The Bank of Canada ranks LAST out of 100 major central banks globally

Friends:

I have blogged and talked on social media for years now, often several times a month about the #COMER lawsuit in Canada and all related issues.

The COMER group, which I am a part of -- has been in court SUING the Federal Gov't to give control BACK to the people of the monetary supply and policy.

Canada came off the gold standard in 1974, the USA came off in 1971.

I remind people ALL THE TIME of this corrupt mismanagement that people actually pay for every day.

You can get updates via www.COMER.org

It is my opinion that any country having a fiat currency system (backed by nothing) -- is part of the global plan to create a global currency and the planned One / New World Order.

And that is bad.

Today I found a good article on ZeroHedge for some of this.

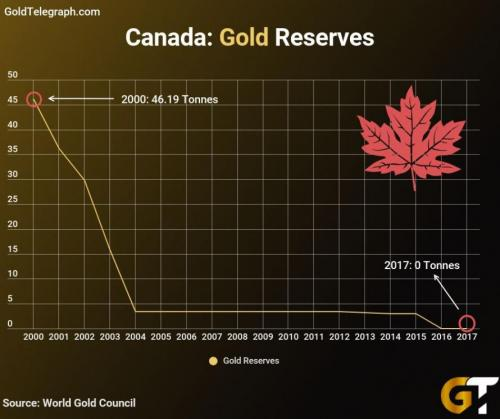

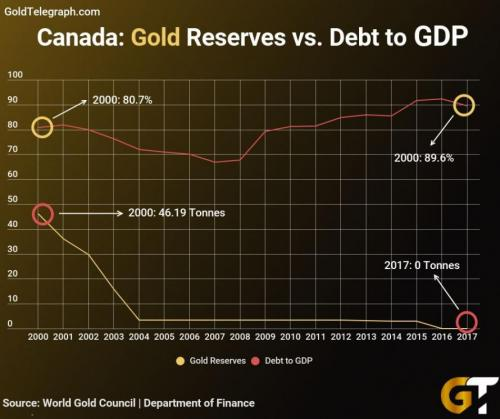

While other central banks have been busy increasing their gold reserves, Canada sold off all its gold reserves in 2016.

https://www.zerohedge.com/news/2016-03-03/its-official-moment-canada-has-no-gold-reserves-left

There is precedence in a central bank selling off its gold, and it didn’t work out very well. In 1999, when the price of gold was low at $282.40 an ounce, the United Kingdom sold half of its gold reserves, worth approximately $6.5 billion.

This sale raised $3.5 billion.

By 2007, the price of gold had risen to $675.00 an ounce, and the UK had lost more than £2 billion. This financial disaster, known as Brown’s Bottom, did not work out well. And Canada appears to be following in its footsteps.

With many uncertainties globally, Canada’s gold sale could have serious consequences.

https://twitter.com/GoldTelegraph_/status/988912890970234880

In this age of fiat currency, many people forget that gold is actually money, and has never stopped from functioning as a reliable store of value. Gold is a relatively liquid currency and one of the most highly traded.

As per Canada’s senior Finance Department economist Bill Morneau, the reason for the gold sale was the cost involved in storing the gold and the fact that gold offers a poor return.

If you ask me, that is absolute GARBAGE for a really really poor excuse. It is beyond laughable.

https://www.zerohedge.com/news/2016-03-03/its-official-moment-canada-has-no-gold-reserves-left

How about fire some bureaucrats in big government and use the space to store the gold??????

That seems like strange logic since gold has outperformed the S&P 500 since 2000. The price of gold went from $35.00 an ounce in 1967 to over $1,300 today.

As former US Federal Reserve chairman Alan Greenspan has said:

Central banks have been big buyers of gold since 2010. The prime buyers have been Russia and China, but most other central banks have scrambled to follow suit.

On the other hand, Canada has now joined developing countries such as Angola, Belize and Tonga that have no gold reserves at all. Is Canada headed for disaster?

Canada’s current reserve position of $10,412 billion in the IMF entitles it to 2.26 percent of votes within the organization. It has reduced its reserve position by $1.2 billion. With the sale of gold, Canada is greatly reducing its voting power in the IMF.

