This post was originally published on Researchly

Researchly's Industry Sentiment tool for last week (15.07.2018 - 21.07.2018) shows the typical high around Prices and Markets and Regulations. Besides that Malta showed again why it has been dubbed the “Hub of Cryptocurrency World” and Coinbase why it is a crypto empire. Finally, new products and companies were launched and announced, especially in regards to enterprise blockchains.

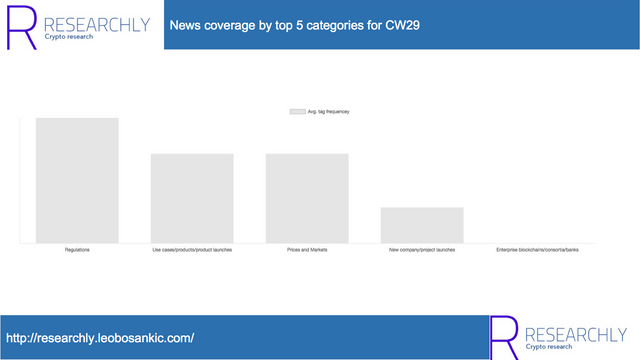

News coverage by top 5 categories for this week based on Researchly’s Industry sentiment tool

News coverage by top 5 categories for this week based on Researchly’s Industry sentiment tool

Coinbase and Lobbying

Coinbase is present almost every week. Last week it was their announcement of exploring adding new cryptos and the resulting price increase of those assets (Cardano, Basic Attention Token, Stellar Lumens, Zcash, and 0x).

This week they received approval by the Financial Industry Regulatory Authority (FINRA) (not SEC as was initially wrongly reported) to acquire Keystone Capital Corp., Venovate Marketplace Inc., and Digital Wealth LLC. This could lead to Coinbase trading security tokens.

The other news was the reveal of their Political Action Committee (PAC) (an organization - often a business - for financing political campaign). Coinbase’s mission is to create an open financial system for the world. So far they have been doing this via acquisitions (e.g. Earn.com) or investments through Coinbase Ventures, essentially building a crypto empire.

However, as this week’s regulations (or any other week for that matter) show, building a crypto empire is impossible without political involvement. As such, it should not come as a surprise that A16Z managing partner Scott Kupor was present at the above-quoted cryptocurrencies-hearing or that Coinbase launched a PAC. As such, they would not be the only one with a “crypto PAC”. A similar PAC is the Cryptocurrency Alliance Super PAC. The Cryptocurrency Alliance Super PAC was formed in 2017 to “raise awareness about cryptocurrencies and blockchain technology, counter the relentless propaganda espoused by the global banking elite who are threatened by a decentralized currency, and to oppose legislation and political candidates who intend to regulate cryptocurrencies at the expense of consumer privacy”.

Coinbase and crypto exchange strategies

The other angle to evaluate Coinbase's foray into politics is from a strategic perspective. Exchanges are taking different approaches towards their market strategy; Robinhood wants to “Kill Trading Fees”, Binance is diversifying with their investment into Founders Bank, and Paxful by expanding into Venezuela is targeting the bottom of the pyramid (see below). And Coinbase now wants to expand their reach through lobbying.

This week Coindesk reported that Paxful plans to expand to Venezuela. First, targeting the bottom of the pyramid is a good way to avoid the competition in more mature markets like the US. Secondly, Paxful’s experience in Venezuela shows that exchanges must offer more than just the core product. Coindesk reports how Paxful is challenged by lack of government-issued IDs, legal requirements to check IDs, unbanked people, and high banking fees. All these issues impede Paxful’s growth. Solutions include “banking people” and - again highlighting the importance of lobbying - collaboration with governments.

Malta

Malta Says Crypto Rules Aren’t Yet In Force Out of three crypto bills one hasn’t been enforced yet. Also, the Malta Stock Exchange launched, together with Neufund, MSX a tokenization platform for trading and issuing security tokens making it one of many other blockchain startups changing securitization. Malta is once again enforcing its image as the “Hub of Cryptocurrency World”.

Based on this, I am curious how strong cryptocurrencies will impact Malta’s economy. Currently, Malta’s GDP represents 0.02 percent of the world economy (Germany’s in contrast around 6%). In the course of history, how countries handle innovations has caused their rise and fall. And although cryptocurrency transaction volumes are still small compared to traditional investment assets (in 2017 the 24h volume of all cryptocurrencies listed on Coinmarketcap was around $50 billion while the global daily FoRex volume rounded at around $5 trillion) it will be interesting to observe the impact of cryptocurrencies on economies.

Regulations

The CFTC spoked at “Public Hearing RE: Cryptocurrencies: Oversight of New Assets in the Digital Age” (you can watch the video on YouTube). According to Coindesk CFTC’s director, Daniel Gorfine asked for a more “thoughtful” labeling of cryptocurrencies. He also argued, “to be sure that we are thoughtful in our approach and do not steer or impede the development of this area of innovation.”

Warning to “not steer or impede the development of this area of innovation” points at the ongoing battle between technology and law; does the law set the technology’s boundaries or does the technology force the law to change. The classical example are ICOs; they started as completely access free and initially, laws were defining what they can do based on existing legal frameworks. The most extreme stance is to dismiss all existing regulations and consider ICOs as a new asset without ties to existing frameworks. As such they would remain completely access free (e.g. not requiring any governmental approval for issuance.

“CFPB Wants to Help Launch New Fintech Products” (WSJ Archive Link). It states that “he expects the bureau’s new innovation office to look closely at cryptocurrencies, other financial technologies based on blockchain, private currencies and microlending, or lending by individuals rather than institutions. The office also could help companies explore alternatives to traditional credit-scoring methods, such as considering rent and mobile-phone payments, consumer shopping behavior and social-media activity in credit decisions.”

I have the feeling that blockchains are receiving over-proportionally much attention (medial and financial) nowadays and that other innovations (especially from the healthcare sector) are left out. I have no data for that but if it is the case, I am sure that we are missing out on some (potentially life-saving) solutions.

Use cases/products/product launches

Leigh Cuen from CoinDesk reported on the issues surrounding PinkDate a blockchain-based matchmaking platform for the adult industry.

Whereas PinkDate does not seem to be a serious project, I still believe that blockchains will play a significant role in the adult industry as blockchains in the adult industry show two of the most important factors driving the diffusion of innovations.

New company/project launches: Politics

Former Trump-advisor Steve Bannon is working on a cryptocurrency. No details yet but still interesting to see somebody so close to the president working on a cryptocurrency. For context, Donald Trump ordered an Executive Order “Regarding the Establishment of the Task Force on Market Integrity and Consumer Fraud” with “particular attention to fraud affecting the general public; digital currency fraud […]”, last week.

New company/project launches: tokenization and Banks

Again Malta. Together with Neufund (which Binance used to invest $155 million into Founders Bank), The Malta Stock Exchange launched MSX, a tokenization platform for trading and issuing security tokens, making it one of many other blockchain startups changing securitization. Similarly, OKEx has launched OKMSX also together with MSX. This comes at the same time as TrustToken, a similar company, has opened registration to their token sale.

Enterprise blockchains/consortia/banks

A lot of talks around (financial) enterprise blockchains and use cases.

The Thailand Bond Market Association (TBMA) is evaluating the use of blockchains for bond transactions.

Japan-based SBI Holdings’ initially exclusive exchange went fully open. This is actually only interesting when contrasted to Litecoin’s 9,9% acquisition of German WEG Bank. It shows namely that both sides (crypto and non-crypto) are expanding into each other’s areas and that the crypto/blockchain and financial industry are more and more overlapping.

This week we have seen two new additions to trade finance; NatWest (part of the Royal Bank of Scotland) joining trade finance platform Marco Polo and the launch of CrimsonLogic’s Open Trade Blockchain. Although trade finance is an essential part of the global economy, it is an incredibly inefficient process. Besides the two new additions, several companies such as Commerzbank are using trade finance platforms to improve their trade financing.

Prices and Markets

Like last week, this week most mentions focused on Bitcoin which went from $6300 to slightly above $7500.