These amazing cryptocurrency ICOs (like the upcoming and much anticipated TenX ICO) may drive the industry directly into the path of extensive government regulation as a result of simple old human mistakes.

I started mining bitcoin and other cryptocurrencies in 2014, when a specific problem became a reality as "altcoins" flooded the industry. The problem was the pre-mine, resulting in a terrible disease called a pump-and-dump scheme. We saw the developers of far too many cryptocurrencies "pre-mine" a percentage of their new coins. Meaning, of the total number of coins to ever be released, the developer(s) or investors took a certain percentage; often a big percentage. Now, if the release rate of coins was fairly low, the actual number of pre-mined coins would sometimes be a large percentage of the total number of coins actually trading on the exchanges. In other cases, if the pre-mine was actually a high percentage of the maximum coins, it didn't matter how fast or slow the release rate. The pump-and-dump problem reared its ugly head because the very circumstance of owning a large number of coins that were worth a lot of US dollars on an exchange or two (or more) was simply too much of a temptation, and many dumped their pre-mined allotment on the markets in a way that was a pump-and-dump scheme. They would drive the price up, and then dump their coins, driving the price back down. This left miners and smaller investors holding worthless currency with absent developers.

You see, even a well-meaning developer, who believes they have high morals and strong integrity, will find little personal resistance to cashing in on a big payday. It's just human nature, and to say, "I would never do that!" is to be naive of our selfish and self-serving tendencies. The entire industry of accounting has Generally Accepted Accounting Principles (GAAP) it follows, in large part, because of this reality. People, even professional accountants trained in financial ethical behavior, are too easily tempted when something is so powerfully in their self interest and life changing. That being said, I do not mean this to be an indictment of the human condition. Rather, my goal with this is to point out a disturbing similarity in a current trend in the cryptocurrency industry. One of which we all need to be aware. One of which I will make a reluctant, heartfelt and sad prediction.

ICO = Premine

First, the trend is the popularity and big money in ICOs. It may have already been pointed out by someone else, and you may already know the similarity. If not, it needs to be made very clear that the numbers in ICOs are very similar to the pre-mine of old. You see, it doesn't take a large percentage of the total coins in the marketplace to manipulate the price in a pump-and-dump scheme. Yet, we see that ICOs are resulting in high percentages of total coins ending up in the hands of single or very small groups of investors. In one case, fully 33% of the total coins minted are not in circulation and appear to be held by the developers or investors.

Do we honestly think that it will be different this time? Let me share my observation and make a prediction. The initial problem back in 2014 often appeared to only enrich the perpetrators in the tens of thousands of dollars, and less often in the hundreds of thousands (rarely if ever in the millions). Now that the potential payoff is, in a few cases, in the hundreds of millions of dollars, what do we think is going to happen? Is it really a reach to predict that we will see the pump-and-dump scheme raise its ugly head? Only this time, with much worse consequences.

Remember Enron!

How could it be worse? The industry has attracted far more people; regular people taking big risks with money they can ill afford to loose. The numbers are staggering and the consequences are not only to the pocketbooks of average people. Anytime the people are screwed, legislation, regulation and governmental intervention happens. When the corporate fraud of Enron happened the government created Sarbanes Oxley and the entire country found itself under new rules. To enforce these new rules and create cases the Department of Justice paid almost 2,000 lawyers to spread out into the country and file suit against organizations in an effort to establish Sarbanes Oxley's constitutionality and quickly create a strong set of case law, so the countries legal minds could fully understand the law's reach.

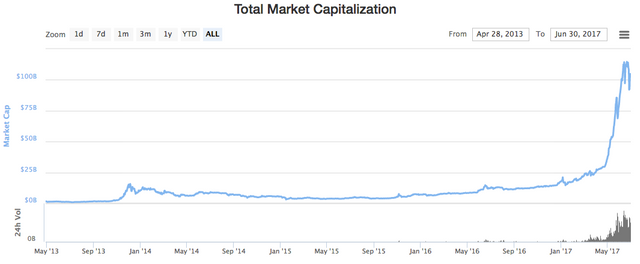

Please understand, the potential pumping and dumping of currency on the cryptocurrency exchanges, could lead to far more than the outcry of miners who lost money in 2014 due to these schemes. Because of the amount of money now on the table, the US government (of the people, by the people, and for the people), that is supposed to protect the people, will be forced to respond. How much money is on the table? Well as the chart below shows (source: coinmarketcap.com), as of the date of this writing its dancing just above and below $100 billion dollars.

Unfortunately, the people the government is tasked to protect seem to be running full speed into this trap, and there is probably no stopping it, or even slowing it down. New records are being set. Hundreds of millions of dollars will soon be raised in minutes. Big percentages of new currencies are going to developers and big investors; you know, "the smartest people in the room." Sound familiar?

That is my prediction, hundreds of millions of dollars will be lost by regular people and our government will have to establish legislative remedies and empower the DOJ, SEC, IRS, et al, to quickly respond and establish case law.

So, what's the possible solution? the same as it was before, and perhaps some creative ideas from you. What was done before was the industry insisted on low pre-mines and demanded escrows or deposit accounts, so large currency holders, while they technically owned the currency, could not dump the currency on the market. That is the technique I am recommending to the market. We need to self-regulate before the government steps in. What do you recommend?

This article is so insightful! I appreciate the perspective. This article proposes a well-founded warning on conditions in the market. I appreciate that you took the time to write it. It is our human nature that gives us such unfounded possibilities and yet it is our very human nature that is also our greatest downfall. I absolutely agree with you that it would be in our benefit if the people stepped in and took the proper measures before the government steps in. It is purely idealistic to think the human beings won't act like human beings. I wonder what the process would be in demanding these types of standards. I suppose the initial process would start with an Ico that has the foresight and character to implement these standards on themselves. That way the natural inclination of the market would be to gravitate towards the coins that offer the safest options. It would be in their favor to do so. It would also offer them an advantage over their competition. And usually the first companies to implement a groundbreaking change are the ones that benefit the most from it. The average person is too bombarded by life circumstances to have much influence on a change of this nature. Yet wise entrepreneurs have always been the Catalyst for change.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @coinae-vance! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit