Last summer, well before CBOE or CME were stealing headlines for launching bitcoin futures trading, LedgerX was the first exchange to be licensed to do so by the government's Commodity Futures Trading Commission (CFTC).

Here's how Michael del Castillo described the event in an article for CoinDesk: “For the first time ever, the U.S. Commodity Futures Trading Commission has given permission to a private company to exchange and clear any number of cryptocurrency derivatives. After three years of work, New York-based startup LedgerX was today granted a rare derivatives clearing organization (DCO) license allowing it to clear and custody financial instruments backed by bitcoin, ether and any number of blockchain-based cryptocurrencies.” (emphasis added)

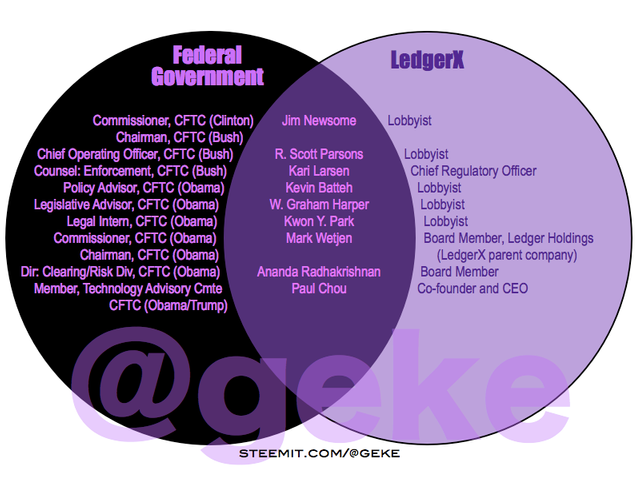

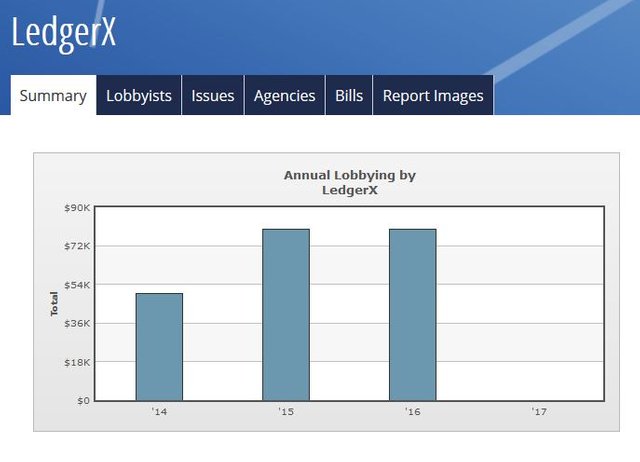

LedgerX's “three years of work” were the three years it spent lobbying the CFTC, as the OpenSecrets graph below illustrates.

Source

The three years' work probably wasn't all that hard, as LedgerX and the CFTC were already pretty friendly. It turns out that the comapny's CEO, Paul Chou, also worked at the CFTC on its technology advisory committee. In addition, two of LedgerX's board members, as well as its chief regulatory officer, have also held prominent positions at the CFTC (prominent, as in, one board member is a former CFTC chairman, its top position). And beyond all that, their lobbying firm, the Delta Strategy Group, happened to be comprised of five former members of the CFTC. In fact, you might notice that the LedgerX venn is composed entirely of former and current members of the CFTC. Nice connections if you can get 'em.

And as if this company's ties to the CFTC weren't garnering enough privilege and favor, Aziz Abdel-Qader at FinanceMagnates.com reported last summer that, “Upon request, LedgerX was also granted an exemption from complying with certain CFTC regulations due to its fully-collateralized clearing model. More specifically, the Bitcoin options platform will not be required to undertake monthly stress tests of its financial resources to ensure that it could withstand the default of its largest participant.”

One prominent lobbyist at Delta is Kevin Batteh, known on Twitter as the “bitcoin lobbyist.” A more accurate description of Batteh might be: lobbyist pushing for adoption of various regulations and oversight of cryptocurrency. Below is a recent tweet in which he's excited about “sensible business friendly regulation” having just attended a cryptocurrency regulation roundtable.

Source

So why are insiders like this LedgerX lobbyist so eager to see crypto and its exchanges regulated? Because as Batteh notes above, most regulation is "business friendly" to the right businesses. For one thing, a regulated industry can impose useful barriers to entry. This protection from competitors makes those first established in a regulated industry more centralized and more profitable than they would otherwise be in a competitive market. Smaller firms seeking to enter this industry will be prevented by the bigger, established players, corporations like LedgerX that are already embedded in government and that can literally write laws (and lobby for their passage) that allow further industry protections, including things like subsidies, tax breaks, regulations that penalize competitors, and as mentioned above, their own regulatory exemptions.

Being “regulated” is the most efficient way to embed a company within the federal government.

Another reason to push for your industry to become regulated is to garner various types of market monopoly. In the case of LedgerX, being one of only a few exchanges licensed to trade in crypto futures and derivatives gives LedgerX a huge competitive advantage over most other exchanges in the cryptosphere.

And its regulatory agency, the CFTC, may have just netted LedgerX even more future business. In exchange for their license, the CFTC placed heavy customer surveillance requirements on LedgerX. According to Castillo at CoinDesk, Chou sees a potential creation of other business opportunities as a result of this surveillance requirement: “By moving the trading and settling of cryptocurrency assets into one heavily observed operation, Chou expects he'll be able to generate revenue from an entirely new source: data analytics to an unprecedented depth.”

But before you worry that Chou might have been a purist crypto enthusiast who sadly sold out to big institutional interests: nothing could be further from the truth. Before co-founding LedgerX, Chou and his wife, Juthica, were both algorithmic securities traders at Goldman Sachs.

GekeVenns originating on Steemit are shared on the following platforms:

Facebook Profile: (930 friends)

Facebook Page: (4,200 followers)

Twitter: (340 followers)

Awesome work, resteemed. Hope it gets widely read.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm kind of torn on this one. LOL On one hand, I wonder if crypto/blockchain needs an advocate in government to help it avoid persecution. On the other, I wonder if it'll just lead to "Crony Crypto" I would touch neither Ripple nor Neo as they are centralized/non-distributed and thus non-minable.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There is a bipartisan Congressional Blockchain Caucus headed up by Jared Polis and some Republican that I forget his name. They promise to do exactly that: advocate for blockchain tech to help it avoid persecution. We'll see...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm actually starting plans to retire out of the country. I don't see how any of this will improve even if more people know it seems fewer care.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Really i appreciate you. Sir Nice to see your post.... Keep it up and well done... Best of luck.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i think you mean Ma'am! at LEAST look at the profile pic buddy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Extraordinary good work....nice one post....

carry on...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin is a remarkable achievement in the field of cryptography, and its ability to create something that can not be duplicated (faked) in the digital world is of great importance.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When you copy/paste or repeatedly type the same comments you could be mistaken for a bot.

Tips to avoid being flagged

Thank You! ⚜

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

you are putting to much work and push in this work...keep it up @geke

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very informative. Well, I think this regulation of an issue is where govt wants all exchanges to end for their centralist goals and revenue generation through tax etc. But due to huge issues related to ICOs failing etc, don't you think they need a sort of regulation. I wrote on ico and from the points I raised I think it requires more of a sort of regulation . My view

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I knew about the LedgerX approval, but didn't understand how they were able to get approved. Thanks for sharing.

I wonder though if they will have a place at the table with CBOE crypto options launch in December? If you are in need of an options market/exchange for BTC and ETH, I think you would go with THE worlds largest options exchange.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit