Global Equity Markets: Possible recovery in the works

Most major equity markets moved into recovery mode last week with gains above 1.0%, following selloffs in the previous week. Global trading was quiet as the week came to a close given that many markets were closed for the Easter Holiday on Friday, and some in Europe will be closed on Monday.

Investors are now looking to positive earnings surprises to help propel the markets higher as we finish the first quarter of the year. Threats of a trade war by the Trump administration and a hammering of technology stocks has been a cause for concern recently. Global tech leaders including Facebook and Amazon have faced pressure, and that concern has spread throughout the markets with investors moving to risk-off mode.

At least for the short-term, it looks like we may be shifting given last week’s somewhat consistent positive performance among major equity markets. Nevertheless, a most of the indices will be heading up into overhead resistance if they do go higher and this could mute the advances.

BSE Sensex: Bullish pattern setup

The BSE Sensex 30 Index has framed a potential bullish falling wedge amid the latest rectification following a record high in January. In the event that the base has been set at the 32,483.84 low from two weeks prior, at that point an upside breakout will be activated moving over the downtrend line. A week ago's high of 33,371.04 and a two-week high can be utilized as an intermediary for the line. The base has conformed to help of the 200-day moving normal line (dark colored) and earlier help and protection over various months in 2017. Different help markers meeting up can improve the noteworthiness of the value bolster zone.

The current touch of the 200-day MA is the first run through the Sensex has hit it in over a year. Every now and again, once the 200-day MA is drawn closer as help in the wake of being above it for a considerable length of time, it tends to go about as help. A bullish wedge is a pattern continuation design and if activated has the potential for value energy to quicken upward.

S&P 500 Index: Continues to hold long-term support at 200-day moving average

Sadly for financial specialists in the U.S. markets, the S&P 500 Index finished the main quarter of the year with a misfortune out of the blue since the second from last quarter of 2015. This conduct is strong of the possibility that the circumstances are changing for stocks as instability gets. A quarterly misfortune without precedent for a while enhances the shot that further quarterly misfortunes could happen and it adds to the developing stress among financial specialists as they look forward finished the coming 6 a year or something like that.

Regardless, last week the S&P 500 advanced by 52.61 or 2.04% to close at 2,640.87 as it tests support of the 200-day MA for the second week in a row. Watch now for further strengthening off this key support zone with a low of 2,585.89.

Next week investors will be watching the U.S. jobs report carefully and the market reaction for signs of shifting investor sentiment. The jobs report is released on Friday.

Cryptocurrencies: Correction deepens

Dangers of further direction and the developing assault on the ICO show by web-based social networking channels kept the weight on crypto costs. Though previously, the apparent terrible news was here and there overlooked, it never again is. Twitter affirmed that it will join Google and Facebook in forbidding cryptographic money notices, particularly with respect to ICOs and token deals. In the interim, after the declaration from Binance that it is moving to Malta, Bitfinex, one of the world's biggest crypto trades uncovered it thinking about a move to Switzerland. Change can be great yet it likewise makes vulnerability, and that can influence financial specialist slant.

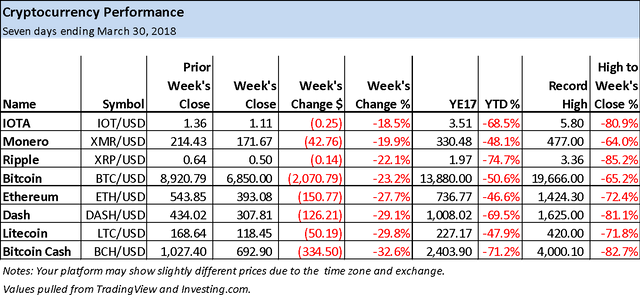

It got terrible again a week ago with three out of the eight noteworthy cryptographic forms of money took after (see encased table) finishing underneath their earlier swing lows. Those drops activated bearish pattern continuation signals for each. Dash, Ethereum, and Ripple met the criteria. The other five, Bitcoin, Bitcoin Cash, IOTA, Litecoin, and Monero each fell observably and are drawing near to their earlier swing lows.

Since the major cryptos have been moving basically together as of late, relative shortcoming, affirmed bear incline continuation signals, in the few might be an indication of what's to go in close vicinity to the gathering. Here and now it would seem that help may have been found around a week ago's lows, and a skip could be coming. In any case, in the master plan, since patterns typically proceed with bear drift continuation flags for the most part prompt further decreases past the underlying help zone trigger, earlier swing low.

In the meantime, as found in the going with table, the eight noteworthy cryptos have just had huge remedies off their record highs. Note that decays from high zones of a week ago's nearby, not the remedial swing low, which is bring down for a few. Without anyone else's input, this would appear to demonstrate that we are nearer to the end than the start of the redresses, however drawback hazard stays high still.

Bitcoin: Finds short-term support

So far Bitcoin has discovered help at the 88.6% Fibonacci retracement zone with a low of $6,550. That could prompt no less than a bob. Notwithstanding, a dip under that value level will flag a continuation of the here and now downtrend and in this manner put the restorative low of $5,920.72 in danger of being busted. Note that the BTC/USD match has as of late tried the protection of the 200-day MA (dark colored line) and it turned around the progress. Besides, the cost is falling further beneath the uptrend line. Every sign is a general bearish sign.

Ripple: Bear trend continues to new low

Swell achieved its most oversold level on the 14-day Relative Strength Index (RSI) force oscillator a week ago as it hit a low of $0.47. Believe it or not around potential help of the 88.6% Fibonacci retracement level of the long haul uptrend. Despite the fact that being overbought independent from anyone else isn't a flag it might mean we are getting more like a low for no less than a skip.

The XRP/USD match set off a bear incline continuation flag a week ago as it fell underneath its earlier pattern low of $0.5335 and finished the week close to the low of the period, at $6,850. A further worry for the bulls is the trial of the 200-day MA as protection half a month prior. Protection held at this long haul drift pointer and cost transformed down to selloff into a week ago. A dip under a week ago's low will probably prompt a more profound redress and conceivable quickening in descending energy.

Your post has been voted randomly by @autovoters :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit