Crypto: Technical Analysis - What is Candlesticks?

Summary

Besides the general depiction of price graphs like line graphs or bargraphs many trader uses a slightly more advanced and informative graph which is called a "candlestick chart" or just a candle graph. The graph is named after the individual columns that look like candles and are therefore called candles. A regular line graph shows only the closing price, whereas a candlestick graph shows an opening price, the lowest price, the highest price, and a closing price for the selected time period.

The candlestick graph contains far more information than a simple line graph, giving a more visually nuanced image of how courses develop within the individual time periods. It may take some time to get used to candlestick graphs, but once you've done it, you have a much better picture of how the course actually moved.

The graph shows a candlestick course graph of the German DAX index based on 10-minute intervals.

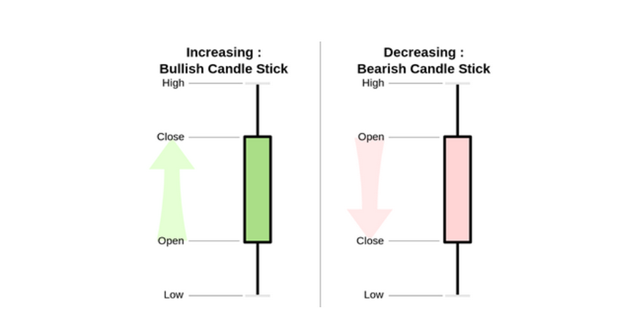

Each candle typically consists of a thick bar and two thin vertical lines, which show the price range - that is, course range - which the course has moved for a certain time interval, on the above graph in a 10-minute interval. The thick bar in the candle (sometimes called the body - sometimes the thin line is completely contained in the body), were typically displayed in the colors green and red (also appear white and black). This bar illustrates the difference between opening and closing prices. If the bar is green, then the closing price was higher than the opening price, and the market has an upward direction. If the bar is red, then the closing price was lower than the opening price, and the market has a downward trend.

The image above shows two examples of how candlestick bars can look. To the left is a green bar, which indicates that the closing price was higher than the opening price for the given period. To the right is a red bar, which indicates that the closing price was lower than the opening price. The two tails (also called shadows) in the upward and downward direction mean that the course during this period - eg. 10 minutes on a 10-minute graph - has been both higher and lower than opening and closing rates. Together they make up the course of the candle that has moved in. The colored part enclosing the closing and opening price is called the body.

A green candle is called a bullish candle because the course is upward, while a red candle is called a bearish candle because the rate is downward. The longer the body is on a candle, the more the course has moved during the period. The body's length thus tells something about how intensely the buying or selling pressure has been for a period of time. On the other hand, the body is briefly indicated small course movement, ie. that the market has consolidated or is indefinite.

Both daytraders and longer-term traders use a variety of candlesticks as well as formations of these to interpret the course's development.

For example, if you find that the graph shows one or more long red candles, the market is downhill at high speed, and it may be very risky to buy up before the market has consolidated a bit and indicated that it could be ready for a turn. It is said that this situation resembles trying to grab a falling knife, and that is a strong warning. It can be very dangerous to try to buy up in a market that moves down at high speed. Here it is better - or more certainly at least - to wait for it to stop, for example. by the occurrence of a so-called doji, see below. But it is not true that it is actually the case.

Examples of special candlesticks

An example of a special candlesticks type is a "doji candle", which is a candle that has tails in both ends, but a very small - or no-body, because the course opened and closed at the same level. It looks like a cross, most of all. An example of a doji can be seen below. A doji is seen by traders as a sign that the market can stand in front of a turn or as a sign of indecision.

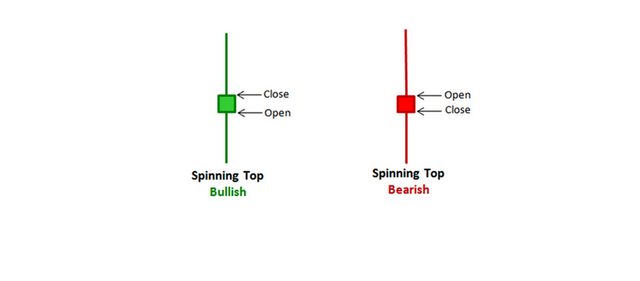

Another example is the so-called Spinning Top candlestick, which has a small body with long shadows in both directions, see below. This kind of candlesticks signals like doji's indecision in the market.

Reversal Patterns

Just as many technical traders are looking for potential twists and turns in the market by spotting double-ups and bases, head against shoulder or other patterns on the course graph, candlestick formations can be used for the same. Looking at a turning pattern does not always mean that the current upswing or downturn as such will turn, but to a greater extent that it will stop. Oftentimes, instead, the market will move sideways. Flip patterns for candlestick graphs must - in order to be effective - be seen in conjunction with previous formations. Two identical candlesticks may have different meanings, depending on the previous trends and formations on the graph.

Most daytraders not only use the shape of candles or formations of multiple candles as a signal that can stand alone, but rather as an indication that can support an assessment of where the market is going. For example, one might imagine combining the reading of candles together with other elements of technical analysis, for example. MACD or Bollinger Bands.

More info about candlesticks

There are countless forms/shapes of candlesticks and candlestick formations with exotic names like Hammer, Evening Star, etc. Some candlesticks even have Japanese names like Harami, as candlesticks are originally a Japanese invention that was used a few hundred years ago to predict price movements in rice. In particular, Steve Nison, for example, has introduced the term "Japanese Candlesticks Charing Techniques" for use in modern technical analysis of securities markets.

You can also find more inspiration from, for example, Thomas Bulkowski's excellent site, The Pattern site, and Stephen Bigalow's many interesting videos on Youtube of both shorter and longer duration.