Is Canada’s financial power gradually diminishing along with its gold reserves? It seems to have created a mysterious scenario of “ … and then, there were none.”

Following the sale of its of gold, Canada’s market debt has surpassed $1 trillion in a historic milestone.

http://www.cbc.ca/news/politics/federal-market-debt-1.4590441

This debt is mostly due to the uncontrolled borrowing made possible by the Bank of Canada’s easy lending policies. Canada has a current debt ceiling of $1.168 trillion, and it is anticipated that Parliament will have to increase that ceiling in the near future.

According to the government, it has the power to borrow to refinance its massive debt. But borrowing will only serve to increase the already existing mountain of debt further. Canada has become one the leaders in global debt, and its solution appears to be to continue adding to it with new borrowing. Canada household debt now equals 101 percent of its GDP.

Canada is in a BAD spot financially.

- Any shift in the global economic wind would leave Canada twisting in the wind, it seems.

Ironically, Canada’s record debt comes at a time when economic growth is at 3% (2017) which was the highest in six years and many economists expect this to continue.

That optimism, however, is misleading. Canada’s economic growth comes at a time when its total deficit spending has increased to beyond $18 billion. Outstanding corporate credit reached a historic high of $803 billion in 2017.

In addition, Canada is facing a mortgage bubble, with homeowners who bought lavish houses on easy credit now finding themselves unable to afford increased interest rates on their mortgages or being unable to sell a house they can no longer afford.

Canada’s financial policies has been a puzzle to many. While other countries are amassing gold, it has deliberately sold off all its gold reserves, while other countries are attempting to reduce massive debts, Canada appears to plan on increasing its own.

Countries that have historically valued gold have been or have strived to be global powers. The mere ownership of gold has always been a sign of authority. Canada, on the other hand… is flying solo, and might be heading for a crash.

Source in Parts

Thanks for Reading.

Hope you are doing better than #Canadastan.

I commend you Barry, Rocco and all the others standing up for our rights.

I have followed the progress for years.

Bank of Canada Act is Clear!

We all must STOP USING PRIVATE BANKS!

There will be North American Bank Holidays within 180 Days!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Canada is just one more domino in the line of economies about to topple.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What I see @barrydutton is over the last 89 years or so we’ve not developed any manufacturers and offshore all of our raw resources to be refined elsewhere for basically nothing so we can buy it back at a premium. Basically we’ve given away all of our resources. Gold, water, nickel, trees, produce. Basically we grow all this stuff so other countries do well because our leaders made too much ch money licking the balls of american and eu leaders because of our lack of true democracy and the wool cast over the eyes of our people through a broken and basically obsolete school system.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well said as always man.

I am really not doing well healthwise so I do not feel like doing much at all

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That’s not good barry, sending out love, I hope this passes and your health improves, you’re one of my inspirations as a young blockchain entrepreneur and I think i’m not the only one who feels that way, my prayers go out to you sir.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A lot has changed in the 2.5 yrs since I was nearly killed by the car running me over.

Such kind words can make a difference in a day for someone...

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You brought the goods here!

Sometimes it's all fun and games with the Steemu and the pizza sandwiches but then BAM, hard cold reality.

"don't jump off the bridge just because your friend did", if only countries just listened to our Moms lol.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks my man, it is always nice to hear from you, and flattery is nice too LOL

I appreciate that!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

baha ya flattery plus a solid @full-measure sighting is rarely a bad thing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the nice comment vote too my man.

https://steemit.com/crypto-news/@barrydutton/breaking-largest-banks-in-canada-continue-crypto-crackdown-on-population-overview-and-solutions-in-post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good to read your post and observe them are of good quality I hope you follow me I will follow you too, I hope to have your support for my blog

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your repeated generic spammy comments like this, and begging for followers, while NOT reading blogs, is adding no value here.

Stop it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Remember guys constant borrowing and inflation is totally cool. Look how well it turned out for pre-Nazi Germany.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I wouldn't say collapse is imminent considering they use FIAT to manipulate the price of GOLD/SILVER DOWN.

I would say the control is already there in full force. Gold would require responsibility. The government is anything but responsible and the show will go on until the banks collapse and they print more FIAT to bail the banks out.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We need a complete revolution, that is mainly why I am in crypto.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit