Why I am doing this daily report.

The research and reading I do everyday yields a surprisingly significant amount of information, providing an overview of sentiment, major news details, confluence factors, and insight into our cryptospace.

Due to the encouragement of friends I decided to start making my personal blog, that I had been using to archive this information I aggregate, public.

As a result I've found that by publishing I've been receiving support for the time and effort I spend formatting and sharing out this information.

What is the Daily Dimes?

The Daily Dimes is a publish where I post an aggregate of news information that I come across in the cryptospace every day. There are two sections found below:

- A news bulletin section, where I cover brief descriptions of noteworthy news and developments with sources for further reading.

-and-

- A trading report section, where I release signals and information from my paid memberships, private groups, and personal trades that I'm monitoring, as well as my own market analysis.

Today

- 5 Bulletins

- 2Trading Section Reports

- 1Updates

- BTCC is relaunching after being out of commission for some time it is planning to launch it's own token as well, it appears it's token strategy is going to be similar to Binance's current BNB model where people who trade with it get a discount and then get small rewards as a return for hodling and usage. BTCC moved to it's operations away from China to Hong Kong and was bought by an investment fund at the start of 2018.

They are planning on taking steps to increase liquidity, and the speed of deposits and withdraws integrating with their system. Source

- Binance opens EOS deposits and withdrawals, also crediting ADD and MEETONE at a rate of 2EOS:1Airdrop in both instances.

They also updated their airdrop policies to reflect that they will support all airdrops they are able to however the responsibility will rest on the 'relevant project to' who needs to contact them directly. Airdrops will also happen as close to the correct time as possible, but may not occur on said snapshot that is released from the project team as well. Source1 Source2-AirdropUpdate

- Concerning the chinese miner hardware and farms that was impacted by recent floods in china, I didn't do a release about this yesterday because I was hoping to gather more information as it turns out there is a terribly tiny amount of reliable or useful information about it but there is a lot of 'sensational' coverage of it.

What we know is that the area that was hit by flooding is popular for mining bitcoin as it's next to a hydro-electric facility that likely supports the area around it with cheap electricity. A common local economy stimulus strategy used to help make projects like this worthwhile.

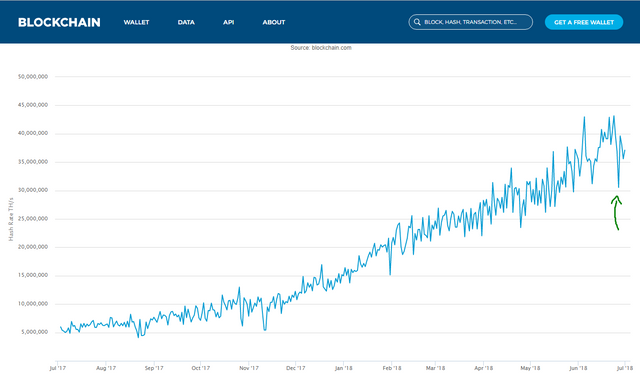

We know the flood happened around the 25th of the & we can examine bitcoin hash-rate charts.

As a result we can see a dip that happens around that time that might coincide with the flood,

What's strange is that we also see a rebound of hashing power which may mean that there was a limited amount damage done to the hashrate by the network and it may have more likely been an opportunity to capitalize on a news event more-so than anything else.

I'll be putting a pin in this and updating this article as I find more information in the future.

Source BTC Hashrates Charts

- Switzerland announces completion of blockchain voting test, the results were a success this is news for the reason of blockchain tech seeing new use case adoption that projects may come into the space to captilize on.

"Almost all participants found it easy to vote digitally"

This led Swiss officials to explain that they are more positive on the idea of someone to have a digitial identity secured by the blockchain and to be able to use this to make it easier for citizens to interact with their government. Source

- In Japan cryptocurrency regulations may be ready to change, the result of which would make for exchanges to handle private and institutional funds separately. This would set exchanges up to provide stronger customer protections as a result. This is preceding the changing of authority for the regulatory head for the FSA in Japan, where the successor has been picked by the current minister that is stepping down. Which means we're likely to keep seeing bullish tones from Japan on crypto and tech related to the financial sector. