The Green Surge: Exploring Bitcoin's Bull Run and Environmental Implications

In the dynamic landscape of cryptocurrency markets, few phenomena capture the imagination quite like a "green day" – a day when Bitcoin and other digital assets surge in value, painting trading screens with hues of optimism and excitement. Yet, amidst the fervor of bullish rallies, a pressing question looms large: what are the environmental implications of Bitcoin's meteoric rise?

The Bitcoin Bull Run:

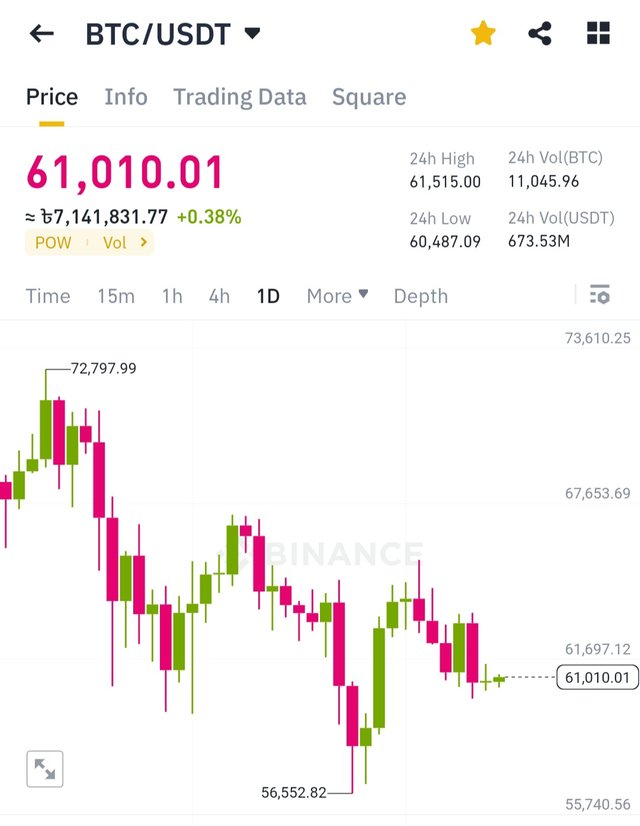

Bitcoin, the pioneering cryptocurrency, has experienced a remarkable resurgence in recent months, with its price soaring to new heights. Fuelled by a combination of institutional adoption, mainstream acceptance, and macroeconomic uncertainty, Bitcoin's bull run has captivated investors and speculators alike, propelling it into the spotlight as a digital gold and hedge against inflation.

Environmental Concerns:

However, Bitcoin's ascent has also reignited concerns about its environmental footprint. The process of "mining" Bitcoin – the computational work required to validate transactions and secure the network – consumes vast amounts of energy, primarily derived from fossil fuels. Critics argue that Bitcoin's energy-intensive mining operations contribute to carbon emissions and exacerbate climate change, raising ethical and sustainability concerns in an era of heightened environmental awareness.

The Energy Debate:

The debate over Bitcoin's energy consumption is multifaceted and nuanced. Proponents argue that Bitcoin mining incentivizes the development of renewable energy sources and fosters innovation in energy-efficient technologies. They point to initiatives such as the Bitcoin Mining Council, which aims to promote transparency and sustainability within the industry. However, skeptics contend that the environmental costs of Bitcoin mining outweigh any potential benefits, citing studies that estimate Bitcoin's carbon footprint to be comparable to that of small countries.

Green Solutions:

In response to growing environmental scrutiny, efforts are underway to promote greener alternatives to traditional Bitcoin mining. Some mining operations are exploring renewable energy sources such as solar, wind, and hydroelectric power to mitigate their carbon footprint. Additionally, initiatives like the "Green Bitcoin Foundation" seek to incentivize sustainable mining practices and promote eco-friendly protocols within the Bitcoin ecosystem. These developments underscore a growing recognition within the cryptocurrency community of the need to address environmental concerns while fostering innovation and growth.

The Path Forward:

As Bitcoin continues to make headlines and attract mainstream attention, the conversation around its environmental impact is likely to intensify. Striking a balance between technological advancement and environmental sustainability will be paramount in shaping the future of cryptocurrency markets. Collaborative efforts between industry stakeholders, policymakers, and environmental advocates will be essential in charting a path forward that reconciles the promise of digital assets with the imperative of planetary stewardship.

Conclusion:

The "green surge" in Bitcoin markets offers a glimpse into the transformative potential of digital currencies while raising important questions about their environmental footprint. As investors and innovators navigate the complexities of this evolving landscape, the need for responsible stewardship of resources and the environment remains paramount. By addressing environmental concerns and embracing sustainable practices, the cryptocurrency community can chart a course towards a more inclusive, resilient, and environmentally conscious future.

The Green Surge: Exploring Bitcoin's Bull Run and Environmental Implications

In the realm of cryptocurrency, a "green day" holds a special significance. It's a day when Bitcoin and other digital assets surge in value, painting the trading landscape with optimism and excitement. However, amidst the euphoria of bullish rallies, a critical question arises: what are the environmental consequences of Bitcoin's meteoric rise?

Bitcoin's Resurgence:

Bitcoin, the pioneer of cryptocurrencies, has experienced a remarkable resurgence in recent months. Fueled by institutional interest, increased adoption, and economic uncertainty, Bitcoin's price has skyrocketed, positioning it as a sought-after asset for investors seeking diversification and hedging against inflation.

Environmental Concerns:

Yet, Bitcoin's ascent has reignited concerns about its environmental impact. The process of "mining" Bitcoin, essential for validating transactions and securing the network, consumes enormous amounts of energy, predominantly sourced from fossil fuels. Critics argue that Bitcoin's energy-intensive operations contribute to carbon emissions, exacerbating climate change and raising ethical and sustainability questions.

The Energy Debate:

The debate surrounding Bitcoin's energy consumption is multifaceted. Advocates highlight how mining incentivizes renewable energy development and technological innovation. Initiatives like the Bitcoin Mining Council aim to promote transparency and sustainability. However, skeptics counter with studies estimating Bitcoin's carbon footprint comparable to small countries, questioning its long-term viability.

Green Solutions:

In response, efforts are underway to promote greener alternatives to traditional mining. Some operations explore renewable sources like solar and wind power. Initiatives such as the "Green Bitcoin Foundation" advocate for sustainable practices within the industry. These endeavors reflect a growing acknowledgment of the need to balance technological progress with environmental responsibility.

The Path Forward:

As Bitcoin garners mainstream attention, the discourse on its environmental impact intensifies. Balancing technological innovation with sustainability will shape cryptocurrency's future. Collaboration between industry, policymakers, and environmentalists will be crucial in charting a path that reconciles digital assets' potential with ecological stewardship.

Conclusion:

Bitcoin's "green surge" symbolizes the intersection of finance, technology, and sustainability. Responsible stewardship of resources and the environment is paramount. As the cryptocurrency community navigates this transition, it's clear that the future of finance must prioritize both prosperity and planetary well-being. In embracing sustainable practices, digital currencies can lead us towards a more inclusive, resilient, and environmentally conscious global economy.

In the dynamic interplay between finance, technology, and sustainability, Bitcoin's green journey represents a microcosm of broader societal shifts towards a more equitable and environmentally sustainable global economy. As we navigate the complexities of this transition, one thing remains clear: the future of finance is inexorably linked to the fate of our planet, and it is incumbent upon us to chart a course that ensures prosperity for both.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit