What is Compound?

Compound is a protocol built on the Ethereum blockchain. This protocol allows borrowers to take out loans and lenders to provide their assets as loans by locking crypto assets into the protocol. Supply and demand of each type of crypto asset determines the interest rate. You're free to withdraw or repay at any time.

In Brief :

- Is an autonomous interest rate protocol.

- You supply to and borrow from pools of liquidity.

- Protocol supports BAT, Dai, USDC, USDT, WBTC, ZRX.

How to Supply in Compound?

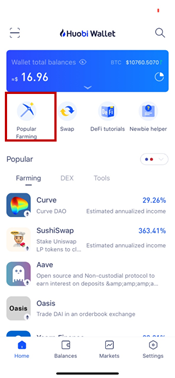

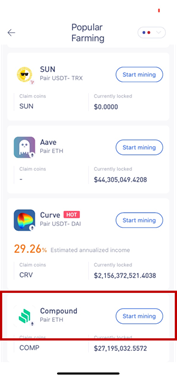

1.Enter ‘Home’ and find DeFi. You will see a range of DeFi applications. Choose Compound.

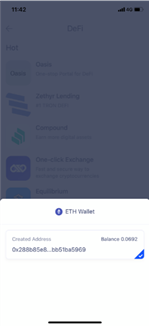

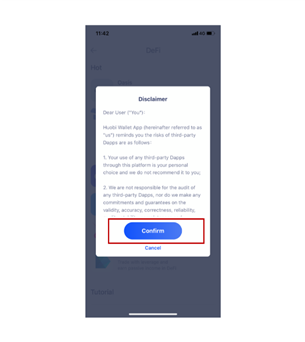

2.Tap to enter. Choose ETH Wallet and Confirm the disclaimer.

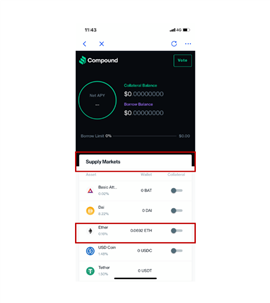

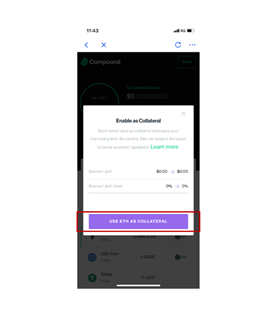

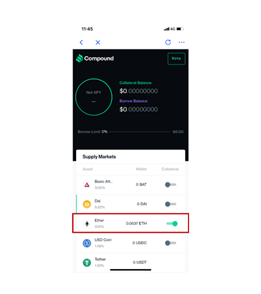

3.Choose ETH or other tokens you want to supply shown on the page Supply Markets and Enable it as collateral.

*Collateral is a guarantee in case you don't redeem you borrowing.In order to borrow in Compound you must have a collateral.

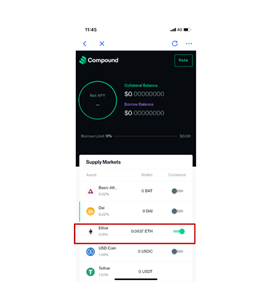

4.When successfully enabled it turns green.

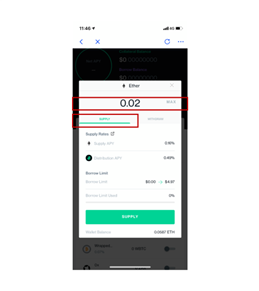

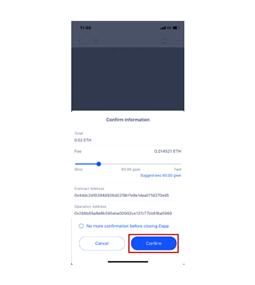

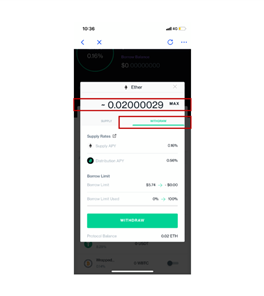

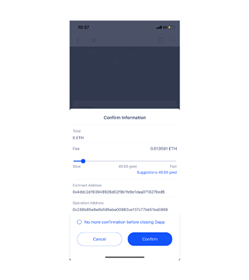

5.Click enabled ETH again and fill in the amount to supply. When confirming you will see the gas fee for related amount.

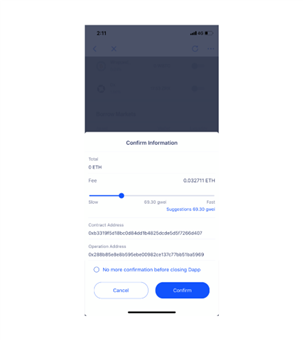

*If you choose “No more confirmation before closing Dapp”, the reminder of gas fee will not appear again.

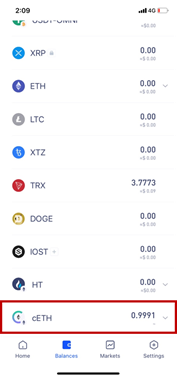

6.When successfully deposited you can see cETH balance in your wallet.

- cETH is the liquidity from depositing ETH into Compound. You can use cETH to deposit into other projects at the same time.

How to Earn COMP?

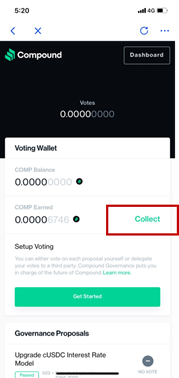

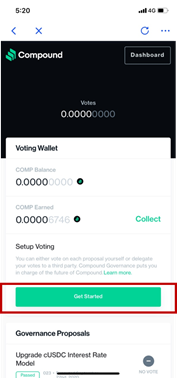

1.Tap ‘Vote’, then ‘Collect’. When tapping on Collect your earned COMP will move to COMP Balance.

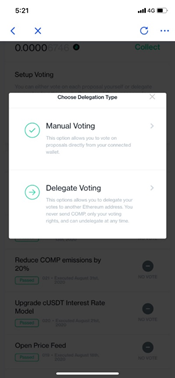

2.If you want to participate in the community governance of Compound, you can click ‘Get Started’ on the ‘Vote’ page to participate in the vote.

How to Borrow in Compound?

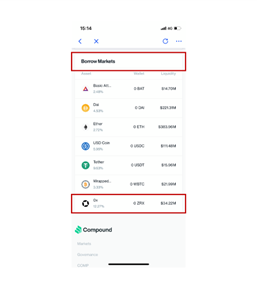

We will show it on the example of 0x.

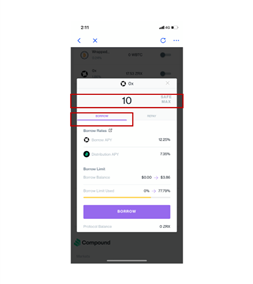

1.Find Borrow markets, click on 0x and enter the amount you want to borrow.

2.On the confirmation page you will see the gas fee for borrowing.

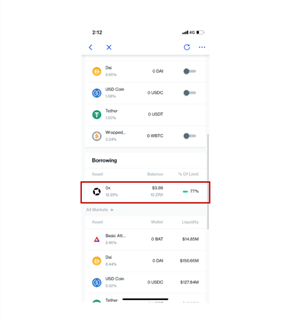

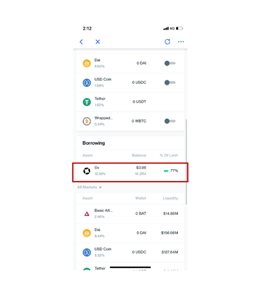

3.When borrowed you will see the amount on the top of Borrow Markets.

How to Repay Borrowed Amount?

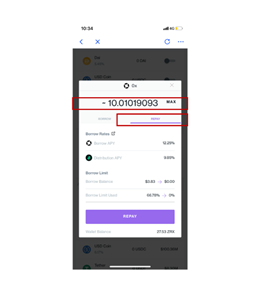

1.Click on 0x, and enter the amount you want to repay.

*You can click on ‘Safe Max’ on the right side to see the whole amount with counted interest.

2.Press ‘Repay’ and you will see the gas fee you need to pay.

3.If the operation succeeds there will be no amounts on the top of the ‘Borrow Markets’.

How to Withdraw Collateral?

- Click ETH and enter the amount you want to withdraw.

*When withdrawing collateral you can click on “Max” and the system will show you the maximum safe amount you can withdraw at the moment. You can withdraw collateral at any time.

2.When confirming you will see the gas fee.

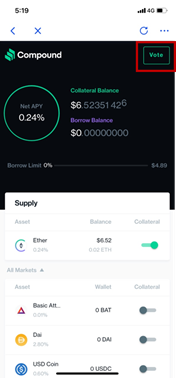

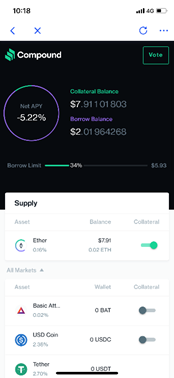

In this page you will the collateral balance, which means how much you supplied and borrow balance how much you borrowed respectively. In our case 34% means that you can borrow this much of collateral. Net APY means how much you get from your saving. In our case it has a negative meaning, that means we are losing part of our savings as the rate for lending is lower than for borrowing.

How to Check the Interest?

On the top of the home page, you can see:

The collateral balance, which means how much you supplied and borrow balance how much you borrowed respectively. In our case 34% means that you can borrow this much of collateral.

The net APY, which means how much you get from your saving. In our case it has a negative meaning, that means we are losing part of our savings as the rate for lending is lower than for borrowing.

*Please pay attention that every financial operation and decision has a potential investment risk, when making an investment think carefully, do not take any impulsive decision.