Find the best latest news about cryptocurrency and blockchain technology in this daily post. Good read!

Crypto Market Drops Another $10 Billion as Bitcoin Price Retreats to $6,150

Over the past 24 hours, the valuation of the crypto market has dropped by $10 billion, as bitcoin fell to $6,150 and ether dropped below $440.

Even after recording a steep 5 percent fall from $6,700 to $6,400 and demonstrating an oversold condition with low Relative Strength Index (RSI), bitcoin struggled to rebound and attempt a corrective rally.

Low Volume

On July 11, CCN reported that a corrective rally is unlikely even with bitcoin at $7,400 due to its low volume and overly strong downtrend. Although bitcoin broke RSI trendlines with optimistic momentum indicators, its low volume at $3.6 billion prevented the dominant cryptocurrency from surging to the upside.

CCN’s report that was released yesterday read:

“If bitcoin had rebounded to the $6,600 mark in the past 12 hours, a corrective rally could have occured, delaying or even preventing another drop in the short-term to the lower end of $6,300. However, after briefly recovering to $6,413, the price of bitcoin fell again to the mid-$6,300 region, reducing the probability of a bear trend reversal and corrective rally in the upcoming days.”

The condition of the bitcoin market remains nearly identical, with lower a daily volume and stronger downtrend. The RSI of BTC is still showing oversold conditions, which may lead BTC to climb back up to $6,250. But, at this point, given that BTC has failed to rebound to $6,200 over the past three hours, a further drop below the $6,100 mark is expected.

On a downward trajectory, small cryptocurrencies and tokens often tend to perform worse than major digital assets like bitcoin, ether, Ripple, and Bitcoin Cash. Tokens like Power Ledger, Nebulas, Ontology, Pundi X and Bancor, which performed relatively well throughout April and May, dropped by another 10 percent in the past 24 hours, after recording large losses in the past three days.

The low volume and lack of demand from bulls have reduced the probability of a corrective rally occurring in the next 24 to 48 hours. If bitcoin can recover back to $6,300 and stabilize in that region, it could eye a move towards $6,400. However, if BTC fails to find any momentum at this price range, a further drop is inevitable.

Read more on : ccn

Ripple Appoints Facebook Payment Executive Kahina Van Dyke as Vice President

California-based provider of blockchain-powered payment solutions Ripple made two changes in its management team on Wednesday, appointing former Facebook (NASDAQ:FB) payment executive Kahina Van Dyke as senior vice president (SVP) of business and corporate development and transferring Ripple’s chief cryptographer David Schwartz to the position of chief technology officer (CTO).

Ripple’ CEO Brad Garlinghouse announced the changes in a blog post on Wednesday.

“David is a world renowned leader in the blockchain and digital asset world, and Kahina is a seasoned veteran in the traditional banking and financial services industries,” Garlinghouse explained.

From January 2016 till June this year, Van Dyke was Facebook global director of financial services and payments partnerships. Before that, she worked six years for MasterCard at top management positions, including global head and senior vice president for global initiatives. In 2006-2009 Van Dyke was Citibank SVP of product management and business development for Europe and the Middle East and North Africa (MENA) region.

“Companies like Facebook have improved access to services, digitized payment flows and made it quicker and easier for people to transact with each other domestically. Now we need a new global technology solution for international payments that offers interoperability with existing systems, connecting them and leveraging their value,” Van Dyke said in interview for Ripple’s blog.

Read more on : investing

China And France Come Together To Build Eco-Friendly, Blockchain-Monitored Skyscraper

Last month, French architecture firm XTU Architects partnered with Systematic, a French business consortium, and an undisclosed Chinese developer to construct an eco-friendly, blockchain-monitored skyscraper, according to an article in Forbes published on July 10.

The project, which is still in the "vision" stage, was introduced in the Chinese city of Hangzhou, which has a history of blending architectural structures into its landscape. It boasts expectations of creating four interconnected, energy efficient, and eco-friendly "Dream Towers."

