The CIBIL Score is the credit rating- a number that is computed which can determine the credit- worthiness of an individual. In other words, it determines his financial standing and how good a debtor will prove to be in case he applies for a loan- that is, creditors are mostly concerned with the “probability of default”. The score is computed by a valid credit rating agency and the entire credit history of the individual comes to light with this score. The CIBIL Score required for personal loan has to be met with if you do not want any glitches in the application.

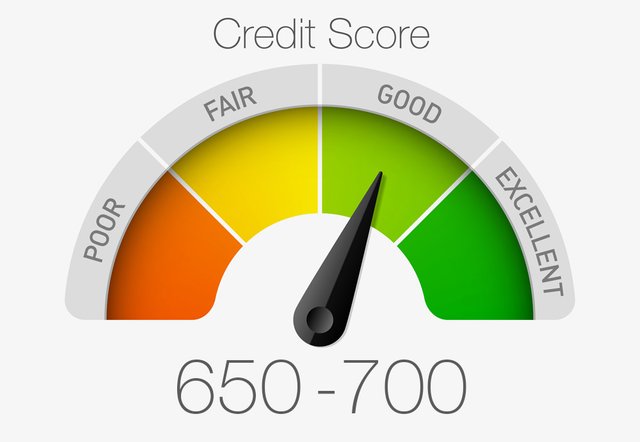

This automatically means that one has a good credit history and a high credit score, their chances of getting their loans approved considerably increases. The score by itself is a three digit figure, mostly calculated on a scale of 300 to 900 and a score above 700 is considered to be a good one. While the credit rating is the same as the credit score, some banks might still ask for a detailed credit report before finally approving your loan. This is because, although the score itself is based on the final repayment of the loan, the nature of repayment during the loan tenure might be erratic in case of certain individuals. Reputed banks and corporate conglomerates are keen to know the repayment behavior as well as the final score before they finally approve the loan.

Those who are new to this and are probably applying for a loan the first time would probably have a few questions regarding CIBIL score. However, a little self check can help you clear inconsistencies even before you have approached the bank, rather waiting for them to tell you about them.

First and foremost, get your own copy of your credit score and credit report and scan it meticulously for all the lags and glitches that you might have ever made in the course of your financial history, which would clearly be reflected here. Consult a CA to determine why those discrepancies arose and know about the best ways of resolving them.

If you know that you would be applying for a instant Personal Loan in the near future, make sure not to delay payments on any of the other arrangements that you might currently have, even if it means paying your electricity bills. Any kind of defaulter status does not do well with credit scores. On the other hand, using too much of credit all at once also means that might be “credit hungry”, as is reflected in the overuse of credit cards.

It also helps if one has a balance between secured loans, which is loan taken against a security or fixed deposit- and unsecured loans, which is loans taken without security. In case a creditor has rejected one of your loan pleas, refrain from immediately going to the next one and rather spend time to determine what it might have happened.

This brings us to the next question, which is: Does a good CIBIL score automatically guarantee that all of one’s loans would be immediately approved?

Well, the answer is both yes and no. While a good credit score is pre- requisite for getting loans approved, there are so many other factors that come into play. A creditor would also want to know about your balance of income and expenditure on a day to day basis. A good income is a plus point, but if the debtor already has too many existing loans, even though he might be making good repayments, he might be asked to clear some of them before applying for a new one.

So what about those who had no loans before and are applying for the first time?

For those who have never taken a loan before, or have never used a credit card, the credit bureau marks the individual as NH or with No History. Naturally, it becomes impossible to determine your repayment behavior and although you might have a good income to show, creditors would only give you a secured loan, that is, they would want collateral like a fixed deposit in the eventuality that you might not be able to repay the amount.