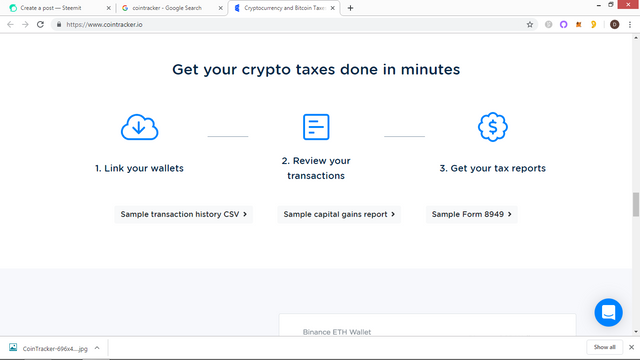

The cryptocurrency world is coming like a tornado, taking over the internet. Almost all the basic internet activities we used to do before, the cryptocurrency world has a better and nicer alternative for it. Let's say you're a blogger, blogging your interest with little or no reward, just for the fun of it. Cryptocurrency and blockchain technology have created tons of blogging platforms that reward content creators with crypto tokens, better right? If you are an online gamer like me, we play games like Clash of Clans, King Castle and the rest, with no rewards for playing them. There are now tons of crypto games that are more entertaining and rewarding like Axie Infinity, World of Ether, and the rest. These games reward their users with crypto tokens. There are literally crypto platforms on almost every internet activity, like online shopping, online betting, even getting loans, like the Ethlend platform. Each of these different crypto platforms have their own tokens which they use to reward their users. The issue many people are facing, including me, is that, we can't really keep track of our tokens, therefore we can't have an accurate tax assessment of our crypto assets. Can this issue be solved? Yes!! But how? By using a cryptocurrency platform called Cointracker. I will advise that you find somewhere quiet, as I let you in, on all the necessary details you need to know about this amazing platform called the Cointracker

What Is Cointracker?

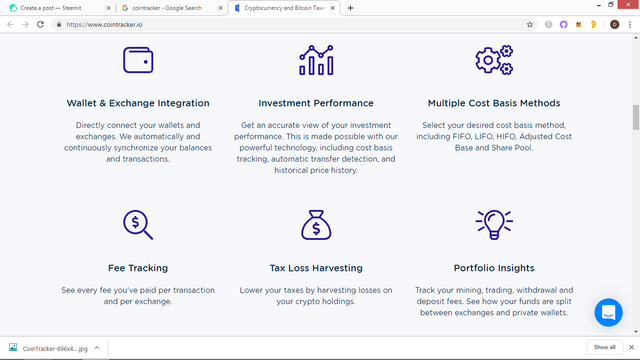

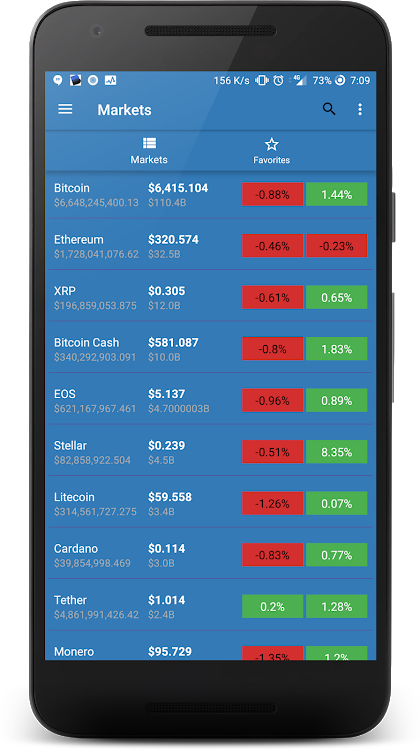

Cointracker is a platform that tracks and manages your cryptocurrencies. This amazing platform was founded by Chandan G. Lodha and Jon Lerner. Their main aim/objective was creating a platform that would make crypto portfolio management easier as well as tax filing. Cointracker is a platform that can keep track and manage over 2,500+ cryptocurrencies, by automatically syncing all of your cryptocurrencies into a unified dashboard for quick access of your entire cryptocurrencies and also for a quick performance evaluation.

