Centralized exchange trading volumes, which had been growing consistently over the past three months, hit a new low in April. This drop in trading volumes on centralized exchanges was largely attributed to digital assets cooling down from a hot first quarter. According to Kaiko, a blockchain data provider, trading volumes on centralized exchanges fell following three months of consecutive gains. In April, the volumes were almost half of those in March, at approximately $500 billion. This made April the month with the lowest trading volumes this year, with March having the highest.

CEX Volumes Return to Pre-FTX Collapse Levels Until April's Decline

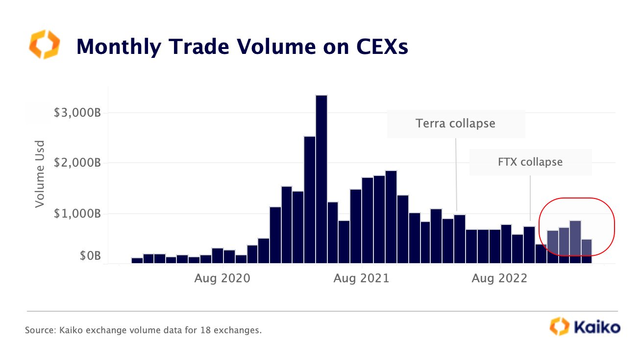

Kaiko also noted that the volumes had reached pre-FTX collapse levels until the decline in April. Nevertheless, the markets remained above 2020 levels in terms of trade volumes. Despite the decline, the overall crypto market is still significantly larger than it was before the 2020 bull run, according to Kaiko.

Binance Adds Back Fees on BTC Pairs Contributing to the Decrease

Blockchain analyst Lars0x reported that legitimate centralized exchange spot volume decreased by 43.8% to $400.5 billion in April. Lars0x noted that the majority of the decrease was due to Binance adding back fees on BTC pairs. Binance remains the market leader, with a dominance of 71.6%, according to their data. Additionally, Binance has a 24-hour trading volume of around $10 billion, which is significantly higher than its nearest rival, Coinbase, with $1.1 billion, according to CoinGecko.

In late April, Cointelegraph reported that Binance's Bitcoin balance had increased by over 50,000 BTC, roughly $1.5 billion, in a month. The move preceded the sell-off as BTC hit heavy resistance just over the $30,000 level.

Coinbase Sees Declining App Downloads

Coinbase, a US-based crypto exchange, has also seen a decline in app downloads in recent months as trading volumes dwindle in the sideways market. Tom Grant, the vice president of research at Apptopia, a research firm that tracks app usage metrics, said the shrinking app usage paints a bearish picture for the company.

Digital Asset Markets Retreat from 2023 Highs

The CEX volume decline came as digital asset markets began to retreat from their 2023 highs in mid-April. On April 16, the total market capitalization hit an eleven-month high of $1.34 trillion. However, markets have declined 7.5% to $1.24 trillion since then.

Since the beginning of the year, crypto markets have gained 50%. However, they have remained largely range-bound for the past six weeks or so. Analysts have hinted that the correction is likely to continue as the markets have been somewhat overheated for the first quarter of the year.

Conclusion

The decline in trading volumes on centralized exchanges in April 2023 marked a departure from the upward trend seen in the previous three months. Binance remained the market leader, but its decision to add back fees on BTC pairs contributed to the decrease in volumes. Coinbase saw declining app downloads, which is a bearish sign for the company. Digital asset markets began to retreat from their 2023 highs, and analysts have suggested that the correction is likely to continue.