“Crypto weekly roundup” is a new series I’d like to introduce here on Steemit. Every Sunday, I will present some major developments in the crypto space and try to make sense of it, zooming out for the bigger picture, and discuss impacts on future crypto technological advancements, market development, and investment opportunities.

This week, we cover:

- “Do not harm” regulation approach by G-20

- Facebook privacy breach and the future of the centralized web

- Binance under FUD attack, fights back

- Traditional stock markets crash, impact on crypto markets

But first of all, a quick glace at the markets on Sunday, March 25, 2018:

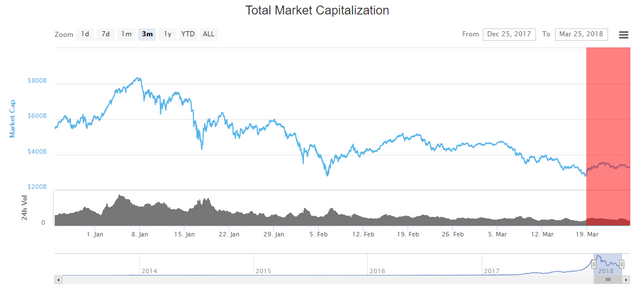

3 month total market cap by coinmarketcap.com, last week highlighted

| Asset | USD | % gains | % of ATH | Comment |

|---|---|---|---|---|

| Total market cap | 330B | 18% | -60% | |

| Bitcoin BTC | 8550 | 2,5% | -57% | |

| Ethereum ETH | 520 | 5,6% | -63% | This week’s Top-10* crypto loser |

| Litecoin LTC | 159,5 | 11,3% | -58% | |

| Ripple XRP | 0,64 | 8,6% | -83% | |

| EOS | 6,55 | 58% | -64% | This week’s Top-10* crypto winner |

| Storm STORM | 0,054 | 220% | -78% | This week’s Top-100* crypto winner |

| Particl PART | 12,7 | -1,4% | -76% | This week’s Top-100* crypto loser |

(* by total market cap)

I am not a financial advisor, I’m not a lawyer. Do not take my articles as financial advice. I’ll gladly offer my honest insight on these topics, but please note that you are solely responsible for your financial investments, and I take no responsibility for any decisions you make based on my content.

“Do not harm” regulation approach by G-20

After the crypto market has suffered substantial losses in the last few weeks, which have partly been attributed to uncertainty and fear regarding stringent market regulations and / or bans by the world’s leading economies, this week has started with favorable news preceding the G-20 summit in Argentina, an annual summit of the world’s leading 20 industrial countries talking economics. On Monday, reports came in that in a letter posted by the chairman of the G-20 Financial Stability Board (FSB, coordinating financial regulation across G-20), Mark Carney said that currently, he doesn’t see cryptocurrencies as a thread to global economy due to their comparatively small total market cap.

The markets have reacted positively to this news. Later, during the summit, G-20 members have in fact postponed any in-depth discussion about cryptocurrencies until July 2018 so as to leave enough time to build the required knowledge in this still relatively new area of economical discussion. This of course leaves us with some degree of uncertainty.

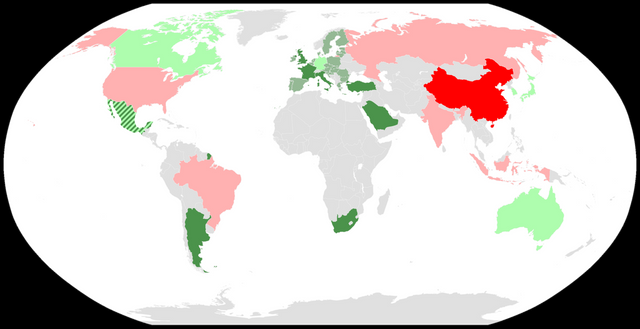

I’ve made this overview picture, presenting a very rough outline of crypto regulations of the G-20 member countries at the time of the G-20 summit this week:

