|

|---|

Hello friends and I welcome you all to my article in the SLC: S21/W3 I would be sharing my immense thoughts on with us all.

Costing methods are laid down processes in which small and medium scale businesses use to track records, deep analyses into cost associated with producing it manufacturing. Costing Methods helps align businesses by systematically tracking profitability, providing access to highly harnessed financial decisions to businesses, making the more relevant in the business space.

Costing method span across Industries where products are manufactured in bulk, the system makes the allocation of cost to each department easly accessible tracking the average cost per unit product. Costing method help set a budget frame for various businesses, it measures difference in expected cost output and the real difference in expected cost output and the real actual cost. The system aids businesses in accelerating the growth and viewing lapses.

Importance of Costing Methods

Yardstick for Price Action:

The voting methods gives business a good yardstick to implementing price in the business. It makes the administrative body set right prices after deep analysis into the costing process.

Threshold for Budgeting:

The voting method is indeed a point where the business bodies can ascertain the estimated amount needed to run a particular sector. This indeed gives businesses a threshold for Budgeting.

Tracking Business Profit & Loss Margin:

The costing method is a great tracker as you could trace profitablity in the business, product review, you would find out whether you are in profit or loss as a business owner.

Support Business Growth:

The costing method is a life support to the business, these costing policies put to place would definitely make the business grow as it creates room for analysis into othr great business ideas which would grow the business.

Difference between Job Order costing and Process Costing methods would be shared here immediately.

Job Order Costing is best suitable for small scale business producing special products which is different from others. There are specific tracking used and most likely used in big engineering companies

Process Costing is applied in industries where there are continuous production in succession. Products used here are identical products which are produced in mass. It is suitable for environment where products pass through various stages. To quickly get the estimated profit margin. These business could be food processing businesses,oil and gas, amidst a host of others.

In Job Order Costing there is a unique cost allocated to each sector. Moreso like cot division for each department or quarters

In Process Costing, cost are averaged and allocated to each varying unit produced within each department. In other words cost are averaged and processed equally.

Job Order Costing comprises of separate cost being recorded for each job, involving track records comprising of rows and columns for tracking costs for jobs registered.

Process Costing uses a unified cost recommended for each and every process. Cost are recorded as they go through each and every stage successfully.

This special costing is primarily used for high income business, large contracts, which is characterised by long term accounting periods, it is used by businesses involved in ports, road construction companies which build bridges and a host of others.

Perfect scenario, where a construction company in charge of building a fly over needs about 2 tons of concrete to complete the project. Eventually a ton was used and remainder kept and recorded into inventory and transferred to the contract account for the succeeding year ahead.

This is the sequential costing of items produced specially in the series of batches. It is used when producing products in batches. It could be used in production proper. The use of special raw materials required could be acquired and used specifically per unit as the case may be in special batches.

Perfect scenario, a restaurant purchase 5 bags of flour for dough and snacks. They used about 2 bags for baking cakes, the rest stored for the next batch for baking dough nuts.

|

|---|

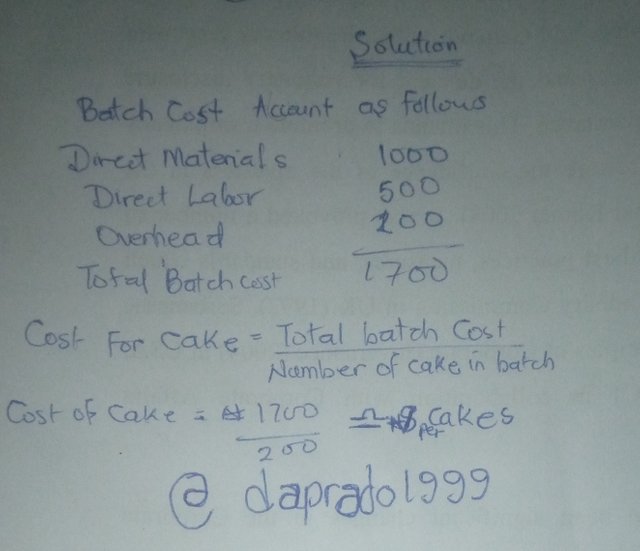

- Batch Costing: A cake manufacturer produces a batch of 100 chocolate cakes with the following cost as shown.

Total Batch Cost: Direct material + Direct Labor + Overhead

Cost Per Cake: Total Batch Cost / Number of Cake in the Batch

|

|---|

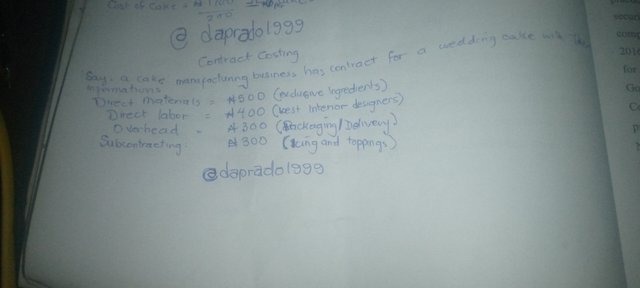

- Contact Costing: This is crucial for cake production in large events such as functions, birthdays, parties.

|

|---|

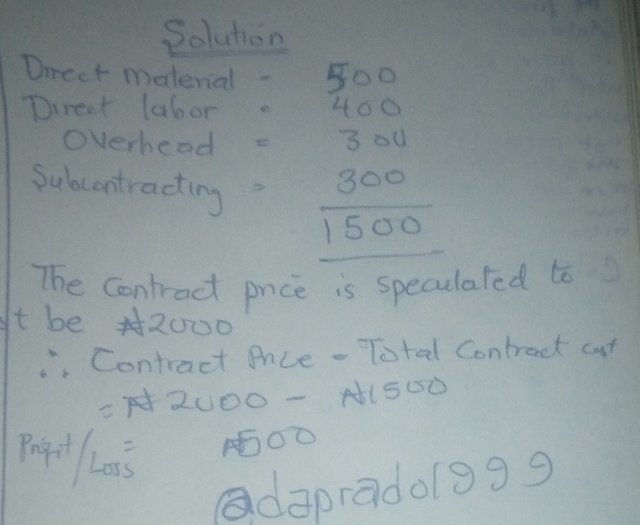

Calculating the above in image

Total Contact Cost : Direct Material + Direct Labor + Overheads + Subcontracting

Profit/loss:Contract Price - Total Contract cost

|

|---|

This is my basic understanding of the context in the lesson.

Cc;

@jolvijrm

Greetings @daprado1999

1.- You have shared the concept of cost methods and named their importance, making it clear that they provide necessary information for decision making.

2.- You have presented the differences between costing methods by work order and by process. Each method generates an appropriate way to calculate costs according to the production need.

3.- You have presented 2 types of appropriate cost methods, which serve to facilitate the calculation of large-scale production.

4.- You have developed the proposed exercise in an acceptable manner, taking into consideration a cake productive environment.

Thanks for joining the contest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Warm regards to you my highly esteemed friend. I appreciate your beautiful review on my article.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Poor cost management can cause permanent damage to a business. So do a proper analysis of each cost.

Finally good luck for the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Warm regards and thanks my dear friend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit