Since the beginning of 2019, the contract market has been climbing in popularity, and the trend has continued in recent years, with more and more exchanges starting to lay out contract products. The dramatic market fluctuations of the 519 plunge before and the bitcoin breakthrough of the 40,000 mark afterwards have thrown the crypto market into a frenzy, and with the favorable spot market, some investors have started to focus on leveraged trading.

Many users may still be confused between leveraged trading and contract trading. Both leveraged trading and contract trading are using small capital to make excessive investments, and while amplifying returns, you also need to bear the amplified risks. Both can be traded in both directions, and many similarities make some users equate contracts with leverage, but in fact they are two completely different instruments, and today we will explain the differences in detail.

- The difference between leveraged trading and contract trading in terms of definition

First of all, let's explain the essence of the two. Contract trading is essentially an agreement in which the buyer agrees to receive an asset at a specific price after a specific period of time and the seller agrees to deliver the asset at a specific price after a specific period of time. Leveraged trading, on the other hand, is a type of investment that uses a small amount of money to gain several times the original amount.

In the crypto market, leveraged trading is when investors use their own funds as security and borrow coins from a platform to enlarge their original principal several times and invest in larger transactions, thus achieving a small return but at the same time requiring a higher risk. Leveraged trading is an extension of spot trading and exists in the spot market.

Contract trading, also known as futures trading, differs from spot trading in that contracts are bought and sold on a standardized forward contract for a commodity or financial asset. Under this forward contract, the buyer will buy an asset at an agreed price after a specified time and the seller will need to deliver an asset at an agreed price after a specified time. In the crypto market it is a separate product in the derivatives trading market.

In the crypto contract market, the product types are mainly divided into two types: delivery contracts and perpetual contracts. Delivery contracts are usually settled on a weekly/monthly or quarterly basis, while perpetual contracts have no delivery date and are never settled.

- The difference between leveraged trading and contract trading in terms of experience

After the definition of the difference, let's talk about some details of the differences. As mentioned above, leverage exists in the spot market, so leverage trading can support a relatively large number of coins, while contract trading as an independent derivative can usually only support mainstream coins and some popular coins, the specific types of which are determined by the platform they belong to.

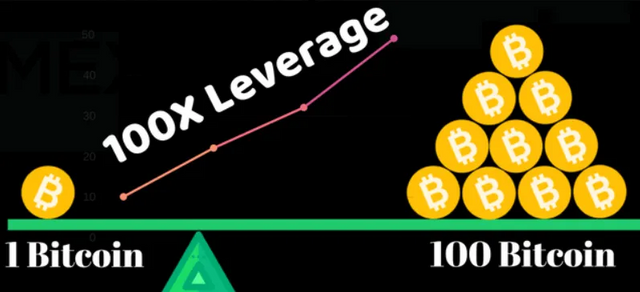

Although both are small to large, most leveraged trading platforms can provide lower leverage than contract products, usually in the range of 1-10, while contract trading can generally reach 20x, 50x and 100x, and some platforms can even give a thousand times contract leverage for special coins.

In addition, there are differences in the calculation of fees between the two. Leveraged trading is spot trading and therefore incurs a corresponding spot trading fee, and due to the existence of a lending relationship, the user also needs to pay a corresponding interest fee, which starts to be calculated when the asset is lent and is generally charged on a daily basis, even if no position is opened after the lending. Contract trading will usually only incur fees at the time of delivery, which vary by platform but are usually lower than the spot rates.

Both can be operated in both directions, i.e. you can go long or short on a particular currency. Contract trading only requires you to choose the long/short direction when opening a position, compared to the slightly more complicated process of leveraged trading. For example, in a BTC/USDT leveraged trade, if you are long, you need to borrow USDT, and if you are short, you need to borrow BTC.

Since the contract has a higher leverage, it is usually more beneficial than leveraged trading with the right trading strategy, but it also requires a higher risk. We can only say that both have their advantages and disadvantages, investors just need to choose rationally according to their needs.