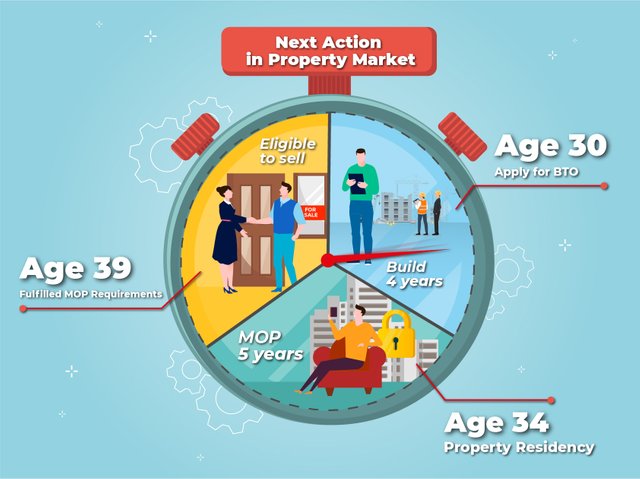

Actually the 4 years long waiting of a couple to complete with the Minimum Occupation Period of 5 years which locks a young couple of 30 years old for a period of 9-10 years it means that the young couple reach at age 40.

We know that time is money and this is the unchangeable fact of life! Many people have the misunderstanding that property investment should start in the late stage of life but due to the mortgage limitations in Singapore, they get the shorter loan tenure which sadly means that the monthly loan repayment will be heftier with additional expenses like child care and educational commitments. This makes many people miss the high speed train of property investment, having still advantage.

So, if you can afford to get a very nice home with the first investment which have a high potential of making decent profit in 5 years, wouldn’t it be great jumpstart to your property investment journey? It is crucial to know that you have to start this journey as soon as your finances sound.

Remember I mentioned that being sensible is important. I cannot stress enough that success of your first investment depends on careful planning. Now we can see that private homes going to hit new highs in 2021 in the given figure. Each time the market falls down, it rebounds with more height, and those having fear to invest in the market and choose to wait end up with paying more for which they have to pay. These are the basic mistakes which can be avoided easily.

Even though by seeing the chart show that the home prices continuously climb but we have to consider the truth that some inexperienced “investors” who made losses too. This is because of various factors and most of the common factors are not setting aside reserve funds, wait to invest and misunderstanding the property market without proper knowledge. This can be easy and much safe if you follow our proven strategy.