Love cryptocurrency but don’t have the nerve to lose 20% in a couple hours? There is still a solution for you, Stablecoins. Cryptocurrency stablecoins are what their name implies stable. And while there is no upside potential on the asset itself, you can still make good ROI utilizing the asset within the cryptocurrency industry. At certain times trading or staking stablecoins can return upwards of 30% APR! Can hardly compete with that for the small downside risk

At this time, the best protocols to use to earn interest with the least risk is by using Stable Coins on Decentralized Finance (DeFi) applications.

What are Stablecoins?

Stablecoins are pegged tokens that are supposed to trade 1:1 with a stable fiat currency, (e.g., USD). Putting dollars on the blockchain is the goal, so the price should stay equal to, (e.g., USD) so it should be $1 = 1 Stablecoin.

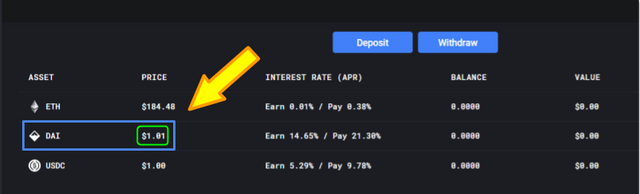

It still fluctuates due to the demand of the market but most, like for example, DAI has been at $1.01 for quite some time now.

It still fluctuates due to the demand of the market but most, like for example, DAI has been at $1.01 for quite some time now.

If you simply want to earn passive decentralized income, all you have to do lock up your Stablecoins so it can start to earn interest from Staking.

What is Staking?

Staking, also referred to as (PoS)Proof of Stake consensus mechanism is to lock up your coins so it can be used for running the nodes to keep a cryptocurrency system in the blockchain, generate income accrued from various sources which will then pay you for the coins you locked up as collateral for keeping the nodes running.

Most of the system is already trustless, like, MakerDAO’s DAI. Most, not all, because you still need to trust the contract as well as the economics and market makers to keep the system liquid.

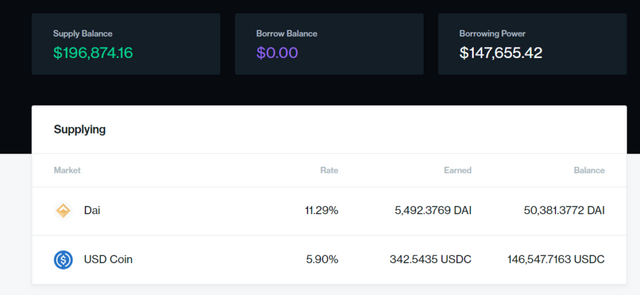

If you want to earn more from various sources you can utilize the full potential of a platform whether be it a Decentralized Crypto Lending or Decentralized Exchange Finance (DeFi) platforms

Decentralized Finance (DeFi) platforms

A Crypto Lending platform is where you can borrow cryptocurrencies against collateral or lend them out and earn interest. Decentralized because all transactions are done via smart contracts, directly between the borrowers and the lenders.

Most platforms accept Bitcoin, Ethereum and Stablecoins. Most profitable Stablecoins to use are DAI and USDC. And to use them in the top Decentralized Finance (DeFi) platforms. Namely,

|

Compound.Finance |

Dy/Dx |

|

|

Stable Coins Accepted |

DAI, USDC |

DAI, USDC |

|

Major Crypto Accepted |

ETH, BAT, REP, ZRX, |

DAI, USDC, ETH |

|

Interest Rates (As of August 2019) |

0.07 – 7.47% |

0.2%-25% range historic 10% APR |

|

Compounding |

Daily |

Daily |

|

Lock In |

No |

No |

|

Decentralized |

Yes |

Yes |

|

Minimum Amt. |

No |

No |

|

Security |

Own Wallet |

Own Wallet |

So there you have it. A low risk, decent reward way to get involved with cryptocurrency and help support the industry indirectly and profit.