Hi, In the next few paragraphs will tell you about the BZX Network Protocol.

At first, let's talk about what is bZx & why it is so useful for Decentralized margin lending?

• INTRODUCTION

The persisting paradox we face in decentralized margin lending or trading is to liquidate from the centralized tokens & coin exchanges.

This is because we are still lacking the competencies of many Centralized Exchanges.

So far, none of the DEX's provided a full margin lending & trading services which could lessen the fees & the security risks.

The counterparty risk is one of them. When the assets of an investor are in the exposure to the third party which can cause to imperil them.

We were needed the Decentralized platform who can justify the security settlement as in the centralized exchanges.

The main hurdle in the margin lending is to design the reliable ORACLE which can solve the security & other issues.

( Oracle is the data provider & it gives smart contracts answers to the various questions about the World)

When we talk about the margin lending the Oracle problem is caused because Ethereum contracts are not conversant with the current asset prices on & off the blockchain.

If smart contracts can't remain aware of asset prices on an open market, they can't tell the liquidate borrowers on a particular market to protect lenders from suspected maneuvres.

The most significant hurdle to decentralized margin lending is to be able to solve the liquidate troubled conditions.

Then comes the bZx protocol into existence which can serve the purpose of the on-chain solution of these kinds of issues.

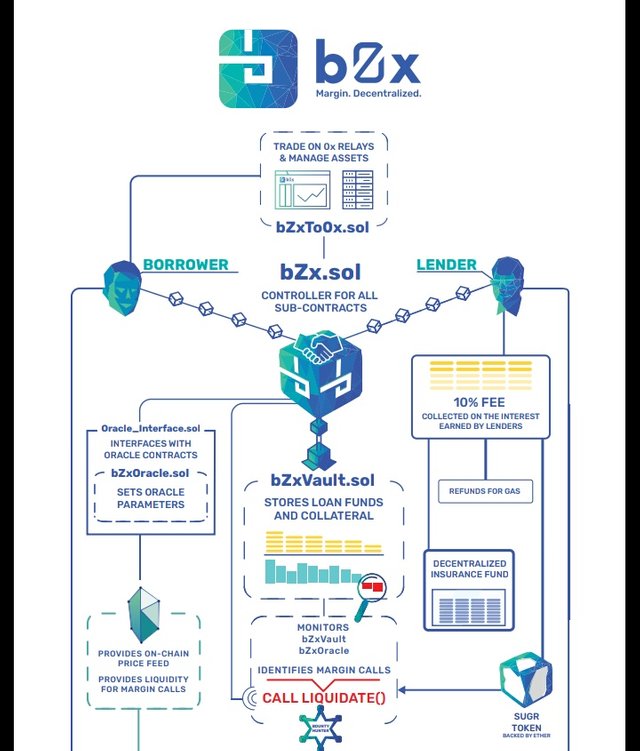

#bZx is not a decentralized Exchange. It is built on Ethereum blockchain & integrated with 0x protocol.

Simply it's the first fully decentralized peer-to-peer margin funding & trading protocol.

A protocol which can be integrated into the current exchange infrastructure.

Exchanges & Relays ( Bridge b/w blockchain & 0x protocol based on Ethereum ethereum blockchain) are incentivized by fees in the form of #BZRX protocol tokens ( #BZRX ) to perform the lending & margin Trading Services.

• BENEFITS OF DECENTRALIZED MARGIN TRADING!

LOW RISK

Both lender & borrower will have the full control of their Private keys like in centralized Exchange.INDIRECT INCOME

You will get the interest for the assets you hold in your wallet.

in addition, Interest rates on margin Trading are quite higher than traditional loans.

*COST EFFICIENT FEES

Generally, traders pay huge interest to overcome the risk of the asset of lenders to be hacked.

Decentralized margin lending is more secure & reliable.

Decentralized exchanges face LOW LIQUIDITY & LARGE SPREADS

(the difference between Highest offered purchase price & lowest offered purchase price).

#bZx uses margin loans in the for of BZRX token to bridge the centralized & Decentralized liquidity pools by it's Universal Liquidity.

Assets are valued & liquidated by the Oracle providers. Also, #bZx protocol separates the valuation & liquidation of assets in order to give the cost-efficient fee to the Oracle providers which encourage the flexibility.

In #bZxOracle , a 10% fee is collected from the interest earned by the lenders & will be used for several functions viz. decentralized governance, bounty hunter incentivization, gas fee refunds etc.

For More info...

https://b0x.network

Article By - Sumit Bisht