It is also difficult to consider or estimate the effect of the appreciation of the fiat currency, says the author. But in addition, cryptocurrencies are an asset that does not depreciate, they can even be reassessed, says Berengueres.

As an alternative to the NPV, this paper proposes the Net Value of Cryptocurrency (NCV) which defines as "... the sum of the flow of coins that a mining operation will produce less operating expenses (not capital) valued at the price of the cryptocurrency the equipment purchase day. "

In the formula for calculating the NCV, the number of cryptocurrencies mined in a given period minus the amount of the electricity bill, the growth of the global hash rate, other expenses such as payment to mining pools, mining software or housing intervene. and administration.

Profitability begins, the author argues, when the NCV is greater than the cost of the mining operation in a given period, divided by the initial price of the equipment.

TWO PROFITABILITY SCENARIOS

An example of Ethereum mining is proposed to illustrate in concept of NCV: an investor considers the acquisition of an 8 GPU RX580 rig, which employs Claymore mining software, and wants to know if it invests in the equipment or acquires ETH with that capital initial, to then save those cryptocurrencies with the expectation that their price will increase.

With the following data the NCV formula, supplied in the work, can be applied.

[Electricity costs 0.19EUR / kwh (Amsterdam price), the rig costs $ 6,756. An administrative expense of 10% is foreseen, Claymore software 1%, accommodation of the rig: between 5% and 25%. Line 1 represents buying the cryptocurrencies and keeping them. Curve 2 is the cash flow that corresponds to the purchase of a rig on day 0 with @ P0 and then account for the currencies produced. Coin production decreases when more hash power is added to Ethereum, follow an exponential curve. Curve 3 shows the NCV for the same rig, but assuming linear growth of the capacity of the network, which corresponds to a linear interpolation. Finally, curve 4 shows the optimistic scenario for the miners: that the capacity grow at the same rate as Moore's Law.]

José López Berengueres

Professor, University of the United Arab Emirates

In this case, the return begins to decline after the first year, and the maximum reached is less than 50% of the HODL strategy. It has been assumed a constant price of the cryptocurrency. If an appreciation is estimated, the expenses such as electricity and operation would decrease proportionally.

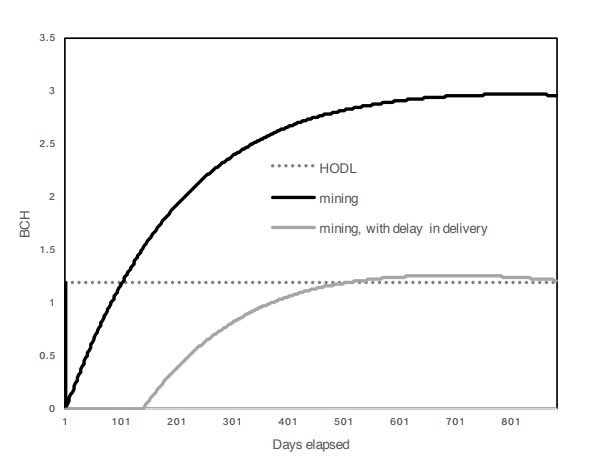

In a second scenario, Bitcoin Cash mining, estimates using NCV, determine that the return of mining operations exceed the HODL strategy. This alternative is described in detail in the publication, where it specifies from the cost of electricity and the daily increase percentage of the difficulty up to the cost of the kWh, among others. It should be noted that currently the Bitcoin Cash hash rate has decreased significantly.

Here you enter the variable of a computer purchased in pre-purchase, a S9 Miner and delivered 4 to 5 months later. The dramatic effect of this dead period, zero return, is evidenced in comparison with the equipment that begins the mining operation immediately after being acquired.

With the same performance, the S9 pre-purchased and delivered 4 months later, must face a higher global hash rate and barely manages to overcome the HODL strategy before the decrease in return begins. Source of the image: study.

In addition to providing accurate guidance for estimating the costs of mining operations with a cryptocurrency-based method, the work also considers other factors that can impact profitability, such as cooling costs, the life cycle of GPUs or the risk of mining with graphics cards acquired without warranty.

As an important contribution to the valuation of mining operations, this work introduces the concept of Net Value of Cryptocurrency, shows how to apply it in the cases of mining Ethereum and Bitcoin Cash and compares its profitability with the strategy of HODL.

It stands out as an important factor that affects profitability the delivery date of the equipment after having been paid. Mining is becoming less profitable for those who start, says the study, because while existing miners can update their equipment only by changing GPU cards, entrants must cover the costs of infrastructure, cooling, wiring and personnel, among other expenses.