According to the plans, the curved design of the four towers will direct rainwater to basins on the ground and roof. Flora in these areas will then help clean polluted air and rain before it evaporates. Microalgae will even be cultivated between window panes in order to regulate the temperature of the buildings.

Read more on : ethnews

Here Is Why XRP, Stellar (XLM) and Tron (TRX) are The Future

What do the cryptocurrencies of XRP (XRP), Stellar (XLM) and Tron (TRX) have in common right now?

Firstly, they are all reasonably priced at under half a dollar in this terrible bear market. XRP is currently trading at $0.44 at the moment of writing this and down 2.53% in the last 24 hours. Stellar (XLM) is currently priced at $0.18 and down 3% in the last 24 hours. Tron (TRX) has also not been doing too well and is valued at $0.032 and down 3.27% in the last 24 hours.

The current low price of these three digital assets is one reason why they are the future of crypto investing. There has never been a better time to get any digital asset at its cheapest than this present moment. We all remember how the lucky buyers of Litecoin (LTC) at $4 early in 2017, are still patting themselves on the shoulder for believing in the digital asset that is now valued at $75 a year later and in a bear market. This is a 1,775% increment in 12 months.

Taking this percentage increment and applying to XRP, XLM, and TRX we get $7.81, $3.20 and $0.568 respectively. These are not bad figures at all ladies and gentlemen. Not bad at all!

Secondly, these three coins are backed by wonderful blockchain technologies. XRP has its own ledger and utility in the Ripple company’s product of xRapid to source instant liquidity for cross-border transactions. The Ripple company has clearly stated it is a software solutions company that coincidentally uses XRP. Therefore, as the Ripple company expands, so shall the use of XRP in banks.

With respect to Stellar (XLM), the foundation has partnered with IBM which has in-turn partnered with the Australian government for the development of blockchain technology, A.I (artificial intelligence) and quantum computing in the country. This means that the Stellar blockchain and XLM will probably be used by the Australian government along the way.

Read more on : globalcoinreport

There was never a better time to go for Litecoin (LTC) than now

Src

Everybody in the cryptosphere is wondering which banks in the world are going to adopt a cryptocurrency for internal purposes (Stellar Lumens and Ripple’s XRP being the leading candidates) or which cryptocurrency will be chosen by banks as a viable option for clients and investors.

In this regard, everybody is thinking about Bitcoin, Ethereum and the top 7-10 big players in general. This trend of thinking only brings to the surface how unimaginative speculators are because nobody is thinking out of the box. What we mean is this: why is nobody wondering about which cryptocurrency project will buy its bank and disrupt both the financial and the crypto world?

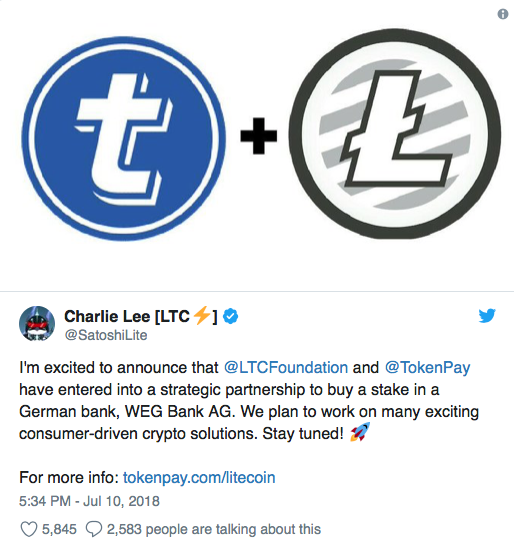

Well, Charlie Lee, founder of Litecoin is thinking just that. Not just thinking. Mr. Lee used his Twitter account just a couple of days ago to announce that he is teaming up with TokenPay to buy a significant stake in Germany’s WEG bank. The idea behind this move is for Litecoin to get closer to terminal users, consumers, and give them an easy-to-use, and cheap way to get involved in Litecoins in real-life.

It’s a most exciting move. It’s creative, out-of-the-box, very ambitious and very intelligent. I’ve stated time and again that the most successful digital assets won’t necessarily be the ones with the best technology, the higher short-term price increases or any other of the usual parameters in which we measure a coin’s performance.

The cryptocurrencies that will take the market over will be those that find a way to be adopted in mass by solving real-life problems for real-life people. That is why projects like Stellar, Ripple or Tron have created so much interest despite the fact they’ve not been around for so long, and they’ve experienced bearish runs at times.

Read more on : globalcoinreport

Bear Market’s Little Helpers? A Guide to Crypto Futures

Since their triumphant advent in the wake of the December 2017 bull run, Bitcoin futures seem to have occupied an oddly fixed position in the minds of many cryptocurrency buffs. A popular view among those who follow the dynamics of the crypto world rests on a set of established points about BTC futures: they exist since late 2017; they are offered by Cboe and CME, two respectable regulated exchanges; they help manage investment risks and as such are supposed to draw institutional money into the crypto space, mitigating price volatility and lending credence to the underlying asset.

The recent weeks, however, saw a shift in this previously serene mental landscape, as new considerations about crypto futures began to pour into media space with increased frequency. From allegations of massively suppressing crypto prices to a widening range of platforms offering crypto derivatives to a real prospect of Ethereum futures coming about soon, these developments point to the need of revisiting the realm of cryptocurrency-based futures. Now that these derivatives have been around for more than half a year, a more nuanced picture of this asset class’ role in crypto finance is emerging.

The origins

In the simplest terms, a futures contract (or a future) is an agreement to buy or sell a certain product on a fixed date. Futures are used as both an instrument for mitigating risks associated with price volatility of vital commodities, and as a tradable derivative product. A comprehensive Cointelegraph primer timed to the launch of the first regulated BTC futures last December is still there for anyone in need to recapitulate the essentials.

There were many reasons for the crypto community to eagerly anticipate Bitcoin futures’ introduction to regulated derivatives markets. Futures have long been seen as the first stepping stone on the path to reconciling the world of crypto finance with the system of traditional financial institutions. Existing within a well-defined legal and operational framework, futures contracts offer legitimacy and security that judicious Wall Street firms were waiting for in order to finally jump onto the crypto bandwagon.

Some of the collateral perks included increased liquidity of the market and transparent reference prices – in other words, more legitimacy and stability. At the same time, crypto futures held a promise for an alleged horde of retail investors who were interested in crypto assets yet wary of trading them on unregulated spot exchanges. Perhaps the biggest advantage of Bitcoin futures for this category of traders is security: since owning a cash-settled crypto future does not entail touching a coin itself, the scheme does away with fears of hacking and theft of cryptoassets. However, a flipside of not owning an actual coin is that futures traders would not be eligible for free coins in an event of a fork.

Read more on : cointelegraph

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice.

Please conduct your own thorough research before investing in any cryptocurrency.

RSI study shows that bitcoin is in selling phase. But bollinger band study shows that right now it is in sidewave conditions. So when bollinger band study shows this kind of behavior then What will be the future price of bitcoin in coming days. According to my analysis as far as bitcoin price holds above 5738 $ which was low of 29 June 2018. There will be no selling in bitcoin price. So in the next coming days due to sidewave movement it will go up again and will touch 6600$ again. What do think sir simobnr.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i agreed with you it will be back on $6600

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://get.cryptobrowser.site/1939657

If uh open the link and install the aap uh will get free bitcoin hurry up and install thiss

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

sir , can steem dollar beat bitcoin in future.???

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree with the point of @simobnr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://get.cryptobrowser.site/1939657

If uh open the link and install the aap uh will get free bitcoin hurry up and install thiss

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If the ETF approval takes place in coming day, we can see a huge pump in the Bitcoin Price. What do you say????

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @simobnr, this time it is very difficult to predict the price of cryptocurrency they are not showing any inclination about trending news impact.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit