Margin trading and lending is a perfectly logical use case for CoVEX for two primary reasons:

- Rapidly expanding market

- Need for an independent trusted platform is immediate

But first, what is Margin trading?

Margin trading refers to the practice of using borrowed funds from a broker to trade a financial asset, which forms the collateral for the loan from the broker. Since such use of financial leverage can potentially magnify gains but could also saddle the trader with devastating losses, leverage has the well-deserved reputation of being a double-edged sword.

The Advantages

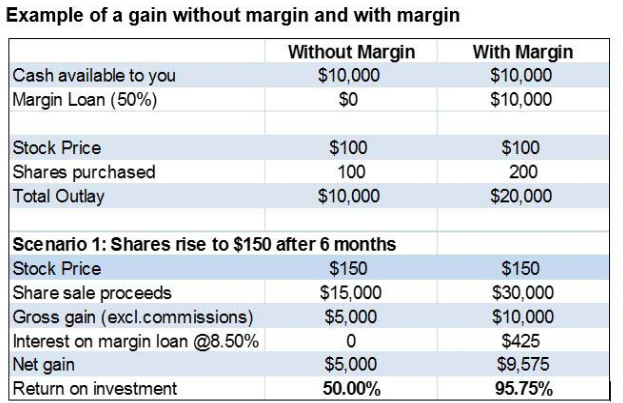

Buying shares on margin enables you to leverage your gains by enabling you to buy more shares than you could if you were doing so on a cash-only basis. The example below demonstrates how buying shares on margin can enable a return on investment that is almost double the return obtained without using margin.

The Risks

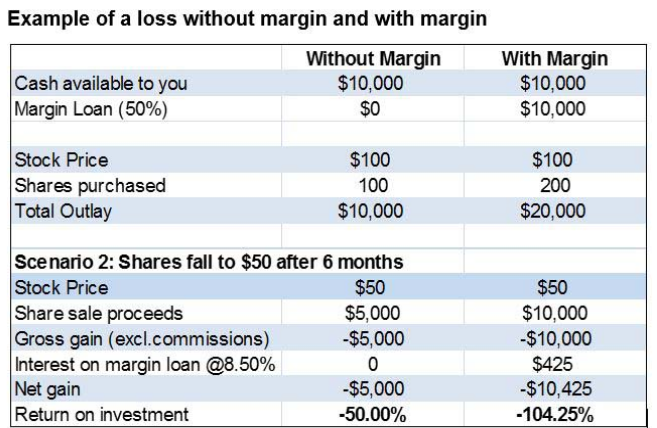

As mentioned earlier, margin trading can amplify gains as well as losses. Note that a debt obligation to a broker is as binding as a debt obligation to any bank or financial institution, and must be repaid in full

According to Bitfinex, margin funding increased from 14,8M in October 2016 to 168.5M in Deceber 2017.

In a centralized exchange, borrowing funds for trading require a trader to manually place a margin call which the exchange makes to the trader. Ideally, the maintenance margin helps to rebalance the margin account.

CoVEX˙s Margin trading platform will allow users to trade using cryptos borrowed from other traders which will be supported by collateral funds. There funds will be computed based on the borrower˙s coin share and portfolio. Margin traders would be allowed to open long and short positions by borowwing money which they can either buy or sell.

Here is how the platform will work for margin traders offering the following features :

Amount : It is the net amount of the market˙s cryptocurrency that you have bought or sold. If your position is short, the amount will be negative.

Base Price : It is the approximate price at which you would need to close your position for you to break even

Action : The trader will clock on "Close" button to close his /her position with a market order

Unrealized P/L : It is the approximate total profit or loss that you would incur if all of your open positions are closed immediately with marker orders, less the unrealized lending fees.

Lending Fees : It is the estimated total value of the interest that you currently owe on your active loans

Net Value : It is the sum of Total Margin Value, Unrealized P/L, and Unrealized Lending Fees. In other words, Net Value represents the current total worth of your collaterals

Total Borrowed Value: It is the total BTC value of your open loans. It is determined by the amount of BTC that you are currently borrowing and the amount of BTC that would be required to purchase on the current order books the total of all other currencies you are presently borrowing.

Initial Margin : It is the percentage of your Net Value to that of the total value you can borrow. For instancem if you borrow 2 BTC and your Initial Margin is 30% you will need to have at least 30% of 2BTC or 0.6 BTC worh of crptos in your account, minus unrealized losses and lending fees

Marging level: It is the percentage of your Total Borrowed Value that your Net Value must support to avoid a forced liquidation.

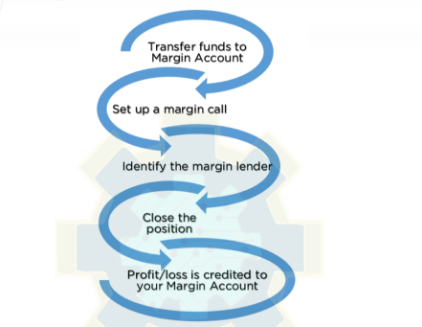

Here is a summarized diagram illustrating the steps in Margin Trading on CoVEX

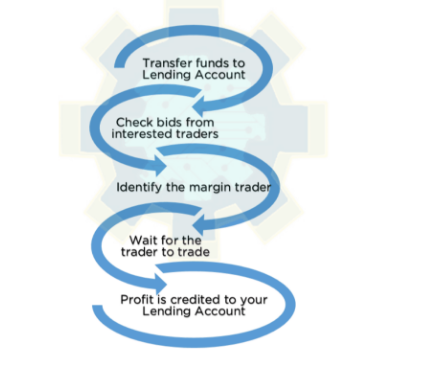

Here is how the Platform will work for margin Lenders:

You will have a Marging Portal from which you can margin lend. Before you lend, you must have funds in your account. You will automatically receive bids from interested traders who place margin calls. The system will use ML and AI techniques to rate each trader and provide a rating that will help you decide wheter to lend or not to a particular trader.

When you agree to lend a particular trader, a position is created automatically. If the trader decides to close the position, you will automatically receive interest in you account irrespective of whethet the trader had profit or loss.

Here is a summerized diagram illustrating the steps in Margin Lending on CoVEX

For more information regarding CoVEX Coin please visit our website at: https://www.covexlabs.com/

Also, if you have any questions regarding CoVEX Coin or would like some extra information check out our social media:

Telegram: https://t.me/joinchat/FGqocRL7Oj3p-YYV3mu2Ng

Twitter: https://twitter.com/CoVEXcoin

Facebook: https://www.facebook.com/covexcoin/

Bitcointalk Forum: https://bitcointalk.org/index.php?topic=3343211.new

Discord: https://discordapp.com/invite/sVufdss

Official Bounty Telegram: https://t.me/CoVEXBountyPrograms

E-mail: [email protected]

Author : https://www.linkedin.com/in/vedran-aracic

Twitter : https://twitter.com/AracicDeimos

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://poloniex.com/support/aboutMarginTrading/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit