designed using canva app designed using canva app |

|---|

What is a cost structure, and what is its importance for entrepreneurship?

Cost structure in business refers to the total of all different costs that make up a company's expense. Simply put, cost structure outlines all the costs and expenses a business needs to cover while operating.

In cost structure, we haveThe economics of scope, The variable costs, The economics of scale, and The fixed cost.

Economics of scope are the cost efficiencies achieved by offering a wider range of products.

Variable costs change depending on how much a company produces.

Economies of scale refer to the cost benefits a business gains when it produces more.

Fixed costs are expenses that are permanent not minding the other activities run in the business.

Companies often use cost structures to set prices and find ways to cut costs. The main goal of cost structures is to assess which products make more money and which ones do not. For an active business, a cost structure helps the owner monitor their expenses. By tracking expenses, the owner can analyze their business and spot areas for improvement.

Cost structure can be divided into: value-driven and cost-driven. Value-driven cost structures aim to enhance premium products or services, helping businesses earn more revenue. These structures work well for companies that use high-quality materials and maintain close relationships with their customers. On the other hand, cost-driven cost structures focus mainly on cutting production costs and reducing overall expenses.

Importance

The cost structure is very important in any business model. It includes all the costs a business has, such as fixed and variable expenses. Knowing how to manage these costs well is key to making profits, setting the right prices, and ensuring the business can succeed in the long run.

A clear cost structure is important for financial management. It helps businesses understand how to use their resources better and find ways to cut costs or improve efficiency. By looking at the different cost parts and how they connect, companies can make smart choices about where to allocate resources, plan budgets, and develop strategies.

• Expense Clarity: Understanding where funds are allocated helps reduce wasteful spending.

• Profit Improvement: Clear insights allow companies to lower expenses on non-essential items, boosting profits.

• Informed Choices: Knowing fixed costs, such as rent and salaries, supports long-term financial strategies.

• Financial Health: Good cost management strengthens a business's ability to break even and maintain financial well-being.

• Expansion Opportunities: By controlling costs effectively, a business can invest more in growth prospects.

Provide business examples that use the explained cost structure methods; reason your answers.

Example under economic of scale

A manufacturing company benefits from economics of scale by producing more items, which lowers the cost for each item. This occurs because the total costs are divided among a greater number of products.

Increasing production allows a business to lower costs per item by spreading expenses over more goods. Improving how things are made can also cut costs. Investing in new facilities can enhance production efficiency and lower expenses. Additionally, cutting the cost of materials can help reduce overall costs.

Bigger companies tend to benefit from economies of scale more than smaller ones since they can produce more items and distribute costs across a larger volume. Economies of scale can be applied at any point in production. For instance, a business might achieve economies of scale in marketing by employing many marketing experts.

Example under fixed cost:

A tailoring business has steady costs because it pays for expenses that do not change, no matter how much it produces or sells.

A tailoring business has to cover rent for its location, even when it's not making any products or money. Utilities incurred must be taken care of. Although the value of machinery decreases over time, no matter how much is produced.

The business has to pay some salaries, including those for management and also for insurance coverage. The business takes care of the property taxes as well as handle interest cost.

The tailor needs to handle its expenses wisely and make sure that their costs are not affected by the number of sales or production, but that they can cover all their expenses.

Example under Variable cost

E-commerce businesses, like shopify a well known e-commerce business sells their products through their websites. The expenses incurred vary depending on how active the business is. The Shipping and delivery expenses are considered, electricity and gas bills for the warehouse, raw materials, Credit card charges, fees from online payment services etc...

Each time a sale is made they cover up their expenses which is dependent on the quantity of items that are ordered.

What are the elements of a cost structure? Provide examples

The cost structure can change based on the business type, so entrepreneurs face different expenses based on their category. Costs differ by business type and industry.

The elements of cost structure includes;

• Fixed cost

• Variable cost

• Semi-variable cost

• Economics of scope

Fixed costs are expenses that do not change no matter how much a business sells or delivers. Examples are rent, insurance, and salaries.

Variable costs on the other hand, fluctuate based on the amount of goods or services produced. Examples include raw materials, shipping fees, and web hosting.

Semi-variable cost also called semi-fixed or mixed costs, include both fixed and variable parts.

Economies of scope look at the average cost of making different products or services in a company, highlighting the benefits of producing multiple items.

Other cost factors include material costs, labor costs, and overhead expenses, all of which contribute to the total cost of production or service delivery.

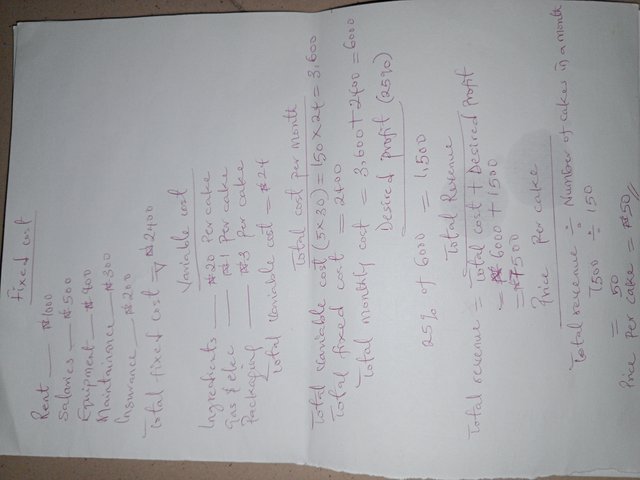

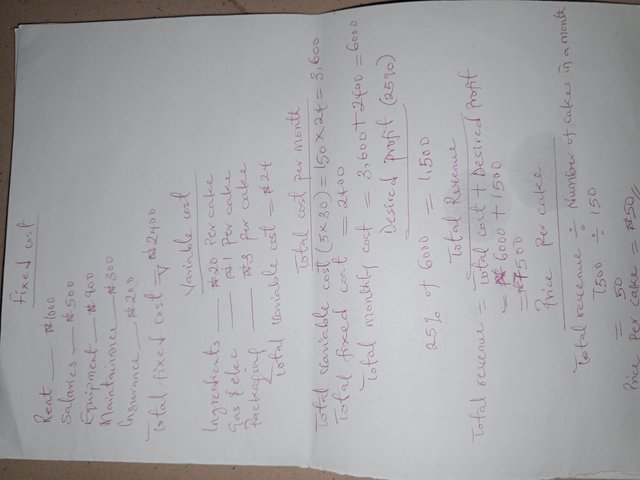

Prepare the cost structure of an undertaking dedicated to making cakes. He has a production of 5 cakes a day and hopes to obtain a total profit margin of 25%.

|  |

|---|

From my calculations of 5 cakes per day and a total margin of 25%, it is clear that there will be a profit gain if a cake is sold at #50.

I invite @aviral123 @dove11 @nancy0

Thanks, I will participate as usual as it's my favorite topic.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are perfectly right. We need a very clear structure for financial management as it is very key.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings @ninapenda

1.- You have shared the concept and importance of the cost structure for entrepreneurship, implying that this will allow you to control all the resources invested in a production process.

2.- You have mentioned acceptable examples of businesses that conform to cost structure methods. Each of them allows for the analysis of all the costs involved.

3.- You have presented the elements of the cost structure, with their respective examples; these allow us to identify the expenses in each functional area of the company.

4.- You have developed the proposed exercise acceptably, however, it was not necessary to repeat the photos, just one would have provided easy reading.

Thanks for joining the contest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very informative post! I especially found the direct and indirect cost examples very helpful. Would love to read more of your posts on this topic. Good luck for this contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit