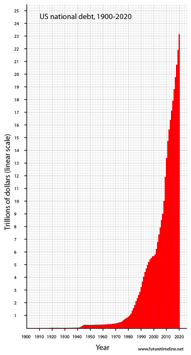

There’s a bubble being inflated right now and, oh boy, this is a big one. It’s being called “the mother of all bubbles”. Let’s have a look:

Here we have the US national debt from 1900 projected until 2020. As of this writing in 2017 it’s a almost reaching 20 Trillion.

“But it’s an USA chart - you might say - What this have anything to do with the rest of the world?”

First of all, I’d say that virtually all countries are doing the same as the US, this is to say, printing money into oblivion and increasing debt, helping basically the banks only (But that’s for another post). So this bubble is happening all around the world, not with the same values but the same pattern.

Another problem is, even if this was occurring only in the US, because of the role of the US Dollar in the world economy, a burst of this bubble would have global implications. Basically all commercial resources are priced in US dollar.

Virtually all countries have reserves in US dollar.

So a collapse in the US Dollar, will definitely not be held lightly around the world.

Now, do you see any relation between the two charts (population growth and debt growth)?

In 1900, when this list chart begins, there was 1.6 billion people on Earth. Seems like the debt system have at least something to do with the boom of almost 5 times within 100 years over a number that took a minimum of 2 million years to reach.

Seems like the population inflation started by the industrial revolution and the later oil fuelled machinery had a push from the debt system. I explain.

The debt system permits you to borrow money (therefore resources) from the future to live a better now, so, the problem with debt is the problem with resources and, therefore, with population increase. For as more resources around, the easier and the more comfortable life is.

As the continuous acquisition of debt into perpetuity is a requirement for this system to work (this is global), it means that that the acquisition of resources in the form of goods and services is also a requirement and this makes possible the maintenance of more people on the planet.

That is to say, once this bubble burst, there will be a problem with resources in quantity and distribution. In other words, there won’t have much around for everybody.

The burst of the debt bubble can definitely start the burst of the population bubble.

I’ll post here below one of Gregory Mannarino (@marketreport) articles, where he explains - brilliantly as always - the same above but with a much better language.

“Global Debt and the Human Bubble.

Written by Gregory Mannarino.

The issue of a global population bubble is virtually not spoken of, in fact I may have been one of the first to openly discuss how grave a situation it really is. However this bubble may be about to burst. When an issue facing an individual or an entire population in this case is so immense, without any solution, it gets blocked involuntarily by the brains inability to cope. When an event is so far out and away from the ability of the average individual to get their head around a self-preservation mode “kicks in,” and subsequently the reality of a given situation gets pushed out of the psyche. The actuality is that the explosion in world population brought directly about by a complete “mismanagement” of the global monetary system via the world’s central banks has inflated a HUMAN BUBBLE. As I have discussed in my book The Politics Of Money and on my business day MarketReport many times, the issue of exploding global debt IS NOT just a monetary issue, it is a problem regarding resources. It’s just that simple. When our politicians allowed Central Banks to implement a fiat monetary system (a debt based economic model), a virtual alternate reality was allowed to manifest itself. This debt based economic model has now evolved into the greatest threat facing mankind with no way out, and there lies the problem. A massive global loss of life is a mathematical certainty. The world’s central banks are responsible for creating a “market” for their product, “currency backed by nothing.” This “arrangement” demands cash be borrowed into existence in perpetuity. This mechanism is a self-feeding one as well, allow me to explain. This debt based system permits and demands an ever increasing debt to be acquired in order to function. Therefore as this fiat currency is borrowed into existence, resources are pulled from the future creating an environment of excess. This has allowed a global population boom and as such the demand for more debt to be borrowed into existence is constantly generated. What must be understood by you the reader is this, without exception all “bubbles” must burst at one point and why is that? Simple, because they rise above a level which can be sustained BY ANY MEANS. The world’s central banks fiat monetary system has allowed a borrowing of monies from the future to live a better now. By pulling monies from the future we have been able to acquire and have access to resources which would normally not have been available. As such we now exist in a “reality” which is not sustainable. A global ever ballooning bubble in debt has directly fueled a population boom, in fact they have risen in tandem. It should be clear to you that the issue of exploding global debt is not sustainable by any means. Therefore, this global HUMAN BUBBLE will burst along with the DEBT BUBBLE simultaneously and tens of millions of people in every continent around the world will die. “

I see it as the population boom has fueled a debt boom. There are huge problems in the near future like a reduction in cheap money. It's going to happen sooner or later unless the cheap money is put into something useful like infrastructure development or alleviating poverty in 3rd world countries.

Right now it is all going to sky high asset prices.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Could very well be, @numpypython. Thing is, the solutions available don't generate profits (especially for the ruling financial sector). Therefore, it's the system that has got to go, for it's inherently flawed when it comes to the welfare of large populations.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit