Why Grayscale is '100% committed' to converting GBTC to an ETF

by Aislinn Keely

Quick Takes

Converting an existing traded security into an ETF is a novel approach, but Grayscale’s CEO says its track record will be an advantage with regulators and investors.

The firm says it will not file until it is satisfied that regulators are ready for such a product.

A Grayscale bitcoin ETF is coming. The crypto asset manager said in a blog post today that it is "100% committed" to converting its bitcoin trust to an exchange-traded fund (ETF).

Grayscale first attempted to convert the Grayscale Bitcoin Trust (GBTC) to an ETF in 2016. After a year of discussions with the Securities and Exchange Commission (SEC), it withdrew its application in 2017, saying it felt the regulatory environment hadn't advanced to a place where a bitcoin ETF could gain approval.

But the regulatory tide could be turning.

You Should Know

Japan's central bank begins digital currency experiments

The Bank of Japan announced Monday that it has begun Phase 1 of central bank digital currency (CBDC) experiments. The first phase of experiments will focus on testing the basic functions of CBDC as a payment instrument, such as issuance, distribution, and redemption. Phase 1 will be carried out through March 2022.

GoDaddy removes listing that showed Bitcoin.com for sale for $100 million

Some in the crypto community noticed Monday that the Bitcoin.com domain appears to be for sale on GoDaddy for a minimum price of $100 million. But Roger Ver, the owner of the domain, said it is in fact not for sale. "100% fake news," he told The Block.

The IRS's $10+ million digitization project aims to find crypto malfeasance using AI

In an informational posting on April 2, the Internal Revenue Service revealed ambitious plans to digitize operations in fiscal year 2021. The initiative includes a shift away from paper, an emphasis on extracting data from poor-quality images and developing new tools based on artificial intelligence and machine learning.

From the Dashboard

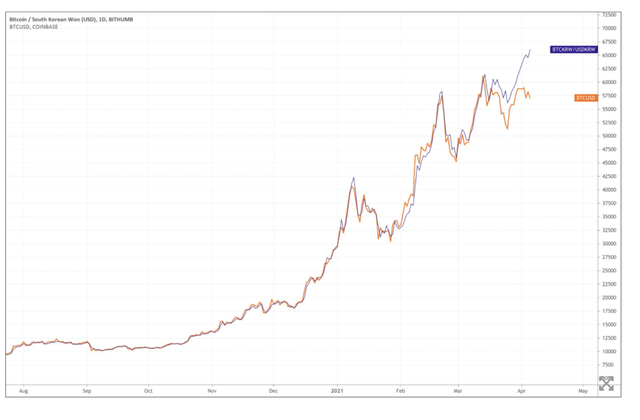

Bitcoin is trading near $66,000 levels in South Korea as "Kimchi Premium" has returned. Kimchi Premium is the spread between bitcoin's price on South Korean crypto exchanges and Western exchanges.

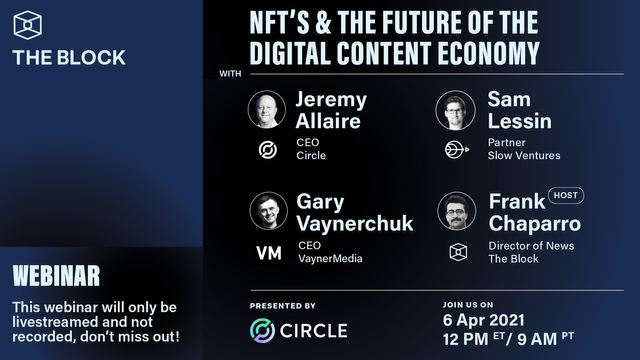

NFT’s & the Future of the Digital Content Economy — Brought to you by Circle

12:00PM(EST)

As an emerging asset class, influencers, online communities, and marketplaces are creating unique liquidity dynamics that make NFTs attractive investment opportunities that hold the potential to accelerate industry growth and mainstream adoption. The Block's Frank Chaparro will host a webinar discussion focused on these and other related topics with Gary Vaynerchuk (VaynerX, VaynerMedia), Sam Lessin (Fin, Slow Ventures), and Jeremy Allaire (Circle).

MORE EVENTS

4/8/2021 Building Financial Infrastructure of the Future: A look at CeFi, DeFi, and TradFi

4/14/2021 Taking Stablecoins Mainstream — brought to you by GMO-Trust

4/22/2021 Embracing Digital Assets: How banks can prepare for digital transformation — brought to you by GK8

Tweets for Thought

Worth It

Crypto firms report uptick in retail activity as US stimulus hits bank accounts

Retail activity in the crypto space appears to be spiking and the latest round of stimulus checks may be an important reason for that. The Block reached out to several crypto firms including Bitstamp, Kraken, Falcon X, and Voyager — all of which reported seeing an increase in retail investments.

A membership is worth a thousand words, to read more become a member here.

DeFi

Decentralized lending protocol Liquity launches on the Ethereum mainnet.

Decentralized exchange protocol Kyber Network has launched a dynamic market-making (DMM) protocol, which it says is designed to be more capital efficient than its automated market-making (AMM) protocol.

This month marks the first time since November 2020 that the monthly DEX volume has decreased, according to data gathered by The Block.