China's iron ore futures officially opened to foreign traders on May 4th at the Dalian Commodity Exchange (DCE), marking another step in the country’s financial opening-up.

The move plays a guiding and groundbreaking role in further enriching the variety of China's futures market.

The introduction of overseas qualified traders to participate in iron ore futures trading will make domestic iron ore futures prices more influential and have a positive and far-reaching impact on the pricing mechanism of iron ore spot trading, said Yang Qing, general manager of Galaxy Futures, a domestic brokerage.

Iron ore is the second commodity China has opened to outside investors following the launch of a crude oil futures contract in March, the first futures contracts listed on the Chinese mainland open to overseas investors.

The internationalization of crude oil and iron ore futures are important steps in opening up China's commodity futures market. The participation by overseas investors will bring challenges to regulators and exchanges and is expected to help improve mechanisms and management.

Fang Xinghai, vice-chairman of the China Securities Regulatory Commission, said introducing foreign investors in iron ore trading is the first globalization move for already listed futures varieties, which can provide valuable experience for other futures varieties.

"We will accelerate the process to attract more foreign investors," said Fang. "China will step up the pace of opening the futures market and promote internationalization of all qualified futures varieties when the conditions are mature."

The most actively traded September iron ore contract closed down 1.2 percent at 471.5 yuan (about $75) a tonne and volume for the most traded contract reached 2.86 million lots on May 4, just surpassing April’s daily average of 2.8 million lots.

Also Read: Australia Expects Iron Ore Price to Fall 20 Percent in 2018

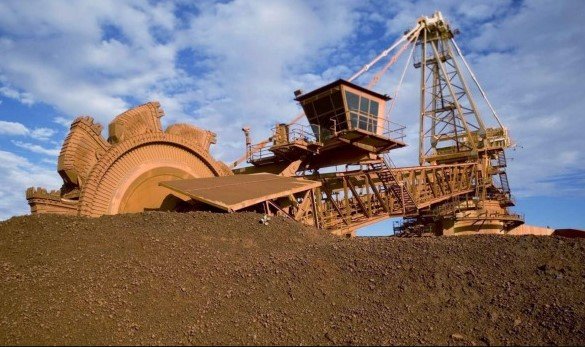

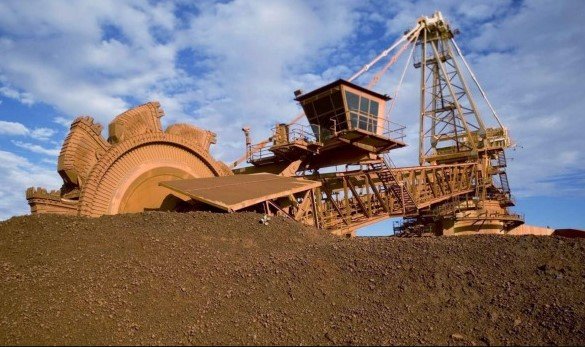

Iron ore contracts were launched in 2013 and broadly traded among producers and traders, with futures prices closely correlated to spot prices. As of the opening day, 21 overseas companies had opened accounts with Jinrui futures, a domestic brokerage.

By including overseas investors, futures prices should better reflect the global iron ore market, according to Li Zhengqiang, president of the DCE.

"Global companies on the supply chain mitigate price volatility by locking into prices through futures contracts. This could help industrial upgrades," Li said.

China imports more than 1 billion tonnes of iron ore annually. As such a big importer, China has a responsibility to provide transparent iron ore futures prices, he added.

The introduction of foreign traders will help promote China's iron ore futures to become a global iron ore trade pricing benchmark, taking China's iron ore futures market from a regional to the global market. The linkage between domestic and foreign markets will become stronger, and cross-market transactions will be more convenient, experts said.

Industry insiders believe that participation by domestic and foreign traders in DCE's iron ore futures will have a substantial impact on the spot market and further improve the international iron ore pricing system.

Posted from my blog with SteemPress : https://insights.jumoreglobal.com/china-allows-foreign-investors-to-trade-iron-ore-futures/