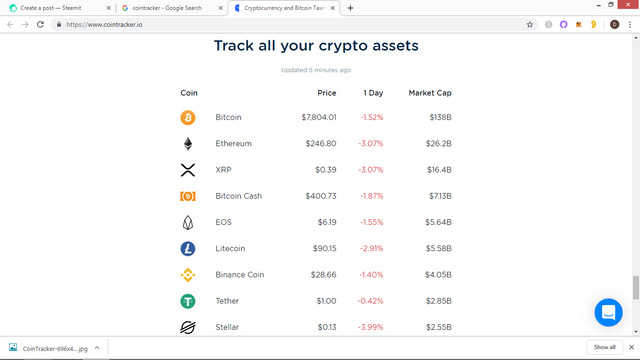

This amazing platform can track the prices of your entire crypto tokens, know their market cap, as well as their historical data, giving a quick glance of each of your entire crypto tokens performance. If this isn't the best coin tracking platform, which is? This platform enables you to track your crypto portfolio across all exchanges and wallets which makes filing your taxes easier and faster. Worried about syncing your exchanges and wallet to a platform? You shouldn't, as the cointracker platform makes use of read-only protocol in syncing your exchanges and wallets to provide 100% security.

.png)

Amazing Features Of Cointracker

Cointracker has gained so much recognition with its unique features which has attracted so many people including big names such as Paul Buchheit[The Creator of Gmail], Serena Williams[The famous American pro tennis player), Alexis Chanian[The Co-Dounder of Reddit] and more. Do you want to know the amazing features of cointracker that attract so many people including big names? I suppose your answer is Yes!!!. For this article, I will be giving you 2 main amazing features of cointracker.

.png)

Crypto-Tax Services

The Cointracker platform is one of the best tracking cryptocurrency platforms in the world today. It is not just for tracking cryptocurrencies that gave the platform this much recognition. It is the crypto-tax services which it offers to its users. Tracking your cryptocurrencies is absolutely free, but then, enjoying the crypto-tax services is not. As a result of the increase in the recognition of cryptocurrency as an asset, the Internal Revenue Service(IRS) has started treating crypto-assets like any other asset, which means that, an individual has to report for his/her gains and losses to Internal Revenue Service(IRS). According to this amazing article;

You have to report gains and losses on all individual trades to the IRS. Specifically, exchanging a cryptocurrency for another, converting it back to USD or spending cryptocurrency are taxable events. Source

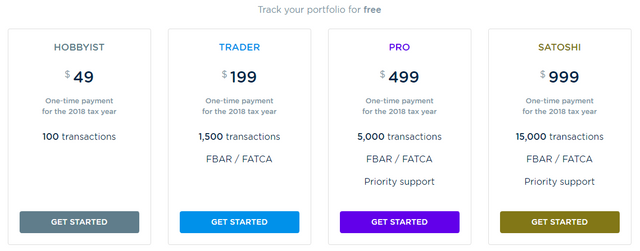

As you can see from the what the article pointed out above, it is very necessary to fill in your crypto gains and losses. It is quite impossible to manually keep track of all your crypto tokens gains and losses. This is where cointracker comes in, cointracker will be able to keep track of all your gains and losses for the year easily. Although, you will have to subscribe for a yearly plan, which will depend how many transactions and crypto tokens you want to track for the year. Here are the plans that are currently available on cointracker;

Hobbyist: This plan costs $49 for the year and covers 100 transactions.

Trader: This plan costs $199 for the year and covers 1,500 transactions

Pro: This plan costs $499 for the year and covers 5,000 transactions.

Satoshi: This plan costs $999 for the year and covers 15,000 transactions.

You should be able to estimate how many transactions you make in a year, therefore you should know which plan suits you best.

Mobile Application

I personally, I'm an on the move kind of person. I always consider if a platform has a mobile application or not. This is one amazing feature of cointracker that attracts people. In this fast moving era that we are currently in, you need to able to keep track of your cryptocurrencies where ever you are and when ever you wish. Imagine you are on the bus, or in your place of worship or in a long boring meeting, you can't bring out your laptop/desktop to see your crypto tokens in these situations but with a mobile application, you are always on the go. You can download the mobile application in the Apple App Store, by clicking here and in the Google Play Store, by clicking here.

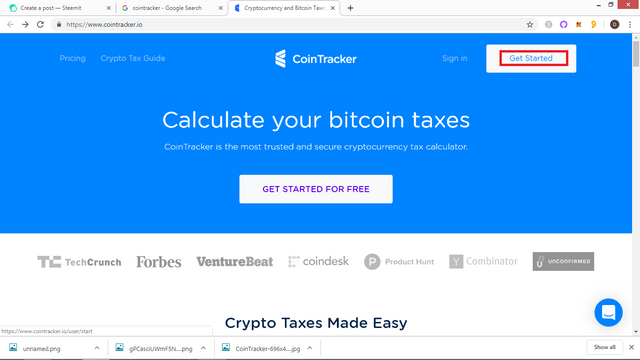

How Can I Get Started?

Its quite simple, you first head straight to cointracker and click on Get Started icon.

.png)

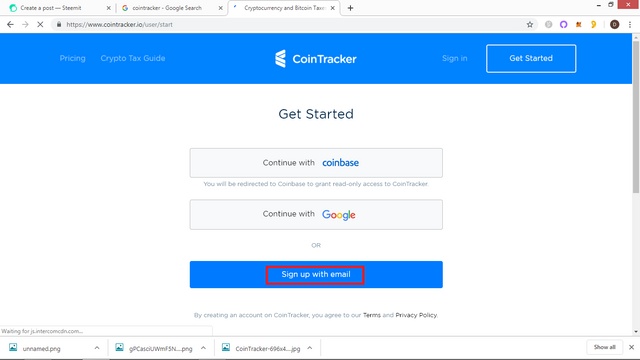

It will take you to a page, where you will be required to login using either your Gmail or your Coinbase account. Make your choice. For this article, I chose the use of Gmail. You will be sent an email, go to your email address to confirm, voila you have successfully created an account. After you have successfully created your account, head back, click on the Sign In icon and then login to have access to your dashboard.

.png)

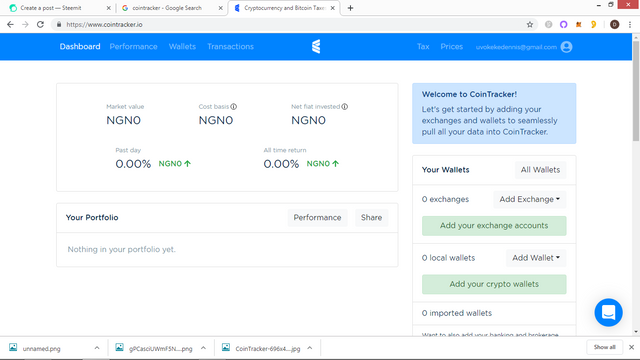

How Can I Synchronize My Account

It's all so simple, simply import your wallet details from your desired exchange platforms. If you have payed for any of the crypto-tax service plans, it will immediately help you to calculate your taxes from your previous and current transactions and present them in CSV format.

.png)

You can watch this very comprehensive video to fully understand how you can file your cryptocurrencies taxes on cointracker

Conclusion

This is an amazing platform that almost every crypto trader should be active on, as it helps keep track of all your cryptocurrencies as well as help you in filing your crypto taxes.

Cool hunt. This will help with ease in calculating crypto taxes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit