INTRODUCTION

The concept of microcredit was developed by Professor of Economics Mohammed Yunus. The teacher was educated in the United States, but he was from Bangladesh, one of the poorest countries in the world. In 1974, Yunus joined the fight against hunger in his home country. During the struggle, he found that even the smallest loan could play a decisive role for the poor. He issued his first microloan from his pocket to 10 women who made bamboo furniture; the loan amount was only USD 27. At the same time, Yunus discovered that ordinary banks are not interested in lending to wealthy entrepreneurs; banks see this as a high risk. In 1983, Yunus founded the Grameen Bank, which began to provide microloans to people in need in Bangladesh. Since 1983, this bank has already issued more than 4 million loans totaling about USD 5 billion. To guarantee repayment of loans to the bank, a pledge system was used: among the lenders, informal groups were formed, whose members trusted each other and supported each other. As this system developed, Grameen Bank developed alternative lending schemes. In addition to the microloan, the bank also issued loans for housing, mortgage loans, and agricultural loans, which were directed to venture capital and made deposits. The success of this model, presented by Grameen Bank, inspired financiers in many other developing and even developed countries, including the United States. Many microcredit projects specifically target women, since the latter suffer from forced poverty as they bear most of the cost of maintaining a family. Almost 96% of the Grameen Bank microloans were issued to women.

We present our product Artificial Intelligence Bank as a digital bank that operates on the principles of the blockchain technology and does not set a goal of making a profit. Artificial Intelligence Bank is able to issue loans to any person (to make a profit from investment) that has access to the Internet. With the help of modern technology and unique artificial intelligence, our product will be able to serve the client in any country without violating its laws. Our mission is to provide financial services in such a way that only people win, not the financial structures of the modern world. It is currently important to launch products like Artificial Intelligence Bank, products that work for a person, not for a system.

We remember the ark was built by an amateur. Professionals built the Titanic. We do not create a bank, we create a digital product that will provide better financial assistance to people on the planet.

ARTIFICIAL INTELLIGENCE PREDICTIONS

Behavioral analysis takes into account human behavior when submitting an application. One of the many factors is how quickly a person fills out a questionnaire, how often one edits the information before the submission, whether one uses insert methods or types character-by- character, the time from the start of creating the application to submitting it, etc. In general, the combination of behavioral analysis with other factors gives an even lower risk of providing a non-repayable loan.

Blacklists. At the outset, AI Bank will try to legally buy as many scam databases as possible, which will not be used as instant locks, but for teaching AI by detecting applications of scammers.

Confirmation of personal data. Verification of the submitted documents or lack of thereof will be used here. If the client submits a forged form, the system will be able to indicate this with its own algorithms.

Client history. AI Bank will analyze the history of previous activity of its clients using AI.

Digital prints. When applying for a loan, about 50 digital parameters of the client will be determined in real time, digital fingerprints of the client will be generated.

The calls of physical operators. Managers of AI Bank will make calls to clients to confirm the entered data and verify the client in selected cases.

Social networks. At the client’s request, AI Bank will use information from the client’s social networks to increase the level of confidence in the client. Besides, this mechanism will allow confirming the authenticity of the person and the documents submitted.

External credit history. If desired, the client will be able to provide their credit history on their accounts in their country in any digital form for the analysis of AI.

LOWEST RATES. Non PROFIT BANK.

In the market of developed countries, it is minimal. In developing countries and economies in transition, it is high. To attract borrowed funds in MFIs for turnover, the interest rate for investors should be higher than in bank deposits. Accordingly, the issuance of loans to MFIs is only possible at a very high interest rate. The interest rate in the proposed project is set automatically and thus the problem of the influence of central banks is completely gone. The proposed project is fully competitive and has no competitors.

All banks rates are constant. On the one hand, it is convenient because it allows you to keep profitability at the same level. However, taking into account the rates and regulation of money circulation by central banks, there is no certainty that the rate will not be sharply raised.

This directly affects the scale of business and public access to both credit and deposit resources. In the proposed project, the lending rate and profitability depend primarily on the product ecosystem. The rate will be equal to such a value, which on the one hand will allow increasing the financial assets of the bank (increasing the number of loans) and on the other hand – ensuring a minimum interest on borrowed funds.

OWN ECOSYSTEM

In order to solve many problems with the current microloan market, AI Bank offers its own ecosystem that is not guided by commercial interests but is designed to provide a complete alternative to global financial systems. AI Bank, like other blockchain systems, directly links supply and demand without the need for intermediaries.

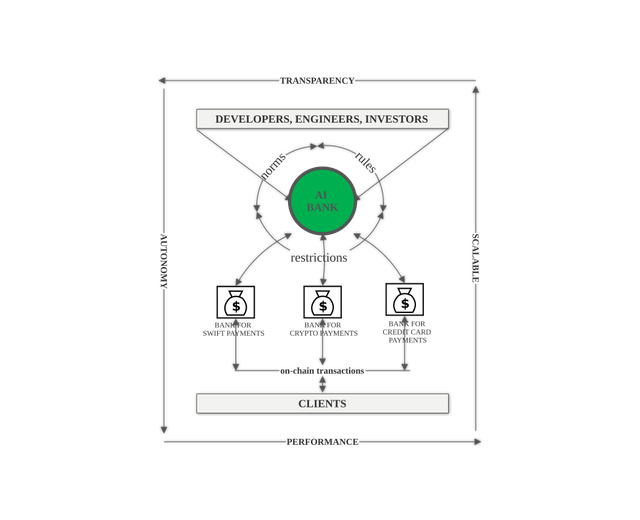

The internal system operates in accordance with certain rules, restrictions, and norms.

The external ecosystem is supported by such layers as:

Scalability. Income from the financial activities of the Bank will continuously increase its assets in order to increase the number and value of loans in the future.

AUTONOMY. Resistance to external forcing through decentralization. Without departments, staff and any attachments to the material world, the system will not interact with external influence. With the help of dynamic web landings, filing an application will be possible from any device and from any country.

Performance. Machines are faster and more accurate than humans. Due to coherent algorithms, any decision in the AI Bank system is made in real time.

TEAM

We started familiarizing ourselves with computers at the age of 7 and were constantly so busy that we don’t even have profiles at linkedin because we always worked on our projects and didn’t fill out our profiles for foreign companies. At the moment, we have an average of 35 years and we have extensive experience in the field of technology and banking systems. At this stage, we can not reveal our identities on website, even profiles on Facebook. It will not give you anything. Get us right. But we will always be happy to communicate with investors in chat, via email, Skype and other network channels, we will always find time to tell about our level and experience. If you are a big investor, you can even fly to visit us. In our humble opinion, there is nothing wrong with the fact that we do not publish our faces and the links to social networks profiles, this is not the main thing in the project. Every investor who joins us will receive regular reports in the course of our work on the project, both in a special mailing list and in all social networks, we will publish all the news as they become available. We are open for whole world but without simple profiles on website. We have advisors for our project - we already in touch with them and you can ask them about the liquidity of our project.

ADVISORS

CONTACT FOR MORE INFORMATION NEWS and UPDATE

https://aibank.global/

https://aibank.global/whitepaper.pdf

BOUNTY0X USERNAME: Ebenco