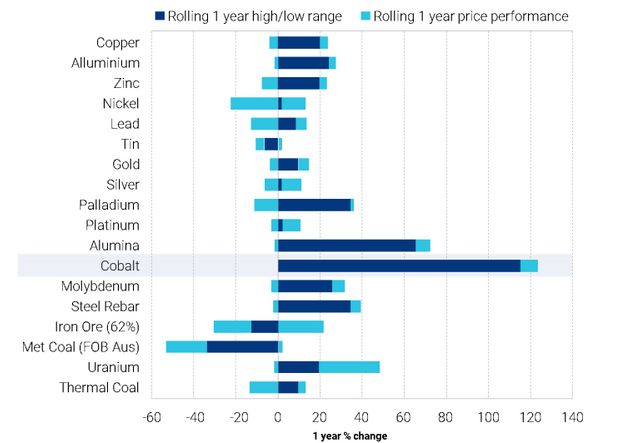

Cobalt Was One of the Hottest Commodities of 2016

Did you know that the price of cobalt exploded last year?

Seriously, it really took off.

In fact, it outperformed all its peers...

I know what you're thinking:

"What caused this crazy spike in the price of cobalt?"

There are three reasons...

1.) Growth in smartphone sales - smartphone batteries are still the main use for cobalt.

2.) Global cobalt mine supply dropped 2.7% since last year - stressing the current cobalt deficits further.

3.) The Electric Vehicle (EV) revolution is just beginning.

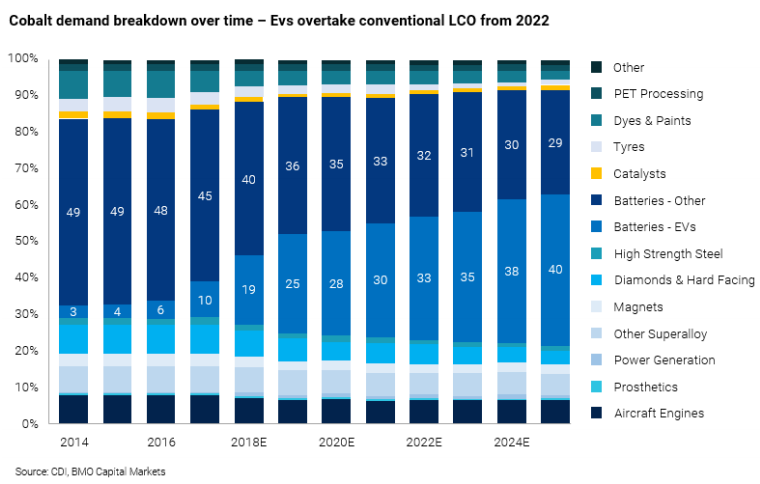

It boils down to this: when you think Cobalt, you need to think Batteries

And over the coming years, especially as EV demand goes parabolic - so will cobalt's use.

To put this in perspective, back in 2000, batteries only made up 16% of total cobalt consumption.

Today, batteries account for 55% of it.

What makes cobalt with lithium-ion so important in batteries?

That's because...

- They are lightweight

- The lifespan of the battery is long

- Short recharge times

- A high density of power from a small amount of space

These reasons have made cobalt containing lithium-ion based batteries crucial for smartphones, tablets, and electric vehicles.

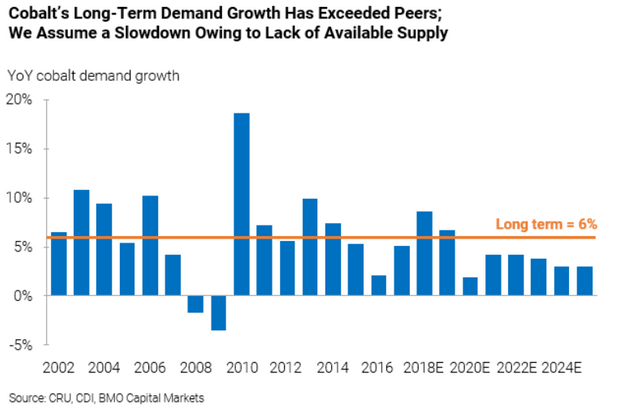

It's no surprise why cobalt demand has grown over the last decade...

Cobalt's Long-Term Demand Growth Has Far Exceeded Peers and a Slowdown due to Lack of Available Supply is Imminent.

And with the huge growth in EV production inevitable, demand will take off.

But getting more cobalt supplies is becoming a serious question.

BMO Capital Markets wrote the following...

"The potential cobalt constraint on EV growth is clear, and is gaining wider acceptance. This process has been accelerated by Volkswagen's notable failure to secure long-term cobalt supply..."

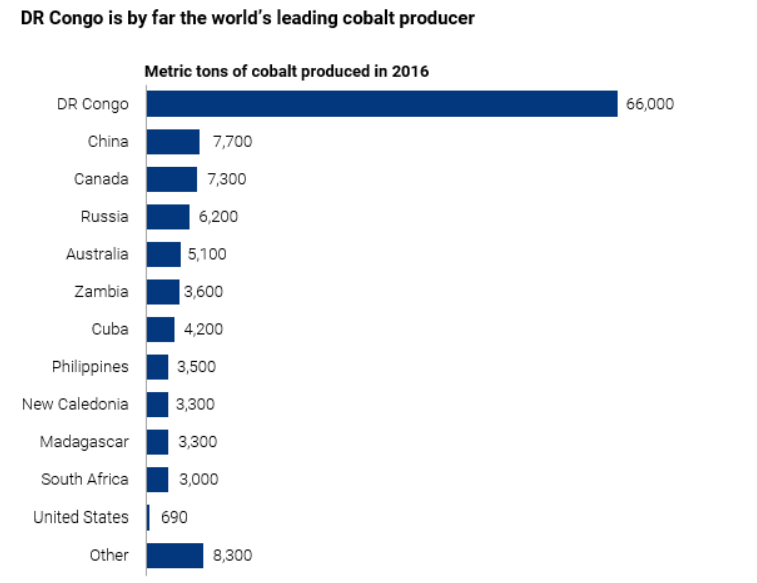

Do you know where most of the world's cobalt comes from?

Almost all of it comes from a single source...

Democratic Republic of Congo is by far the world's leading Cobalt producer

With so much of the worlds cobalt production coming from a single source is worrisome.

Not to mention the DRC is not the most stable of countries...

All it takes is one thing to go wrong there and the supply of such a critical metal - cobalt, could dry up.

Vehicle makers and smart phone producers can't risk this happening. It's already been difficult enough to get the supplies of cobalt they need for the long term secured today.

That's why these reasons will push cobalt prices much higher to bring other new supplies around the world online.

This is what you want to look for when investing in a commodity....

Growing demand plus diminishing supplies equals Higher prices!

I'm personally only invested in one Cobalt company.

And that's:

Cobalt 27 (KBLT.V & CBLLF)

Here is Palisade Research's write up on the company:

KBLT is a pure play on cobalt.

Actually, it is one of the only major ways to position yourself for a rising cobalt price.

Their strategy is really simple that we love it.

“Buy cobalt at these low prices. Hold it until prices dramatically rise. Sell at a huge profit.”

Here some highlights. . .

º Cobalt 27 purchased an additional 800 metric tons of cobalt, and now owns nearly 2,960 metric tons of cobalt

º Cobalt 27’s physical holdings give the company access to inventory financing that can be used to acquire streaming assets

º Cobalt 27’s balance sheet is now among the strongest battery metals pure play companies

Cobalt 27 was even able to out maneuver Volkswagen, Tesla, Unimcore, Panasonic, and other major industrial players to get their hands on physical cobalt.

But there is another unique strategy KBLT is deploying. . .

They are buying streaming contracts from cobalt producers.

And because of their massive physical cobalt assets, they have access to cheap funds and lines of credit.

Management has talked about ways of creating huge shareholder value. . .

One creative option they have mentioned is. . .

1.) Use their assets to secure a stream with a cobalt producer.

2.) Generate cash from the streaming agreement.

3.) Return cashflow back to shareholders through dividends

And because of the company’s huge physical stockpile, this makes them relatively lower risk since they actually have cobalt on hand.

For all these reasons, KBLT is the best way to profit from the inevitable Cobalt boom.

Learn more at:

Cobalt27

Palisade Research

Until next time.

It's your move

JESS

Thanks for reading, if you enjoyed this rant, you might also enjoy some of my

Recent Articles:

How to Invest Like a Two Year Old...

Death of the Petrodollar Imminent as China Moves to Undercut U.S. Hegemony

I've done really well with lithium stocks so far. As for cobalt, my top one is ARRRF as they have a huge quantity in the ground.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah I bought lithium X a few year ago and it really popped.

I got spooked out of lithium after listening to Rick Rule talk about how much lithium there was.

Thanks for that Cobalt tip, i'm reeeeeeeeeeally interested in Cobalt. And i'm having trouble finding legit companies I can invest in.

Also somewhat ethically torn on the whole DRC child mining thing.

I'm definitely gonna check out ARRRF ASAP! thanks @getonthetrain!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

ARRRF is in Australia so no DRC worries there. CTEQF is another one I like.

I still own Lithium X, they are getting bought out. Just sitting on them until the deal goes through. Wasn't the best company as I am only up ~30% or so.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit