Hello dear friends how are you all? I hope everyone is well by the grace of God. I am also very well by the grace of Allah. Today I am here to complete an excellent course on Learning Challenge. The ongoing contests in the Steemit Learning Challenge are great. The teaching contest organized by @yolvijrm is, SLC | S21W6 | Costos para emprendedores - Estructura de costos.. I am ready to take my entry in this teaching contest. I will try to present what I have learned here. Let's begin.

| What is a cost structure, and what is its importance for entrepreneurship? |

|---|

Cost is the cost calculation according to the plan of a business or organization. By which a plan is implemented. Cost structure is very important for any organization. Depending on the cost structure, the dividend effect of a company may fall. Since cost structure is the backbone of an organization or business. Based on cost, an organization, business sector is able to stay fresh. Proper cost structure can make the entrepreneur confident. Which helps to plan the next steps very well. Cost structure is very important for a business organization. Multiple types of costs may exist here. Since there are multiple types of expenditure. Any expense added to the business account is best accounted for.

Importance of cost structure.

Any work of the organization is accelerated based on the cost structure. I mention below the reasons why cost structure is important.

Fill the budget deficit: An integral part of the cost structure is the budget. And if there is a deficit in this budget, it can be called a violation of the cost structure. Basically any haphazard planning in the cost structure can lead to a budget deficit. Therefore, it is good that the budget is balanced and there is no budget deficit to complete the work in a planned manner. Basically cost structure is important for good budgeting and balanced spending from budgeting.

Good planning execution: A good plan is made from the cost structure in any organization. Cost structure plays an important role in implementing a good plan. I understand about cost structure that cost structure is very useful to implement the plan. Which helps to execute a good plan very well.

Take the right decision: Making the right decision is the door to success for an organization. A decision can change the image of the organization, if it is based on good planning and cost structure. Decisions made based on a cost structure will be more likely to be accepted and successful.

Accrual accounting: Some incidental expenses are sometimes incurred to advance the activities of the organization. It should be noted that the cash calculation is done. There will not be too many gaps and discrepancies on the cost structure. Incidental costs and all other cost items will depend on the cost structure.

Basically cost structure is a method by which an organization is stabilized. According to the error cost structure, a standard calculation can be found by calculating all the necessary costs of the organization.

| Provide examples of businesses that use the cost structure methods explained; explain your answers. |

|---|

Among the businesses that use cost structure I can mention our personal family small business. Where a calculation is made based on the cost structure and the product is produced. Here cost structure method is used. Here a cost structure is designed before import. Costs are spent according to that design or plan in which the organization can run very well. Here the cost structure for the product depends. The cost structure depends on all the calculations for the quality of the product and its manufacturing cost. Depreciation and wastage of all materials of the organization can be covered by relying on the cost structure.

The amount of money that might be required to produce a product is planned. Then the activities are carried out keeping that planning design in hand. The price of the product is fixed by calculating the cost of import, selling price, production cost etc. so that a profit of 10% is made on the cost of the product. The amount of this dividend is more or less depending on the production quantity of the product and its cost of production.

As a production cost, the business requires yarn furniture. Since it is a small-scale factory, there are not many workers, but they are paid a weekly rate. In this case I can understand that it depends on the cost structure. It would be better to operate almost all organizations based on cost structure. I got this idea from our business which I asked in this lesson. Basically, if the business organization is managed based on the cost structure, then it can be profitable quickly and worry free of losses.

| What are the elements of a cost structure? Provide examples |

|---|

There are several types of cost structure. All costs are hidden within these structures. All the costs included in the cost structure are mentioned below,

Regular expenses.

Regular expenses are expenses that are fixed at all times. Expenses that must be incurred over a period of time. However, there is little possibility of its increase or decrease.

Labor wages: A business must pay workers wages. It can be at regular intervals, daily or weekly, or monthly. Thus a worker has to pay wages. Which has a specificity. Fixed cost is basically called fixed cost.

Office rent: Office rent is required to run a business. It has to pay a fixed amount every month. Maybe it's twenty thousand or more per month. So office rent is also included in fixed cost. It has to be paid regularly at the same price.

Monthly loan repayments: For the development of a business organization, money can be borrowed from a bank or insurance. After borrowing a certain amount of money, it costs to repay the loan every month. So the installments that will be paid to repay the loan are the same amount every month, so in a cost structure it will be treated as a fixed cost.

Variable costs

A variable cost is basically a cost that changes constantly. It will not be the same in every season but may vary from season to season. Such costs are mainly included in variable costs. Some examples are mentioned below,

Import cost of raw materials: We have to import the raw materials we need to run the business. Imported products must be of different quantities at different times. The price of the product may decrease or increase. Import costs of raw materials fluctuate due to fall or rise in product prices. Besides, the import cost of raw materials varies according to the demand.

Advertising costs: Product promotion has a cost that is variable. Basically this advertisement is done to increase the awareness of the product. Also, if the demand for the product is high, advertising will have to be increased and this will lead to cost variation. Hence advertising costs are included in variable costs.

electricity bill: Electricity is definitely indispensable in running a business. So electricity bill has to be paid at the end of the month. The electricity bill varies depending on the load handling every month. This variation in electricity bill can be referred to as variable cost.

| Prepare the cost structure of a business dedicated to making cakes. It has a production of 5 cakes per day and expects to obtain a total profit margin of 25%. |

|---|

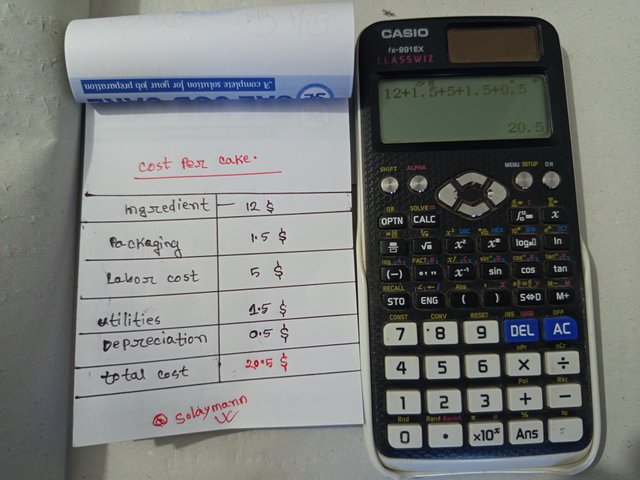

I have done a calculation according to the mentioned question which is easily presentable. I first calculated the cost of one cake. I have planned the structure of how much it will cost to make a cake. which I presented.

In the mentioned picture I have mentioned the cost list for making each cake. Starting from the required materials, we have calculated the ancillary costs of its production cost. Here I have also added the depreciation cost of a machine for making cakes. Here is my total cost per cake, $20.5.

If five cakes are produced per day then the daily cost will be,

| Daily expenses | 20.5x2 | =102.5 $ |

|---|

Then we will be able to produce 30x5 equal 150 cakes per month. The cost list of which is mentioned below.

| Monthly expenses | 102.5x30 | =3075$ |

|---|

As each cake is expected to earn up to 25%. So the selling price of each cake with profit margin will be calculated as,( 20.5x25/100 ) = 5.125 $

| Selling price of a cake at 25% profit, | 25.625 $ |

|---|---|

| Selling price of 150 cakes at 25% profit, | 150x25.625 = 3843.75 $ |

Now if we want to calculate the monthly dividend then we look at the following list.

| 150 cakes per month selling price at 25% profit | 3843.75 $ |

|---|---|

| Total cost of production in a month, | (-) 3075 $ |

| Total profit in one month. | =768.75 $ |

A simple and consistent calculation. I hope the values mentioned are creative and the calculations are unique.

It is a wonderful learning challenge. So I happily participated in this competition. I invite my dear friends to participate here, @irawandedy @simonmwigwe @wilmer1988 @ripon0630 Hope you enjoy participating here.

| cc: @adeljose @yolvijrm |

|---|