Introduction to Compound Finance

What Is It?

Compound Finance is an algorithmically-operated, decentralized, interest rate protocol for lending and borrowing cryptocurrencies. It is a platform where users can frictionlessly supply (lend) cryptocurrencies to be used as collateral, in order to subsequently borrow crypto assets based on interest rates set by demand and supply forces.

The protocol has recently launched its COMP token. Read more about it in the section titled “COMP Token and Liquidity Mining” below and find out how incentives apply to using the protocol.

The Process

As a lender, you don’t lend your cryptocurrencies directly to the borrower. Instead, you lend them to the Compound Finance “liquidity pool,” where borrowers can borrow them. This is done through a series of smart contracts on the Ethereum blockchain that automatically matches lenders and their available assets to borrowers. These smart contracts also algorithmically determine the interest rates.

Why Is It Important?

The platform seeks to bridge the gap between two major flaws in the crypto space.

- Negative yielding cryptocurrencies – Most cryptocurrencies are being held in exchanges/wallets without yielding interest. In fact, these stored cryptocurrencies carry a negative yield due to significant storage costs and risks.

- Lack of borrowing avenues in the crypto space – Without lending protocols like Compound Finance, the only place you can “borrow” cryptocurrencies is via centralized exchanges (e.g. Binance, Huobi, Bitfinex). However, borrowing from these centralized exchange means that you have to place an inherent trust in them (to not get hacked, have your positions closed prematurely etc).

More importantly, with the introduction of DeFi, the gap between people with a surplus of cryptocurrencies and people with productive uses and investments for those cryptocurrencies can now be bridged. This benefits both parties, as the party with the surplus gets interest for lending, and the borrower can utilize the extra cryptocurrencies for his or her own purpose.

How Can I Use Compound Finance? Five Essential Steps

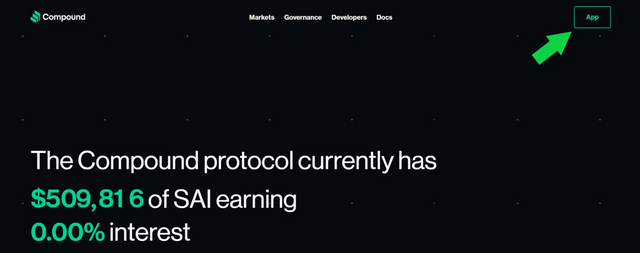

One: Accessing the App

First, you have to go to compound.finance and click on “App.”

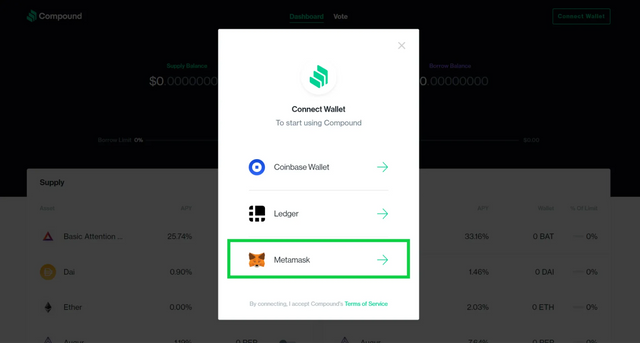

Two: Connecting Your Wallet

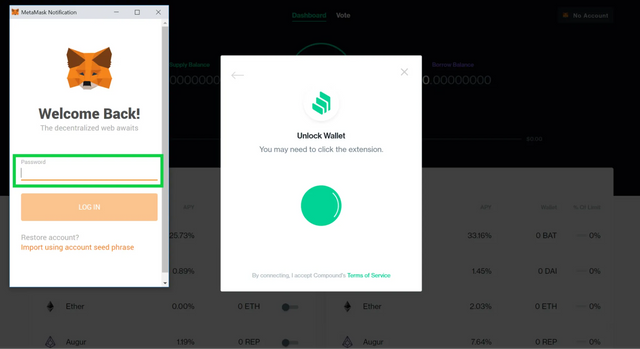

Before you’re able to access the Compound Finance dashboard, you would have to connect the app to your crypto wallet. At this time, there are three types of wallets that can be integrated with the Compound Finance app: Coinbase Wallet, Ledger and Metamask. For the purpose of this demonstration, let’s go with the most popular one, Metamask! (Click here to install a Metamask wallet: you will need to have one to access the Compound Finance app.)

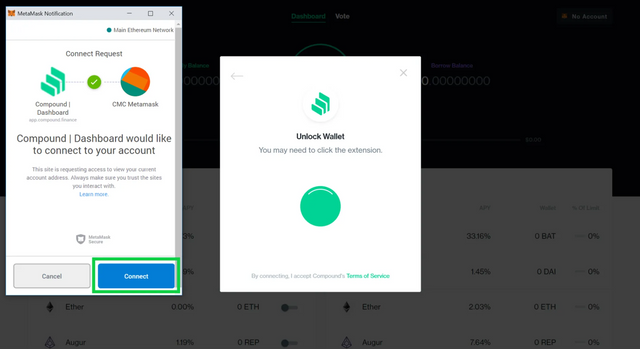

Clicking on “Metamask” will prompt a login pop up. Enter your password, and click “Connect” on the following “Connect Request” pop up.

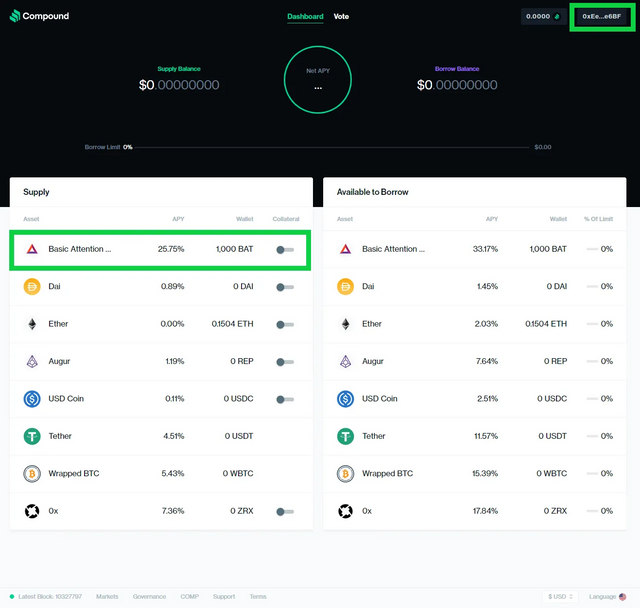

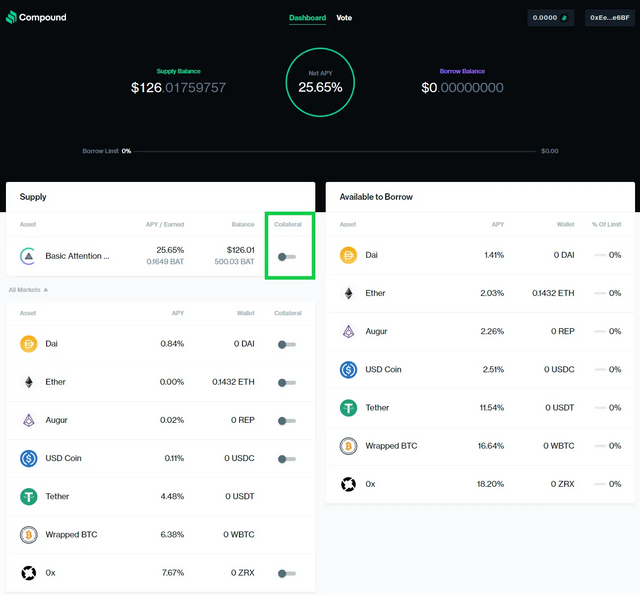

Three: Navigating the Compound Finance Dashboard

Now that you’ve connected your wallet to the Compound Finance app, you will be able to access your dashboard! Before anything, make sure that you’re connected to the right Metamask wallet. You can do this by checking that the address on the top right of your dashboard corresponds with your wallet address.

Four: Supplying (Lending)

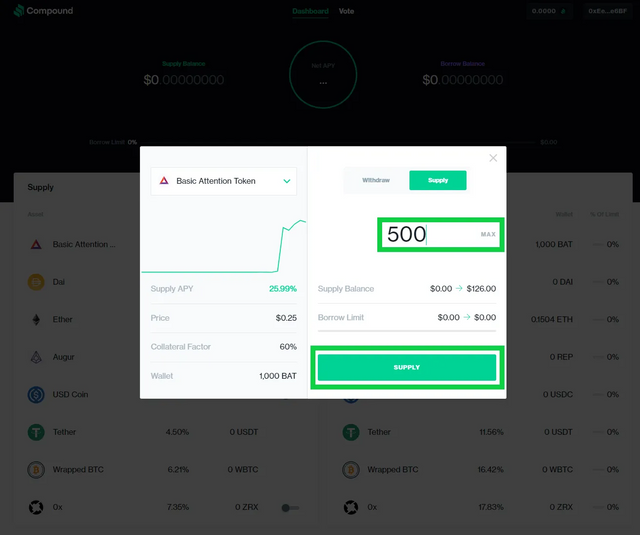

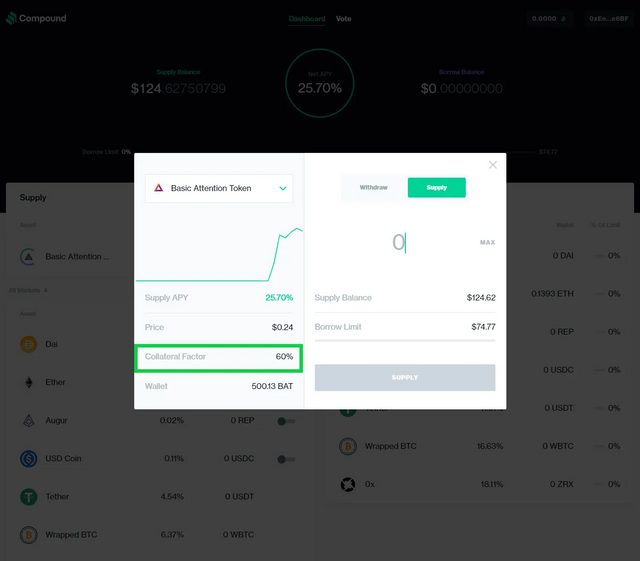

Now, let’s proceed to supplying (lending) Basic Attention Token (BAT). Notice that the current yield of lending BAT is currently at 25.75%. This means that for every 1 BAT you lend, you’d receive 0.2575 BAT at the end of the year. However, this annual percentage yield (APY) rate is not fixed, and dynamically changes due to market supply/demand forces.

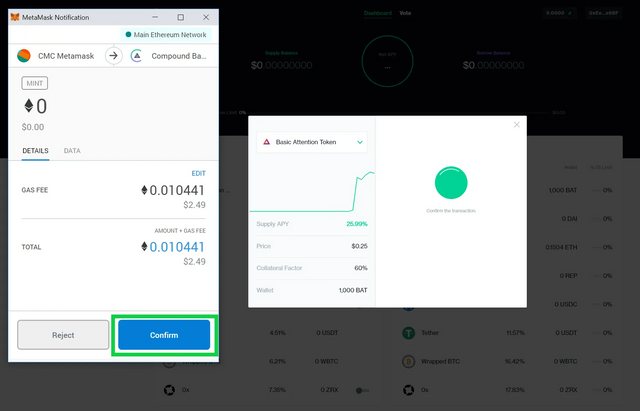

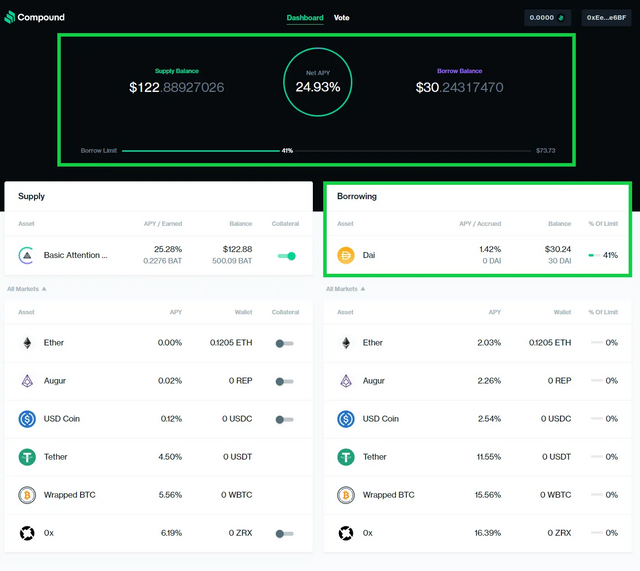

As you can see above, the APY rate had already changed (from 25.75% to 25.99%) from the time it took to confirm the transaction for lending of the 500 BAT. APY will continue to fluctuate every ETH block.

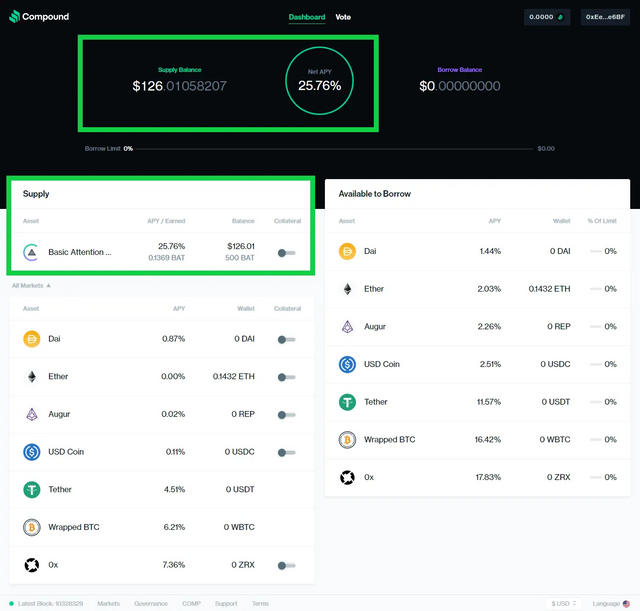

After supplying the BAT, we now can sit back and collect interest! In this case, we are collecting 25.76% interest on 500 BAT! Interest payments are distributed daily, denominated in the token you’ve supplied, and based on the running interest rate.

Five: Borrowing

Once you’ve supplied a token, you’re able to use what you’ve supplied as collateral to take out a loan (borrow). This is similar to how one would use their home as collateral to take out a mortgage. It’s important to note that in Compound Finance, a user can only just be a lender OR both a lender and borrower simultaneously. A user can’t just be a borrower.

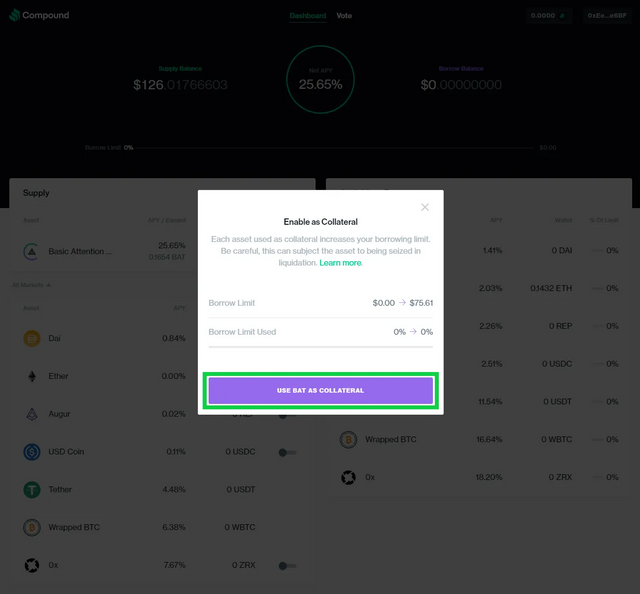

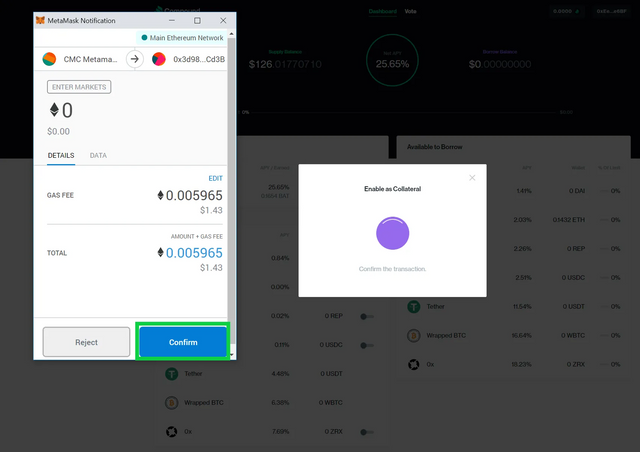

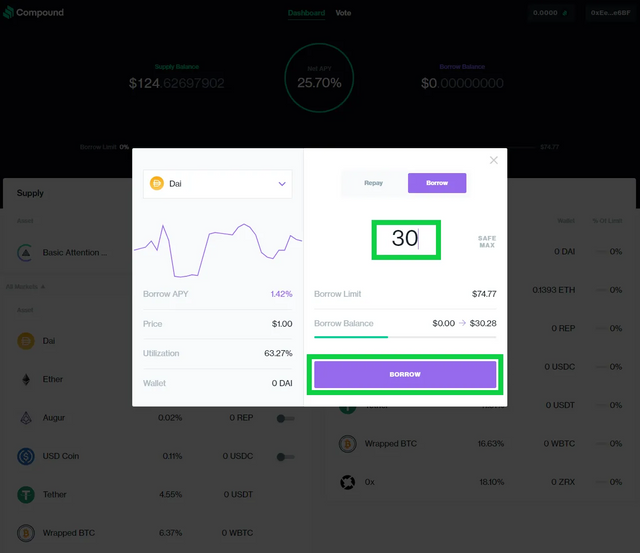

To borrow, first, you’d have to toggle on the “Collateral” button of the token you’ve supplied. Once that’s been done, you can select the cryptocurrency you would like to borrow under the “Available to Borrow” list. In this case, we will be borrowing 30 DAI.

The amount you’re able to borrow is dependent on the amount you’ve supplied to the protocol, as well as the “Collateral Factor” of the asset you’ve supplied. In our case, we’ve supplied approximately $125 worth of BAT (500 BAT). BAT also has a collateral factor of 60% — this means that for every $1 of BAT you’ve supplied, you can borrow up to a maximum of 60% of the value of the deposit of any asset on the Compound Finance protocol (excluding BAT). In this case, that amounts to 0.6 * ($125) = $75.

However, it’ll be smart to leave yourself some wriggle room and borrow less than the maximum amount you can possibly borrow. Any time the total value of your borrow exceeds your borrowing capacity, your collateral (BAT) starts to get liquidated in exchange for the borrowed asset (DAI) at a lower than market rate to pay it back, to the point where the total value does not exceed your borrowing capacity.

Risks of Compound Finance

The Borrow Limit and Risks of Liquidation

Besides earning yield while staking tokens on the Compound Finance protocol, you can also utilize the collateral that you have staked to borrow the available crypto assets on the platform. This means that the more assets you stake, the greater the borrow limit you are entitled to.

The borrow limit of assets differ from each other. At the time of writing, ETH, USDC, DAI and BAT have a collateral factor of 75%, while ZRX (60%) and REP (40%) have lower collateral factors. The collateral factor determines how much you are allowed to borrow. For example, if you deposited 1 ETH when the value of ETH is $200, you will be allowed to have a borrow limit of $150 worth of tokens.

Bear in mind that your account will not be allowed to exceed its borrow limit, or it will risk liquidation. In the example above, if you deposited 1 ETH ($200 per ETH), and borrowed 100 USDC, you would be within the borrowing limit. If the price of ETH fell to $133, you run the risk of liquidation as your collateral value ($133) would only allow a borrow limit of less than $100. As you have an existing loan of 100 USDC, your loan will be up for liquidation.

Liquidation allows a participant of the protocol to repay up to 50% of your loan for you, and the participant that performed the liquidation would receive a proportionate amount of your collateral, at an 8% discount (at the time of writing).

In another example, we have supplied the protocol with 750 USDC (75%) and 250 USDT (0%). This means that we have a borrow limit of $562.5. We proceeded to take a loan of 1,000 BAT ($0.246). This means that we have a 43% utilization rate ($246/$562.5 = 43%) and a “liquidity buffer” of $315. In this example, if the value of BAT shot up to $0.56, we would be at risk of liquidation, and participants could choose to pay back the BAT that we owed and receive the USDC collateral at an 8% discount.

Take note that risks are both ways! If you are borrowing stablecoins with non-stablecoin collateral, your liquidation risk happens when the price of crypto falls. If you are borrowing non-stablecoins with stablecoin collateral (like the example above), your risk of liquidation happens when the price of crypto rises.

The risk of liquidation occurs when the value of the collateral becomes less than the value of the loan. When crypto prices rise, the value of the loan goes up, but the stablecoin collateral value stays the same — that is why there is a risk of liquidation.

Always watch your borrow limit and always have a safe liquidity buffer. As the price of crypto can fluctuate greatly, your liquidity buffer always changes. In addition, interest grows the longer your loan is held — this means that the borrow balance also increases over time!

As long as your borrow balance is greater than your borrow limit, other participants are allowed to liquidate your assets and get an 8% discount on your collateral. If your liquidity buffer is too narrow, repay some of the loan to ensure that you do not get liquidated.

