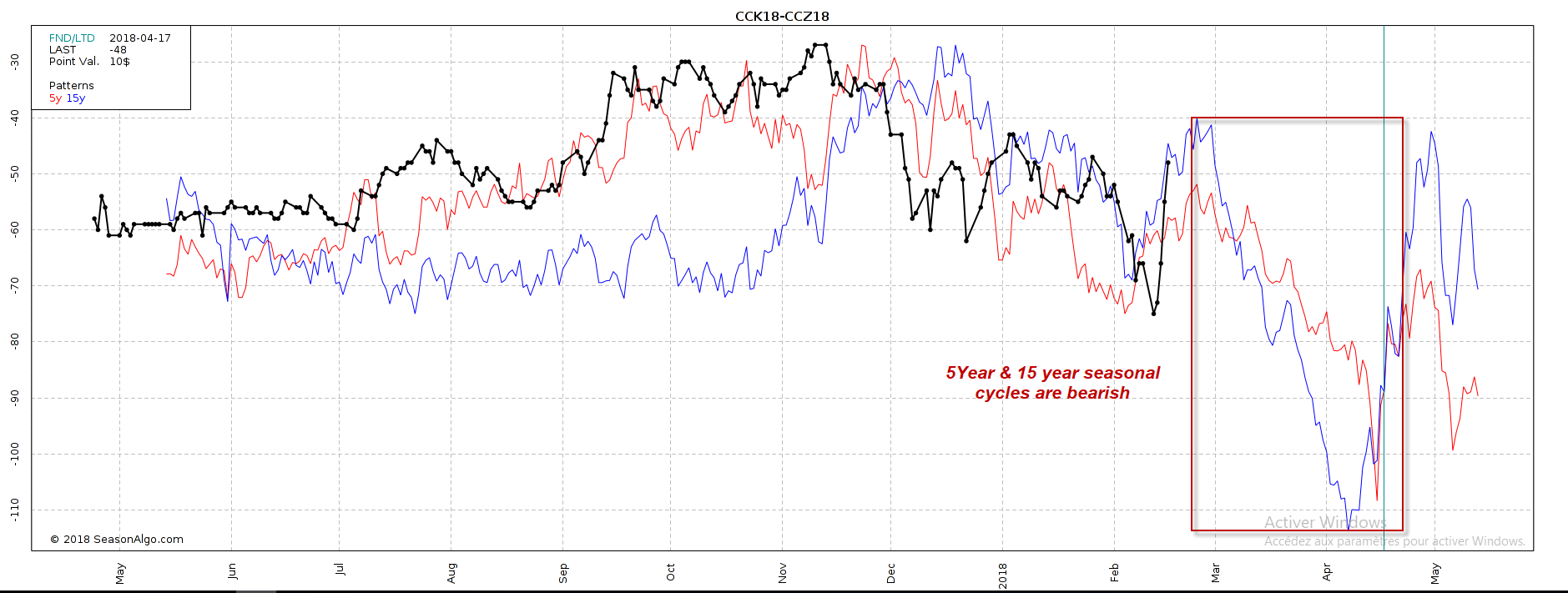

We are talking about cocoa futures calendar spread, made by selling the may contract & buying at the same time the december cocoa contract. A calendar spread allows to have less exposure than the outright. Think of it like an e-mini.

There is a string bearish tendencies starting around next week.

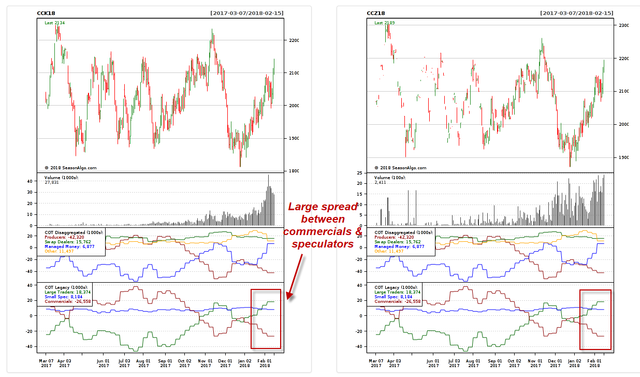

Also commercials are selling while speculators are over leveraged longs. The extreme spread between the 2 market participants very often preceded a reversal.

.

.

On the outright contract, volume of distribution started already with cumulative volume delta turning negative.