Bearish Breakout

Last analysis we were beginning to see wash trading manipulate the volume. I suggested the manipulators did not know what they were doing and that their manipulation would lead to prices declining lower. We were forming a descending triangle, which was broken to the downside, volume picked up as prices fell lower. This is a massively bearish signal to traders and has apparently caused further dumping of smoke coins, as I had suggested it would in my last analysis.

Anticipating at least another 65% drop

Based on order book analysis I would expect another 65% drop in the price paired with bitshares. There isn't much book support for Smoke until we get down to much lower prices.

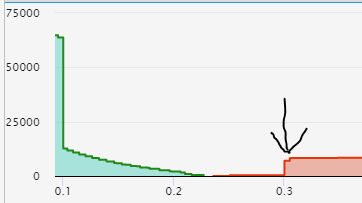

Order Books

We can see a large buy wall, but it is a significant distance down from price. We see a small sell wall put, but we have seen these crop up every drop and grow in side without the bulls eating into them hardly at all. This is creating a lot of sell side liquidity that will resist price from moving up as easily the next time around.

Expectations

I expect we will decline to some random point, possibly to the buy wall or somewhere above it. The buy wall should provide a bounce if we are able to decline all the way to it. We may however pick a random point above it to bounce. That may not be the ultimate bottom either, we will have to watch and assess things as they come.

No new wash trades

Since I made mention of wash trading, there hasn't been a wash trade. So the manipulators may read my analysis. That is interesting to me. Another thing I noticed interesting about the chart that I wanted to point out is how this chart would look inverted. I can't invert the chart like I can directly on tradingview.com for some reason, but if you invert the chart, we can see a classic breakout.

#cannabis #canna-curate #smoke #market #analysis #technicalanalysis #ta