We've spent a fair amount of time discussing Canada's housing market over the past several months as Chinese money laundering operations have sprouted up bubbles all over the place. Here's a modest sampling of our recent work:

All Hell Breaks Loose In Toronto's House Price Bubble

Canada's Housing Bubble Explodes As Its Biggest Alternative Mortgage Lender Crashes Most In History

Canada Housing Regulator Warns Of "Strong Evidence Of Housing-Market Problems"

The Toronto Housing Market Is About To Collapse By This Measure

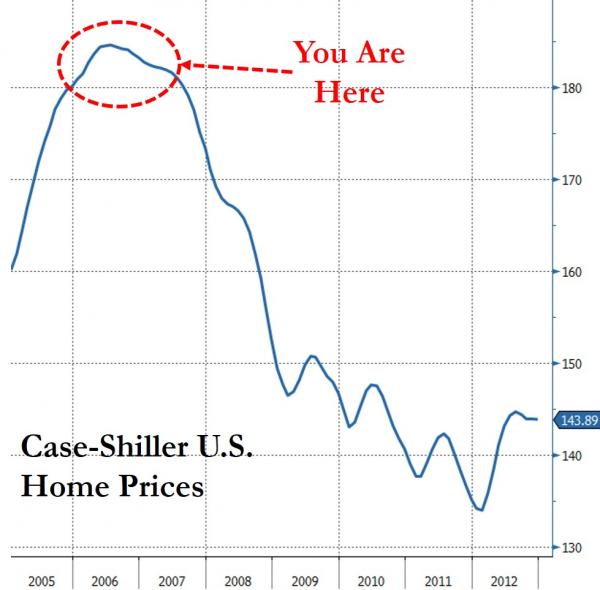

But, as the Globe and Mail notes today, there could very well be a "perfect storm" brewing in several Canadian housing markets as the result of extreme pricing bubbles, over-indebted consumers, a major tightening of mortgage rules and the prospect of rising rates.

On the regulatory front, Canada's Office of the Superintendent of Financial Institutions (OSFI), is considering new rules that would require lenders to effectively "stress-test" borrowers to confirm they would be in compliance with credit metrics even if rates were to rise 200 bps. From a practical standpoint, such a move would immediately remove roughly 20% of the average Canadian's home buying power.

Canada’s banking regulator (OSFI) is proposing that anyone who gets a mortgage at a bank or bank-funded lender prove they can afford a rate that is at least 200-basis-points higher than their actual rate.

A similar debt-ratio “stress test” is already in place for folks getting a default insured mortgage, as well as most variable-rate and short-term borrowers.

If OSFI’s change goes through as planned, otherwise credit-worthy borrowers would qualify for roughly 18 per cent less mortgage, other things equal. This one change would have more of an impact to mortgage shoppers than any Bank of Canada rate hike in history.

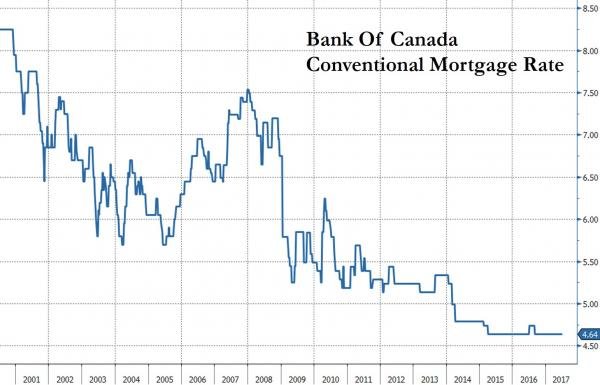

Of course, with mortgage rates at multi-decade lows, they likely only have one direction to go. Moreover, as rates rise, it will only serve to amplify the impacts of the proposed OSFI regulations noted above.

If you believe the Bank of Canada’s hints and bond market probabilities, there’s a real chance we’ll see higher floating rates as soon as next week’s rate meeting, or at its meeting in September. (Albeit, Thursday’s OSFI news could limit the BoC’s rate hike plans.)

As for fixed mortgage rates, they’ve already shot up on the back of a 50-basis-point surge in bond yields since June 6. RBC, Canada’s de facto leader in setting mortgage rates, hiked most of its advertised fixed rates by 20 basis points on Thursday morning. Most other lenders have done the same and it may be only the first of multiple moves.

.jpg)

Congratulations @chlife! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit