Next week is going to be a critical week for US equities. We've seen some intense selling over the past few weeks with a vary sharp correction from the lows of Thursday night. Is this a rip-your-face-off bear market rally or a quick end to the bear market and beginning of a new bull?

Bullish Case

From an Elliott Wave perspective, this could be argued as a larger A/B/C zig-zag correction with wave 3 being a bit longer than wave 1 but not quite reaching the 161.8% level, meaning that we saw the end of the bear market on Thursday night and we're resuming the uptrend. Certainly the sharp rally from the lows and complete retracement of the prior day selloff would support that.

Bearish Case

On the bearish side, from an Elliott Wave perspective, we'd have to argue that the larger wave 4 has just ended with Friday's rally and we'll see continued selling begin on Monday. If wave 4 rallies much more it'll overlap wave 1 which isn't permitted in an impulse wave. Assuming wave 4 overlaps wave 1, the case could still be made for some sort of expanding diagonal but that seems unlikely.

We did see wave 3 extend to approximately 1.27% of wave 1. This is shorter than a typical wave 3, but definitely longer than the 78.6%-100% which we'd expect to see if the overall bear market were a small ABC correction. Perhaps wave 3 is not yet complete and we're going to see extensions continue to push it lower.

.png)

The big bounce on Friday was also on very light volume compared to the prior day's sell-off. Typically significant bottoms occur on peak volume bars. Also, Friday's bullish bar did not completely engulf Thursday's bullish bar. This could indicate a momentary pause in the selling as opposed to buyers stepping in.

.png)

The 5 day MA is moving lower and will continue to move lower into Monday, possibly through Wednesday as data from the 9th and 10th of March is removed. If price spikes above the 5MA that will obviously damper the lower movement of the 5MA.

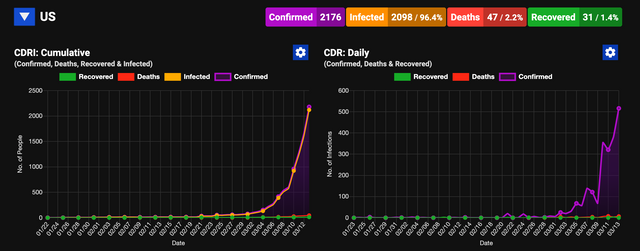

COVID-19 Fundamentals

The market reacted positively on Friday afternoon to The White House press conference. It appears the market wants to hear how the administration is addressing the underlying health issues and not how they are solving the market problems which are clearly a symptom of the underlying health problem.

The big question at this point is, is it too little too late?

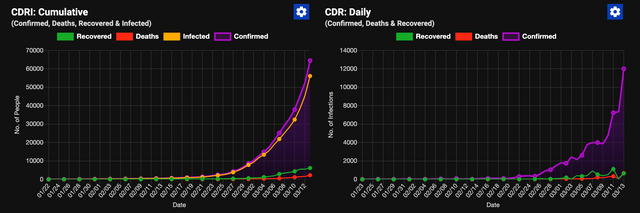

Assuming it's not too late for the US and the infection rate can be managed, how will the rest of the world come out and what will this do to the global economy? It's difficult to find other countries which do not have exponential infection rates with South Korea and Singapore being the obvious exceptions. Can equities hold up with a healthy US and a devastated world?

Outside of mainland China, it looks as though the case counts are starting to grow at an unmanageable rate jumping by over 10,000 confirmed cases a day and continuing to accelerate.

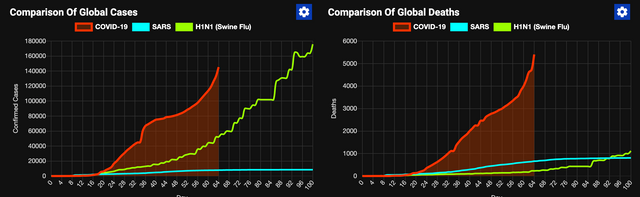

Both case counts and deaths are dwarfing prior epidemics.

The final questions I'll leave you with:

- Are you going to be traveling anytime soon?

- Do you believe we've hit peak COVID-19 cases in the US/World and we're on the downswing?

The Dollar

There is one blow-off valve that the administration could leverage (and appears hell-bent on) to protect equities and that would be the dollar. There are already talks about bailing out the cruise industry, the airline industry and oil companies. By inflating the currency supply the value of the dollar would fall (as compared to hard assets, but maybe not other currencies as other countries inflate as well) which may protect equities in the short run but can't bring back consumer demand or address supply chain disruptions.

Key Levels

.png)

Congratulations @stocks29! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit