Originally posted on Quora March 15, 2023

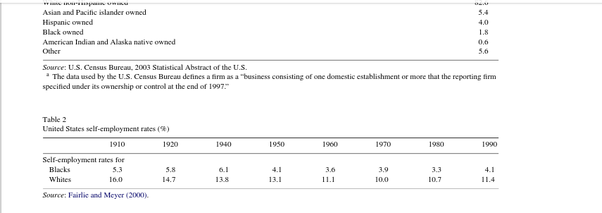

Despite only have a proposed budget of $300 billion and a looming budget deficit of $22.5 billion, California plans to commit up to $640 billion in reparations for its 2 million black residents. Combined with San Francisco's commitment of $250 billion in reparations for their black residents, despite only having an operating budget of about $13 billion and a similar budget short fall like the state, and assuming zero admin costs, reparations sums up to $890 billion. Assuming admin costs the total likely ends up at $1 Trillion, which is about 1/3 of their GDP. Four years ago, I published an exposition, inspired by the late Fred Foldvary, on how land value capture achieves the ends of social restitution by directly compensating the dispossessed for the advantages realty owners claim through exclusive rights to an asset with an inelastic supply. The compensation I’m speaking of is not in the form of a lump sum payment or monthly dole but an increase in the purchasing power of the dispossessed worker’s wages and a simultaneous reduction in the rental income or capital gains of the realty owner. The wealth gap that leftoids think is evidence of systemic racism, on the faith-based assumption that there would be no group differences if not for the past, is really a measure of the differential homeownership rates of blacks and whites. While the average white family supposedly has 6–8x the wealth of the average black family the average homeowner has 40x the wealth of the average renter. All other factors held constant, within group variance is much greater the between group variance since the distance between the white homeowner and the white renter or the black homeowner and the black renter dwarfs the distance between blacks and whites as a group. And despite faith-based assertions that discrimination after WWII held blacks back from becoming homeowners and acquiring wealth the census data actually shows that fastest growth in black home ownership occurred when housing discrimination was legal at every level of government. The black home ownership rate nearly doubled from 23% in 1940 to 42% in 1970, plateauing after the Fair Housing Act of 1968. Black self-employment actually peaked in 1940 at 6.1% and was rising while the white self-employment rate was precipitously falling for the first 4 decades of the 20th century. Today black self-employment hovers around 4.5% while their home ownership rate hovers around 42–45% despite the elimination of negative discrimination and the institution of positive discrimination in favor of blacks in the public sector, government contractors and fortune 500s.

As I pointed out in the previous post the proliferation of single income earner households and rack rents have a lot more explanatory power than racism and legal discrimination post 1960s.

And even if California did somehow have the money to pull this off there’s no evidence that it would eliminate the racial wealth gap, in fact the opposite would probably occur. The amount of money being offered is similar to a lotto wining and if we know anything about lotto winners it’s that 70% of them go broke within 5 years and 30% declare bankruptcy within 7 years. And given the fact that blacks are the most financially illiterate demographic in the country and spend 30% more than whites of comparable income on conspicuous consumption the most probable outcome of reparations is a brief period of demand pull inflation coinciding with record corporate profits eventually crashing back to baseline with an even wider wealth gap between blacks and whites (who invested in the companies they knew blacks would spend their money on) and shrieking for another round of reparations.

Dave Chappelle predicted such a scenario two decades ago:

“These people are breaking their necks to give the money right back to US.”