What are costing methods and what is their importance?

The best systematic approaches that businesses use (applied) to estimate, record, and as well analyze costs that are associated with operations such as producing or manufacturing products, or services are costing methods. We are going to know their importance, but before going to that, I want you to know that costing methods, help allocate expenses, assess profitability, and make well-informed financial decisions for businesses which makes it so crucial for businesses.

There are several costing methods, used by businesses to record, estimate, and analyze all costs associated with operations some of the most common costing methods are the ones discussed below 👇.

Job Costing: This is the most common costing method that is used by a business that carries out tasks or jobs to meet specific customer orders. It tracks costs specific to individual jobs, which is best for customized products, as it allocates direct materials, labor, and overhead costs to each job individually. For example job costing, we can say repair work on motor vehicles is done by a repair firm (company).

Process Costing: This is the costing method that is suitably used in industries where products are produced in mass quantity and continuous process. A good example is the food processing and chemical industries that assign costs to each department it processes and then averages across units.

Activity-Based Costing: This is the costing method used by businesses to focus on activities as the basis for assigning overheads to products. ABC is the abbreviation which the essence of the costing is to provide a more accurate allocation of overhead via linking costs to specific activities like quality control, and machine setups.

Standard Costing: This is the costing method that uses predetermined or standard costs for labor, overheads, and materials, helping to set a budget and measure variances between expected and actual costs. Other costing methods are; variable, absorption, batch, and contract costing which two will be discussed later.

Importance

As we read, earlier costing methods are so important for businesses some of their importance are:

Control Costs: By identifying where expenses are much higher, businesses can make adjustments to reduce and control costs which is one of the important costing methods.

Aid Pricing Strategies helps businesses to get accurate information about costs which in turn businesses use information to set prices.

Support Budgeting: Like standard Costing which helps in setting budget and performance benchmarks for businesses.

Enhanced Profitability Analysis: This helps to show (display) the profitability of services, products or guiding resource allocation, and business segments.

Improve Decision-making: They provide information (data) for making informed financial decisions about resource allocation, planning, and product levels.

Explain the difference between the job order and process costing methods.

Here I will be explaining the difference between the job order and process costing methods in a tabular form and showing their key differences based on how costs are assigned what they are suited for and their types of production.

| Job Order Costing | Process Costing |

|---|---|

| Is best suitable for industries producing customized smaller or unique batches of products. Each order or job is different and needs specific tracking which is best used in consulting services and construction firms. | It is applied in industries where production is continuous, and identical products are produced in mass. It is suitable for environments where products pass through several stages, like food processing, chemical production, and oil refining. |

| In job order costing, costs are accumulated for each specific order of job. Each job has its cost sheet where direct labor, materials, and overheads are recorded. | In process costing, costs are accumulated by a department or process for a certain period. |

| In job order costing, each job has unique cost allocations. Labor overheads and materials are allocated or traced to individual jobs. | In process costing, costs are averaged and allocated to each unit produced within a department or process equally. |

| In job order costing, separate costs are recorded for each job, using job sheets for tracking as they are incurred for each job. | Process Costing, uses a single cost record for each process or department. To this costs are recorded as they pass from one stage to another with each stage adding its portion of labor, overhead, and materials. |

Research and explain, to the best of your understanding, two costing methods different from those explained in this class.

Batch costing and contract costing methods are the two costing methods that I have gladly explained.

Batch Costing

Just as it is called batch costing, it means a system of costing for items that are produced in batches rather than individually. "Production run" is what a batch might also be called. It is mostly used when production units are manufactured in batches. Batch production is used mostly in manufacturing in the following circumstances:

The capacity of a factory to make a product exceeds the sales demand for the product. This means the factory is therefore not required to make the product continuously. Instead, it makes the product in occasional batches or production runs.

The factory makes many different products using the same machinery or equipment. The machinery must therefore switch between making different products, which means the product will not be manufactured continuously. For example, a company might manufacture a range of wooden furniture items on the same machinery. It might manufacture a batch of 100 tables, followed by a batch of 400 chairs, followed by a batch of 200 bookshelves.

Batch costing and similar, but still there are differences between the both. When it comes to batch costing, the total cost is established for individual batches, where each batch consists of a large number of similar items of units.

Contract Costing

I do call this type of costing a special costing because of how it is used for a large-scale contract where the time taken to complete the contract might fall into many accounting periods. It is mainly used by businesses that are involved in industries like ship-making (building) and civil engineering.

For example, company Y entered into a contract to construct a new building for a customer. It took delivery of 100,000 bricks to the site. Only 800,000 bricks had been used by the end of the period. The remaining 20,000 bricks will then be used in the next period.

Based on the given example, the company could achieve this by carrying the bricks down in the contract account or by transferring the bricks into inventory at the end of the year and then transferring them back into the contract account at the start of the next year which a clear practical example has been illustrated in a paper on the next given questions.

Research from

ICAN Performance Management PDF

ICAN Management Information

Perform the costing by work orders, according to what was explained for a cake manufacturing business,

For a cake manufacturing company, batch and contract costings are important for different cases and we will practically be looking at how costing by work order can be applied in each of them.

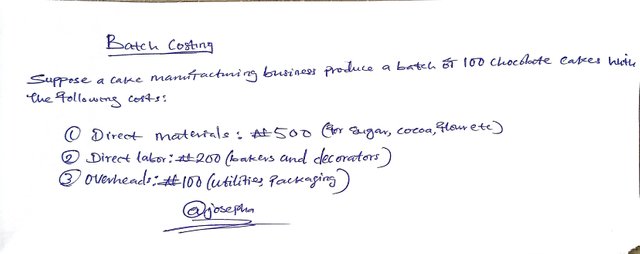

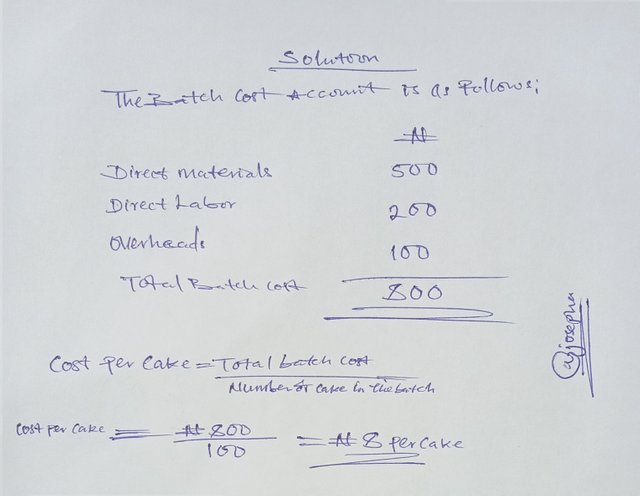

Batch Costing

We already know what batch costing means, in terms of work orders we can say for example, 100 chocolate cakes will be treated as a work order.

Before we dive into a practical example, the components for batch costing in a cake manufacturing company will be specified as;

| Direct Materials | Ingredients used for the batch cake example, sugar, cocoa powder, flour, etc. | |

|---|---|---|

| Direct Labor | This involves the cost for decorators and bakers working on that batch | |

| Overheads | This involves utilities, for example, electricity for ovens, packaging costs, etc | . |

For example, suppose a cake manufacturing business produces a batch of 100 chocolate cakes with the following cost as shown in the image below 👇.

In calculating the above total cost and cost per cake will have to apply the given formula below.

Total Batch Cost

= Direct Materials + Direct Labor + OverheadsCost per Cake =

Total Batch Cost / Number of Cake in the Batch

Above is the solution to the provided questions.

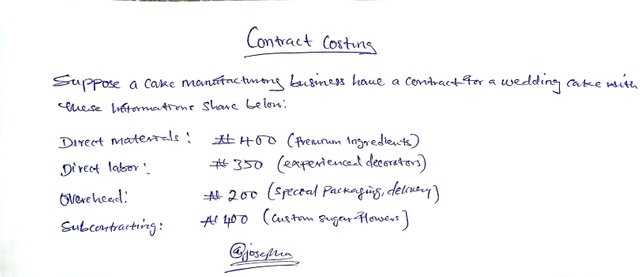

Contact Costing

This is ideal for customized cakes like the production of large cakes for weddings, party cakes, etc. In terms of work order we can say for example, wedding cake is treated as a separate contract work order.

The components of contract costing are as follows;

| Direct Materials | Ingredients specific to the custom order, for example, custom decorations, premium fondant, etc. |

|---|---|

| Direct Labor | Labor costs for skilled chefs or decorators |

| Overheads | This includes special packaging, delivery, and indirect labor costs. |

| Subcontracting | If applicable it is cost for additional custom work or outsourced decoration |

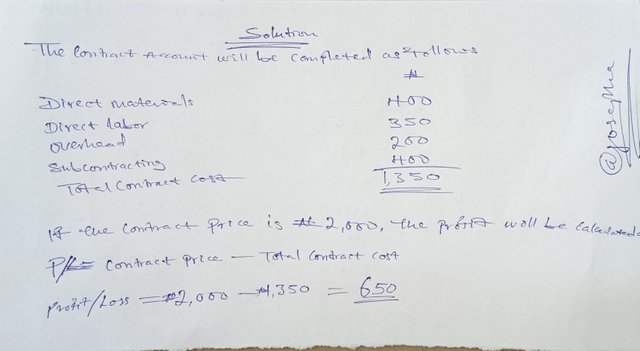

Examples of how these can be applied can be seen below in the given example and solutions as shared below.

To calculate the above in the images we will have to use this formula.

Total Contract Cost

=Direct Materials + Direct Labor + Overheads + Subcontracting (if applicable)Profit/Loss

=Contract price - Total contact cost

Above is the solution to the provided questions.

Batch costing is used in a cake manufacturing business, for high-volume orders, and standards, whereas contract costing is suitable for custom orders that vary significantly by customers' specifications. I believe you have been able to learn something from this post. Thanks for stopping.

I am inviting; @dove11, @simonmwigwe, and @ruthjoe

Cc:-

@yolvijrm

Greetings @josepha

1.- You have explained very well the definition of costing methods and their importance, highlighting that these are a set of specific procedures used to determine a cost.

2.- You have pointed out the difference between job order costing and process costing, indicating the specific differences in them and how both are linked to the way of production.

3.- You have explained two additional types of costing such as batch costing and contract costing. Very well explained the methodology used by these methods, their characteristics and examples.

4.- You have provided the calculation of the cost of the preparation of cakes, according to the work order method. The calculations made are in syntony with what was explained in the class.

Thanks for joining the contest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post explains business expenses and different costing methods very well. The additional methods of batch casting and contract casting are also beautifully illustrated, clarifying the differences between job order casting and process casting. These methods, especially in the cake making business, are presented through practical examples, which are easy to understand. This post is not only informative but also beneficial for business decision making. Wishing you the best of luck for the competition!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I appreciate your support thanks 🙏

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Every expense in your business should have a purpose attached to it. Without it, the cost effectiveness will decrease.

Finally good luck for the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes ooh and that is the best way to manage a business. Thanks for your support.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit