Over the past few months there’s been a lot of internet chatter concerning the digital currency tether (USDT) and whether or not it’s really backed by U.S. dollars. Further, there’s been skeptics, speculators, anonymous Twitter handles, and well-researched reports that claim tether printing moved the price of BTC considerably this past year. However, just recently a Ph.D. student at the University of Groningen analyzed the situation, and his findings reveal the theory of new tethers pumping the bitcoin price looks improbable.

A Statistical Point of View Doesn’t Support the Tether Printing and BTC Pump Theories

Two days ago, Oleksandr Ivanov, a data scientist from the University of Groningen, revealed a “statistical point of view”

that looks into the theory behind tethers pumping the price of bitcoin. Lots of people believe that tether (USDT) printing had caused bitcoin’s significant spike in value, and they think this relationship is correlated to last year’s phenomenal rise. One study called ‘The Tether Report’ says that when USDTs are printed, the price had kicked into higher gear in “two-hour periods following the arrival of 91 different Tether grants to the Bitfinex wallet.” However, even though some people believe the two digital currencies are ‘tethered,’ Ivanov says the “correlation in all cases is still close to zero.”

“I approached this question from a statistical point of view — If the alleged Tether strategy is true, we should see a positive correlation between the change of the amount of tethers and the change of bitcoin price at some time frames,” explains Ivanov’s analysis.

A Negative Correlation Between the Number of Tethers and the Change of Bitcoin Price

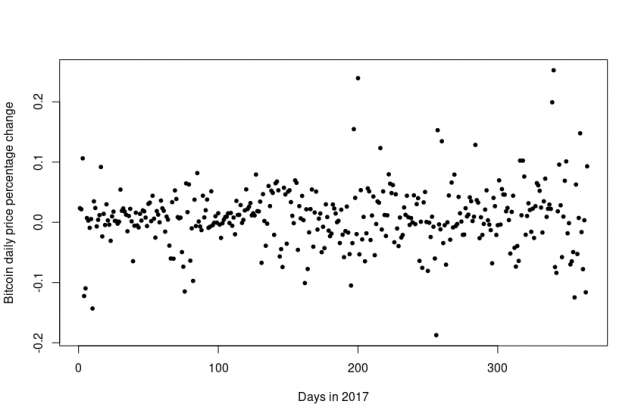

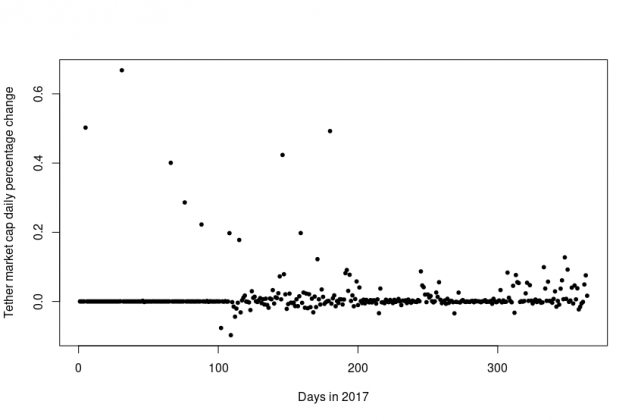

Ivanov used the historical data from BTC prices using Coinmarketcap and the number of tethers in 2017. Following this, he calculated the daily percentage change of bitcoin price and the daily change of the number of tethers in existence.

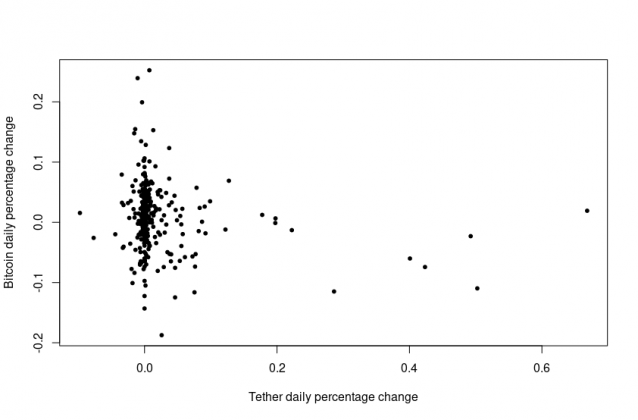

“Next, I plot the bitcoin daily percentage change in price versus the amount of tethers daily percentage change, and most of the points center around zero — Some points on the far right corner of the plot correspond to large percentage changes in the amount of tethers. These are the outliers. Interestingly, they mostly lie below zero in the bitcoin price percentage change axis,” Ivanov’s research details.

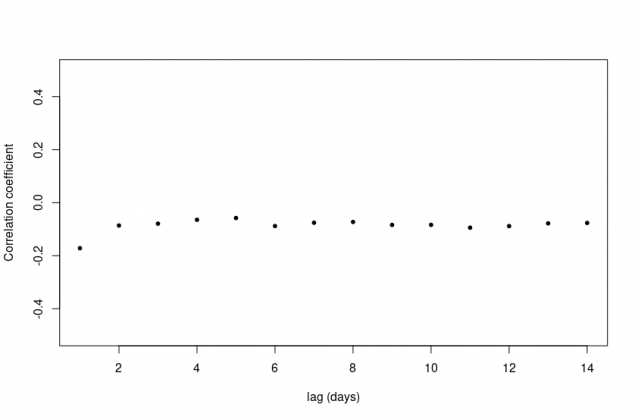

The researcher then looks into whether or not tethers are used to pump BTC prices over a longer period of time. The “correlation in all cases is still close to zero” says Ivanov, and his testing does not support the claims that BTC prices are moved by USDT printing — although, Ivanov explains, his statistical analysis doesn’t necessarily fully disprove tether manipulations.

“A transparent public audit of Tether will shed light on this issue,” Ivanov concludes.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin.com/study-finds-little-correlation-between-tether-printing-and-bitcoins-price/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you i hope what im doing is legal right ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You had to give a link to the original post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thabk you .. well i hope they do not bloc me for that write ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nobody can block you. They can vote down your payments and put into blacklist.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you for the info .. im following you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit