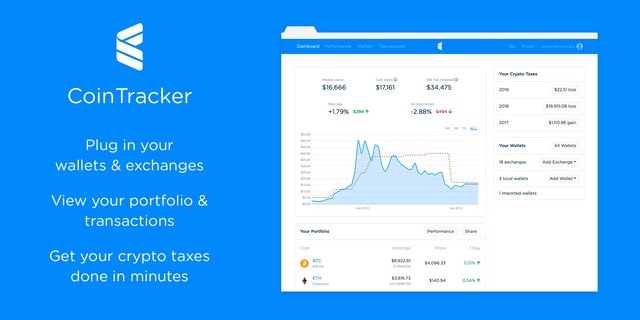

CoinTracker is a web-based application that automatically synchronizes your data across over 2,500 cryptocurrency tokens (such as Bitcoin, Ethereum, Litecoin, Dogecoin, etc.) from wallets and exchanges. It provides you with real-time information on your digital assets by tracking tokens prices, market capitalizations and historical data. In addition to these, it is a very secure application that calculates and generates cryptocurrency tax forms. CoinTracker is very simple and evades clatters that are usually brought about by Google spreadsheets and the likes.

I strongly recommend that you read my previous post on CoinTracker.io before you continue.

Source

Getting Started With CoinTracker

CoinTracker is available for both Android and iOS devices. Find the one supported by your handheld device from the app store and install it. Now you will need to create an account and connect this account to your crypto exchanges. Already integrated on CoinTracker are top exchanges like Coinbase, Poloniex, Binance, Bittrex and nine others.

Once you connect your account to these exchanges, your account will automatically synchronize the wallets balances and other information. You can connect your account to more than one exchange (as many as you have assets on). You can as well connect the account to separate wallets and exchanges not listed on CoinTracker. There is a button named Add Wallet on the dashboard. Click on it to enter the wallet address and indicate the cryptocurrency tokens held on it.

Generating Tax Forms

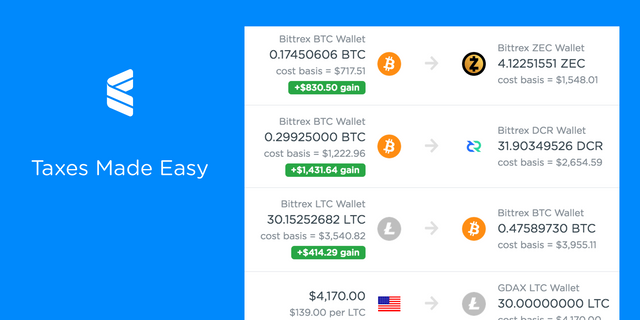

Now that you have your digital assets synchronized on CoinTracker, you should be able to see all your transactions in a uniform environment. You can as well include additional transaction data from other sources using the Import Transaction button. At the same time, you can have a printed copy of your transactions information by clicking the Download CSV button.

The next thing you want to do is to choose your Cost Basis Method. Remember I made mention of the five different Cost Bases Methods that you can choose from on CoinTracker in my previous post. They are FIFO, LIFO, HIFO, ACB and AS. As well, indicate other crypto income you have earned from (e.g. airdrops, pools, affiliate, mining, etc.). By the way, you can get real-time portfolio update through the Performance button. All these depend on the plan you subscribe for.

CoinTracker Tax Subscription Plans & Pricing

You can access CoinTracker and enjoy some features without paying a dime. The moment you need to access tax generation and some other exclusive features, you are required to pay a certain amount of fees. There are four main pricing plans to choose from. These are Hobbyist, Basic Trader, Pro Trader and Satoshi. Each of them has exclusive benefits and limitations. The Hobbyist plan only costs $49 and can generate tax form for as much as a hundred transactions.

Source

The one next to the Hobbyist plan is the Basic Trader plan. For just $199, you can access tax form generation for up to 1,500 transactions. This plan also provides FBAR/FATCA (Foreign Bank and Financial Accounts / Foreign Account Tax Compliance Act) – tax report paradigms required by Internal Revenue services from certain accounts (especially foreign ones) to process tax returns.

The Pro Trader plan costs $499. This plan can generate tax forms for as much as 5,000 different transactions. It also provides FBAR/FATCA, an added report file for its users. As well, subscribers of this plan are given priority customer support by CoinTracker team. Following this plan is the Satoshi plan that costs $999 only. This plan can generate tax forms for up to 15,000 transactions with FBAR/FATCA report. The plan also provides priority support for its subscribers.

For individuals or enterprises that need unlimited tax generations and other customized services, contact CoinTracker support team for information and plan price.

| Subscription Plan | Price | Transaction Limit | Exclusive Features |

|---|---|---|---|

| Hobbyist | $49 | 100 transactions | - |

| Basic Trader | $199 | 1,500 transactions | FBAR/FATCA |

| Pro | $499 | 5,000 transactions | FBAR/FATCA, Priority support |

| Satoshi | $999 | 15,000 transactions | FBAR/FATCA, Priority support |

| Custom | Contact CoinTracker for the plan price | 1m+ transactions | FBAR/FATCA, Priority support, Custom features |

Benefits of CoinTracker

Simple

The cryptocurrency and blockchain technology is complex enough; we do not need something that is hard to operate. CoinTracker is very simple to use. You don’t need to be a professional trader. Connect your account to your wallets and exchanges and start enjoying CoinTracker services.

Accurate

The information displayed on your dashboard is sourced from your wallets and exchanges in real time. Transactions: transfers, withdrawals, deposits, tokens’ real-time values, etc. are automatically synchronized without manual interference. This makes your data accurate.

Scalable

Regardless of the plan you are subscribed to, CoinTracker gets your digital assets tax done in few minutes. There is a powerful technology that monitors your investment performance and provides you with scalable information.

Final Thought

Although the subscription plans may be expensive compared to competitors’, CoinTracker undoubtedly offers additional features that cannot be seen anywhere else. Basic tracking is free and the application is highly diverse. If you are a serious trader that needs more than just a basic crypto tracker, CoinTracker is for you.