COMP Token and ‘Liquidity Mining’

The COMP Token was launched to allow the governance of the Compound Finance protocol to be decentralized. This allows holders of COMP (or their delegates) to debate, propose and vote on changes to the protocol.

Distribution of COMP

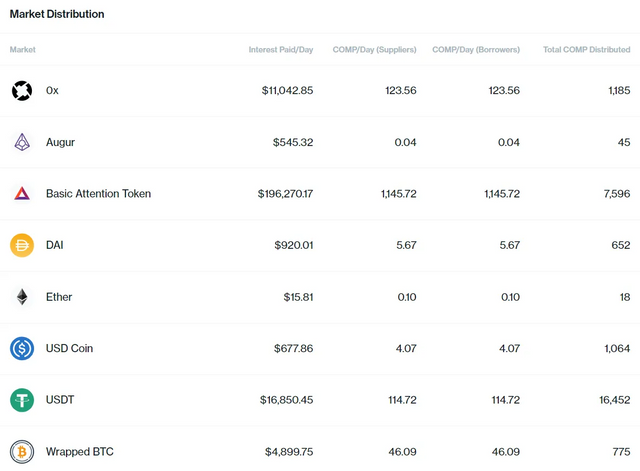

Everyday, approximately 2,880 COMP tokens will be distributed to users (borrowers and lenders) of the protocol. The distribution will be allocated to each market (ETH, USDC, BAT, etc.) in proportion to the interest being accrued in that market. In every market, 50% would be earned by the borrowers, and 50% by lenders.

Screenshot of the distribution table (https://compound.finance/governance/comp)

Liquidity Mining

Hence, in order to earn COMP, all you would need to do would be to provide liquidity (lender) to the protocol or borrow from the protocol (after staking the requisite collateral as stated above).

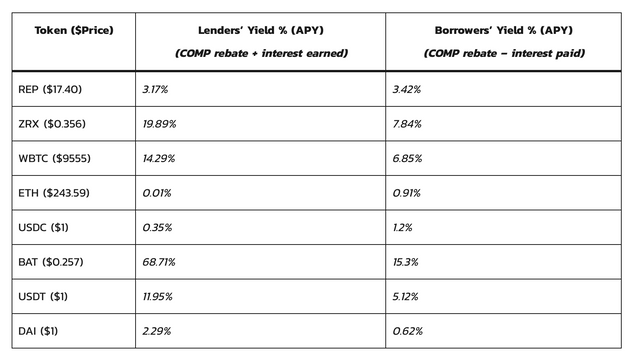

Based on the above, and with a reference price of COMP at $233 (at time of writing), the interest yield from both the protocol and COMP “rebates” can be quite significant.

For reference purposes, on June 24, 2020, the interest yield can be calculated as such:

Do note, these data points are taken at time of writing. Due to the nature of the Compound Finance protocol, the numbers will constantly fluctuate due to the supply and demand of tokens constantly changing. The actual yield you derive from the protocol will differ from the above numbers.

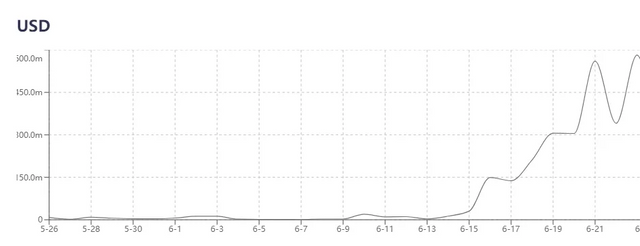

Regardless, the above shows that the value of COMP has heavily incentivized activity on the Compound Finance protocol since the distribution of COMP on the protocol began (June 15, 2020).

Screenshot taken from dapp.review, transaction value in USD terms on Compound Finance

Concluding Notes

The introduction of the COMP token has drastically changed the interaction of users on the protocol by heavily incentivizing activity. From the speed of distribution (4.229 million tokens at 2,880 per day), COMP will be “rebated” to users of the platform for the next four years. Depending on the USD value of COMP, this could essentially be a largely profitable way to stake (or borrow) tokens and earn yield.

Do bear in mind the risks associated with borrowing tokens, and always watch your borrow limit. In addition, while well-vetted and audited, the risk of flawed coding may exist, albeit a small one.

Happy liquidity mining!

Originally published on the CMC blog on June 25, 2020.