Key:

| Color | Regulations |

|---|---|

| No national crypto regulation so far |

| No EU-wide crypto regulation so far |

| Rather liberal, crypto-friendly regulation in place |

| Rather liberal, crypto-friendly regulation imminent |

| Rather stringent crypto regulation in place (e.g. ICO ban) |

| Complete crypto ban in place |

| Not a G-20 member |

Data mainly comes from these two articles:

- G20 and Cryptocurrencies: Baby Steps Towards Regulatory Recommendations [Coin telegraph]

- A snapshot of current crypto regulations of all G20 member states [Medium / Torque Capital Partners]

Crypto and thoughts

While historically, the crypto world has evolved out of a rather anarchistic movement, many prominent figures in the crypto space nowadays actually favor solid, pro-crypto regulations rather than ongoing uncertainty; and I agree with these views.

First of all, crypto regulations will come eventually after all, and bullish regulations are by far the better option than outright bans and tech-backed wars against those, which would leave no winners.

Secondly, governments make a fair point when they say that they want to genuinely protect crypto investors. We’ve seen so many scams, ponzi schemes and pump-and-dump schemes which have destroyed investor’s assets and trust in the market, that now the time has come that we need a well-regulated, juristically sound handle on these illicit practices.

Finally, I am convinced that the really “big” money will only flow into the crypto space when big name companies see that there is a regulatory, juristic and fiscal framework in place, removing the shady aspects of crypto investments, and clearing the way for official involvement in crypto trading. This is in my view what will finally bring a crypto bull market of unprecedented dimension.

Facebook privacy breach and the future of the centralized web

Although not directly related to the crypto space, news about the Cambridge Analytica privacy scandal at Facebook hit the digital world in general and social media like a thundering wave. As a whistleblower unveiled, Facebook has provided data analytics company Cambridge Analytica, which is closely tied to U.S. president Trump’s election team, millions of private user information, allowing them to potentially predict and influence the 2017 U.S. presidential election, without explicit consent from, or even knowledge of, the affected users.

In the wake of these revelations, a public outcry echoed through social media, and under the hashtag #DeleteFacebook, a large number of individuals, including prominent figures in the tech industry, have announced that they would remove their Facebook profile as a consequence to this breach of trust. Eventually on Wednesday, Facebook CEO Mark Zuckerberg apologized.

On the other hand, one might argue that each and every Facebook user agrees to its (albeit very vague) privacy policy and, consequently, that his data may and will be used according to Facebook’s business model to provide third parties with user data.

Herein lays the actual, long-term problem with a social media giant such as Facebook. Because of their centralized nature, these companies have absolute power over the data users provide them. Here, government-driven regulations are much needed, but they will not be enough. There is simply no way to look into these giant black boxes, which have created little “dark webs” of their own, for anybody outside, be it a regulatory body or not, and to see what is really going on under the hood and how user data is stored, treated and shared.

Crypto and thoughts

Now comes the interesting part from a crypto point of view since the blockchain technology actually may be part of the solution to this problem. Blockchain’s promise is to bring decentralization back to the Internet, with data existing in a distributed network, or, as in the case of Bitcoin, in a public ledger. This will spawn a whole new architecture for the web of the future: After Web 2.0, which was mainly driven by so-called cloud computing where data was in the hands of a few big name companies, blockchain will bring distributed computing, which is already referred to as Web 3.0.

Of course, to build something like Facebook on the blockchain, a public ledger like Bitcoin is not suitable. A public ledger actually means zero privacy, which is okay since privacy never was a design goal of Bitcoin. But blockchain technology as such is not restricted to a public ledger architecture. Actually, there are quite a few crypto projects which already work with encrypted transactions, bringing true blockchain-backed privacy. As far as actual currencies are concerned, projects like Monero $XMR (+12 % this week) and Zcash $ZEC (+13 % this week) come to mind. Another promising project, Enigma $ENG (+72 % this week), tries to bring privacy to decentralized data in general. In one of their presentations, they illustrate this by the use-case of a pharmaceutical company collecting anonymized data from participants who in turn get rewarded for sharing their data which gets encrypted and is never exposed:

One could imagine that with a similar technology, it would be possible to build a decentralized social network where users share their private data without it being exposed.

Decentralized applications, or dapps, may soon revolutionize the web, and it has already started: take for instance Steemit $STEEM (+24% this week), a decentralized alternative to Blogger, DTube, a decentralized alternative to YouTube, or, launched recently by Blockstack $STX, Graphite, a decentralized alternative to Google docs. Today’s big name social media companies will have to adapt quickly to these new developments.

Binance under FUD attack, fights back

The world’s largest crypto exchange by volume, Binance $BNB (+60% this week), had a few rocky, but also exciting weeks, and this week was no different. Through all the trouble it has managed not only to stay afloat but to actually strengthen its position:

- On March 7, an attempted hacker attack on Binance has failed. Binance and especially its CEO CZ were quick to clarify that the attack has been repelled, and that no funds were stolen.

- On March 11, Binance went one step further and announced a bounty of $250k USD for “information that leads to the legal arrest of the hackers involved in the attempted hacking incident”.

- On March 13, Binance announced they would create a new decentralized crypto exchange, and that the BNB token would be upgraded to work on the intended underlying blockchain.

- Finally, on Friday March 23, Japan’s Financial Services Authority (JFSA) has issued a warning on Binance’s unregistered status, de facto urging them to leave the country.

Especially this last news has created high uncertainty amongst investors after rumors about the Japanese ban have circulated since Thursday: According to Binance, they have first heard about the government-issued warning from the Japanese news outlet Nikkei, through which apparently the JFSA has leaked its warning before sending the actual official letter.

But again, Binance has addressed the issue promptly and transparently. When they finally received the JFSA letter, in a surprising turn, they announced that they would simply shut down their subsidiary in Japan and instead open a new branch in E.U. member country Malta, a step which apparently has been carefully prepared by working closely with the Malta government.

Binance’s very open and quick communication, especially by its CEO CZ though his twitter channel, has been widely applauded by the crypto community as a stark contrast to more reluctant (or even misleading) communication practices by other crypto exchanges recently (e.g. Coinbase, on the topic of Ripple).

“Way to go” say many in the crypto space, and the prospect of a Binance-led distributed trading platform plus rumors about Binance potentially aiming to offer a fiat-to-crypto exchange in the future have rightfully raised BNB token prices.

Crypto and thoughts

Personally, I will consider taking my fiat money away from Coinbase as soon as Binance has implemented fiat-to-crypto payments and putting it into the trusty hands of Binance. One might expect that with the move to the European Union, at least EUR-to-crypto conversion on Binance is one step closer.

Also, I’m happy to see Binance making a strong case for national pro-crypto jurisdiction: In the globalized world of crypto trading, if one country refuses to provide the necessary framework for crypto businesses to thrive, other countries will gladly step in. This should mark yet another example especially for other G-20 members.

A healthy organization such as Binance is obviously flexible enough to relocate if things go amiss, e.g. on a political level. If in the future, Binance manages to implement their plans for a decentralized exchange, this will strengthen their position even further. Personally, I see a bright future for this exchange, and potentially for all BNB holders.

Traditional stock markets crash, impact on crypto markets

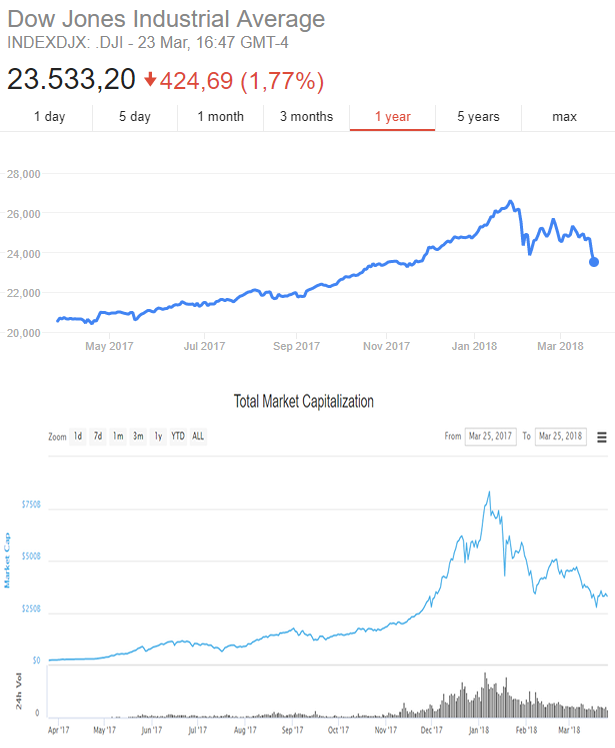

This week has also seen the traditional stock markets, in a bearish mode already since February, taking another dramatic dip which experts clearly attributed to the U.S. administration’s move to apply tariffs which may provoke a trade war with China. Indeed, this March is about to mark the worst performance of Dow Jones in the last 40 years, with the index closing even below the February low-point on Friday, marking a new all-time-low for about 4 months.

Here in the crypto space, many now wonder how the crypto market is going to react to a prolonged bear market in the traditional stocks market. I’m sure many technical analysts will jump at this topic now but the truth is that we simply do not know.

If you just take a brief look at the historic data, you may find that there might indeed be a correlation between the total crypto market capitalization and, say, the Dow Jones index. But there’s simply not enough data, and correlations may still be random. For instance, it is still not clear whether the Dec / Jan / Feb crypto price drop should be attributed to the Mt. Gox trustee incident which flooded the market with found-again bitcoins or whether the simultaneous traditional market pull down had an impact.

1 year performance of Dow Jones by Google, compared to total crypto market cap by coinmarketcap.com

By the end of the business week, crypto markets seemed to look rather healthy with a clear upwards tick. So the question is:

- Will we see people holding back their investments in those times of uncertainty?

- Or will we actually see the opposite strategy, namely people taking away their investments from traditional markets and putting them into the crypto markets?

I would assert that we can be pretty sure there is no imminent cure for the current bearish trend in the traditional markets. This trend clearly has to be attributed to the U.S. administration’s change in trading policies (which, as some might argue, may in turn be attributed to the administration’s lack in knowledge about economic realities and mechanics), and there is no indication that the current economical direction will be changed on a political level.

Crypto and thoughts

As a crypto investor, I for one am happy the investments I’m involved in do not depend on the arbitrary choices of a single central authority which may or may not serve the general public interests or its own agenda, but rather, that my investments drive technological advancements which aim to have a positive impact on our digitalized world, and as such on the development of human interactions and humanity overall. Where knowledge is decentralized, power is decentralized as well.

A closing personal note

This was my first issue of “Crypto weekly roundup”. Thank you for your interest! I hope you enjoyed the read.

I’ve only just started here on Steemit. Actually, in my last article, I announced that I would not continue using the Steemit platform until one of its central flaws is amended: the inability to edit posts. I still stand true to what I have written a month ago. I still think this is a major issue and in fact, it still prevents me from writing general-knowledge articles since this technical limitation prevents me from later update and correct past articles, which I cannot reconcile with my quality standards.

These small weekly articles however I will write in a “fire & forget” manner. Please note that they only reflect my knowledge and thinking at the time the article was written, and that I have no possibility to later make corrections.

I hope that these articles still prove useful. I will primarily use them for myself to take a look back at the last week and reflect on the big news that have come upon the crypto world and what their short- and long-term impact might be. If I still feel this way in a week or two (two because Easter is around the corner…) I will continue this series.

Congratulations @cryptobulb! You received a personal award!

Click here to view your Board

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @cryptobulb! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit