A cryptocurrency is a medium of exchange like normal currencies such as USD, but designed for the purpose of exchanging digital information through a process made possible by certain principles of cryptography. Cryptography is used to secure the transactions and to control the creation of new coins.

A defining feature of a cryptocurrency, and arguably its most endearing allure, is its organic nature; it is not issued by any central authority or financial institute, rendering it theoretically immune to government interference or manipulation.

To put it in another way it is like in the old days when we had no fiat money. People used items to pay eachother and the value was as much the other guy wanted to give for it....

Unlike centralized banking, like the Federal Reserve System, where governments control the value of a currency like USD through the process of printing fiat money, government has no control over cryptocurrencies as they are fully decentralized.

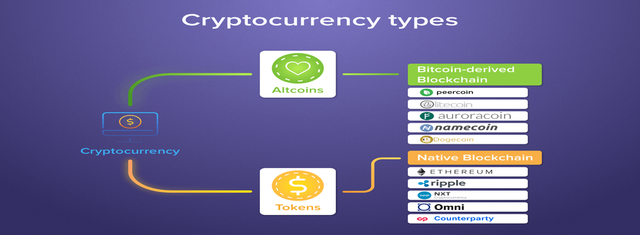

It is very important to know that that all tokens are regarded as cryptocurrencies, even if they don't have a real purpose in society or a real function as a currency or medium of exchange. The term cryptocurrency is a misnomer since a currency technically represents a unit of account, a store of value and a medium of exchange. All these characteristics are inherent within Bitcoin, and since the cryptocurrency space was kickstarted by Bitcoin’s creation, any other coins conceived after Bitcoin is generally considered as a cryptocurrency, though most do not fulfil the aforementioned characteristics of an actual currency.

Cryptocurrencies and blockchain projects other than Bitcoin. An abbreviation of ‘alternative coin’. The majority of altcoins are a variant (fork) of Bitcoin, built using Bitcoin’s open-sourced, original protocol with changes to its underlying codes, therefore conceiving an entirely new coin with a different set of features.

There are also other altcoins that aren’t derived from Bitcoin’s open-source protocol. They made their own Blockchain and protocol that supports their native currency like Ethereum and ripple.

Tokens are a representation of a particular asset or utility, that usually resides on top of another blockchain. Tokens can represent basically any assets that are fungible and tradeable, from commodities to loyalty points to even other cryptocurrencies!

Creating tokens is a much easier process as you do not have to modify the codes from a particular protocol or create a blockchain from scratch. All you have to do is follow a standard template on the blockchain – such as on the Ethereum or Waves platform – that allows you to create your own tokens. This functionality of creating your own tokens is made possible through the use of smart contracts; programmable computer codes that are self-executing and do not need any third-parties to operate.

Tokens are created and distributed to the public through an Initial Coin Offering (ICO), which is a means of crowdfunding, through the release of a new cryptocurrency or token to fund project development.

There have been many attempts at creating a digital currency during the 90s tech boom, with systems like Flooz, Beenz and DigiCash emerging on the market but inevitably failing. There were many different reasons for their failures, such as fraud, financial problems and even frictions between companies’ employees and their bosses.

Notably, all of those systems utilized a Trusted Third Party approach, meaning that the companies behind them verified and facilitated the transactions. Due to the failures of these companies, the creation of a digital cash system was seen as a lost cause for a long while.

Then, in early 2009, an anonymous programmer or a group of programmers under an alias Satoshi Nakamoto introduced Bitcoin. Satoshi described it as a ‘peer-to-peer electronic cash system.’ It is completely decentralized, meaning there are no servers involved and no central controlling authority. The concept closely resembles peer-to-peer networks for file sharing.

One of the most important problems that any payment network has to solve is double-spending. It is a fraudulent technique of spending the same amount twice. The traditional solution was a trusted third party - a central server - that kept records of the balances and transactions. However, this method always entailed an authority basically in control of your funds and with all your personal details on hand.

In the past, trying to find a merchant that accepts cryptocurrency was extremely difficult, if not impossible. These days, however, the situation is completely different.

There are a lot of merchants - both online and offline - that accept Bitcoin as the form of payment. They range from massive online retailers like Overstock and Newegg to small local shops, bars and restaurants. Bitcoins can be used to pay for hotels, flights, jewelery, apps, computer parts and even a college degree.

Other digital currencies like Litecoin, Ripple, Ethereum and so on aren’t accepted as widely just yet. Things are changing for the better though, with Apple having authorized at least 10 different cryptocurrencies as a viable form of payment on App Store.

Of course, users of cryptocurrencies other than Bitcoin can always exchange their coins for BTCs. Moreover, there are Gift Card selling websites like Gift Off, which accepts around 20 different cryptocurrencies. Through gift cards, you can essentially buy anything with a cryptocurrency.

Finally, there are marketplaces like Bitify and OpenBazaar that only accept cryptocurrencies.

Many people believe that cryptocurrencies are the hottest investment opportunity currently available. Indeed, there are many stories of people becoming millionaires through their Bitcoin investments. Bitcoin is the most recognizable digital currency to date, and just last year one BTC was valued at $800. In November 2017, the price of one Bitcoin exceeded $7,000 and in mid december the price hitted an all time high of $19,000!!!!!

Ethereum, perhaps the second most valued cryptocurrency, has recorded the fastest rise a digital currency ever demonstrated. Since May 2016, its value increased by at least 2,700 percent. When it comes to all cryptocurrencies combined, their market cap soared by more than 10,000 percent since mid-2013.

However, it is worth noting that cryptocurrencies are high-risk investments. Their market value fluctuates like no other asset’s. Moreover, it is partly unregulated, there is always a risk of them getting outlawed in certain jurisdictions and any cryptocurrency exchange can potentially get hacked.

If you decide to invest in cryptocurrencies, Bitcoin is obviously not the dominant anymore. In 2017 its share in the crypto-market has quite dramatically fallen from 90 percent to just 40 percent. There are many options currently available, with some coins being privacy-focused, others being less open and decentralized than Bitcoin and some just outright copying it.

Miners are the single most important part of any cryptocurrency network, and much like trading, mining is an investment. Essentially, miners are providing a bookkeeping service for their respective communities. They contribute their computing power to solving complicated cryptographic puzzles, which is necessary to confirm a transaction and record it in a distributed public ledger called the Blockchain.

One of the interesting things about mining is that the difficulty of the puzzles is constantly increasing, correlating with the number of people trying to solve it. So, the more popular a certain cryptocurrency becomes, the more people try to mine it, the more difficult the process becomes.

A lot of people have made fortunes by mining Bitcoins. Back in the days, you could make substantial profits from mining using just your computer, or even a powerful enough laptop. These days, Bitcoin mining can only become profitable if you’re willing to invest in an industrial-grade mining hardware. This, of course, incurs huge electricity bills on top of the price of all the necessary equipment.

As cryptocurrencies are becoming more and more mainstream, law enforcement agencies, tax authorities and legal regulators worldwide are trying to understand the very concept of crypto coins and where exactly do they fit in existing regulations and legal frameworks.

With the introduction of Bitcoin, the first ever cryptocurrency, a completely new paradigm was created. Decentralized, self-sustained digital currencies that don’t exist in any physical shape or form and are not controlled by any singular entity were always set to cause an uproar among the regulators.

A lot of concerns have been raised regarding cryptocurrencies’ decentralized nature and their ability to be used almost completely anonymously. The authorities all over the world are worried about the cryptocurrencies’ appeal to the traders of illegal goods and services. Moreover, they are worried about their use in money laundering and tax evasion schemes.

As of November 2017, Bitcoin and other digital currencies are outlawed only in Bangladesh, Bolivia, Ecuador, Kyrgyzstan and Vietnam, with China and Russia being on the verge of banning them as well. Other jurisdictions, however, do not make the usage of cryptocurrencies illegal as of yet, but the laws and regulations can vary drastically depending on the country.

SOURCES:

https://www.ccn.com/cryptocurrency/

https://masterthecrypto.com/differences-between-cryptocurrency-coins-and-tokens/

https://cointelegraph.com/bitcoin-for-beginners/what-are-cryptocurrencies

https://masterthecrypto.com/differences-between-cryptocurrency-coins-and-tokens/

https://www.thesun.co.uk/money/5130535/cryptocurrency-bitcoin-ripple-ethereum-iota-price-how-buy-risks/

https://www.investopedia.com/terms/c/cryptocurrency.asp

PICTURE SOURCES:

https://vladimirribakov.com/invest-cryptocurrency-join-blockchain-craze/

https://masterthecrypto.com/differences-between-cryptocurrency-coins-and-tokens/

http://www.indiacryptocoin.com/history-of-cryptocurrency

https://cointelegraph.com/news/bitcoin-its-big-in-japan

https://hackernoon.com/countries-approving-cryptocurrencies-d1fb7fefa261

MORE CRYPTO-HELP:

https://steemit.com/created/crypto-help

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cointelegraph.com/bitcoin-for-beginners/what-are-cryptocurrencies

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

lame that you are a bot :p

I used your link in my source

good reaction!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

cheetah 1

yann 0

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

we can't resteem something that has been flagged by cheetah. I know you are new, but just copying and pasting other articles is frowned up and will get you in trouble as time goes on. Just use your own thoughts and you can reference snips of things, but people want to know what "you" think and "why"... I hope this helps. You can do well if you are just yourself and express your own thoughts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit