In June 2022, the crypto market witnessed a historical round of institutional crises. Some of the companies have filed for bankruptcy protection, while others are still holding on. According to the on-chain data, Celsius recently sold nearly 30,000 BTC to pay off the on-chain debts and started to withdraw the ETH it staked.

On July 14, when everyone thought that the crisis was over, Celsius Network announced that it had filed for bankruptcy and reorganization, and said that this move was to provide the company with an opportunity to stabilize its business and a comprehensive restructuring transaction that maximizes value for all stakeholders.

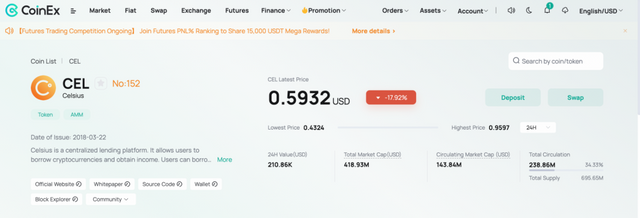

Shortly after the news came out, Celsius’ platform-based token CEL immediately plunged by nearly 18%, according to CoinEx, a crypto exchange.

Celsius, founded in 2017, is a centralized crypto lending platform where users can deposit assets into its wallet address and earn interest through services such as lending, trading, payments, custody, BTC mining, etc. In the crypto space, users think of Celsius as the market’s “shadow bank”. At one point, it managed over $30 billion in assets.

Moreover, in October 2021, Celsius raised $400 million in a Series B funding round led by WestCap (an equity firm founded by former Airbnb executive Laurence Tosi) and Canada’s second-largest pension fund CDPQ. In November 2021, the scale of this funding round was expanded to $750 million.

Initially, the crisis started due to two failed investments made by Celsius. During the BadgerDAO hack, the company lost about 2,100 BTC and 151 ETH. Subsequently, a user pointed out that as the ETH 2.0 staking solution provider Stakehound lost investors’ private keys, the 38,000 ETH (of which 35,000 belonged to Celsius) in the Stakehound account of the company was lost. Following these revelations, Celsius stayed quiet, which also damaged its reputation and hurt investor confidence. Meanwhile, the market saw a round of institutional crises, and a large swath of users began to run on Celsius.

Back then, Celsius, like 3AC, deposited assets into Ethereum through Lido. While the company suffered from scandals, Ethereum started upgrading, which meant that Celsius could not redeem ETH to add more liquidity and was forced to sell stETH to pay for withdrawals. This led to price fluctuations of stETH and investors started to panic once again. In the end, Celsius announced on June 13 that all withdrawals, Swap, and transfers would be suspended.

Although the move temporarily solved the run, the price of its crypto assets plummeted due to extreme market panic, which meant that Celsius had to face liquidation risks of over $400 million on MakerDAO. Soon after, Celsius-related addresses made two deposits totaling 3,542.48 WBTC to MarkerDAO, which resolved the crisis. Then Celsius started to repay some of its debts while withdrawing its staked assets.

To better deal with the financial problems, the company hired restructuring lawyers from Akin Gump Straus Hauer & Feld. They proposed a bankruptcy filing that was rejected by Celsius, and suggested that the company’s customers preferred to support Celsius rather than waiting for a long and painful liquidation process. Then Celsius hired Kirkland & Ellis LLP, and meanwhile announced that it was exploring strategic transactions and liability restructuring and would stabilize its operations and liquidity as soon as possible. Later on, Celsius cut 25% of its staff and reorganized the board of directors.

While everything was going in the right direction, Jason Stone, founder and CEO of KeyFi (the company that manages the whale address 0xb1 for Celsius) said that it has sued Celsius for not paying KeyFi the asset management fee that’s worth millions of dollars.

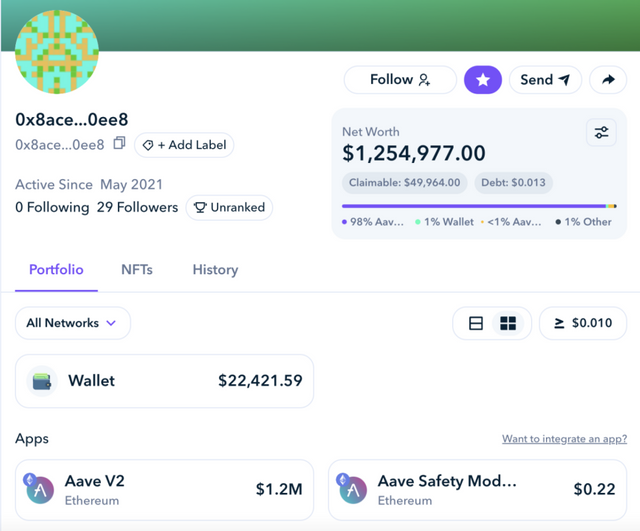

That said, the good news is that Celsius has paid off all the debts of over $800 million on Aave, Maker, and Compound, according to Zapper.

Now that its Defi debts were paid off, why did Celsius still choose to file for bankruptcy and reorganization?

According to Jason, Celsius had repeatedly and materially breached their agreement during the cooperation between the two companies. This brings up another disclosure from an informed source: the crypto exchange FTX had considered buying or supporting the company but walked away after seeing a $2 billion hole in Celsius’ balance sheet.

Simon Dixon, CEO of prominent Celsius investor BnkToTheFuture, said in an interview that he secured up to $6 billion in assets to help Celsius weather the storm, but the deal fell apart after Celsius refused to show its financial records to potential investors.

Recently, the Vermont Department of Financial Regulation issued a document on its official website stating that Celsius is deeply insolvent and lacks the assets and liquidity to honor its obligations to account holders and other creditors. The Department also suggested investors stay on alert and proceed with caution.

So far, two companies have filed for bankruptcy and reorganization due to the fall of 3AC.

Then Celsius started to repay some of its debts while withdrawing its staked assets.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post was upvoted and resteemed on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit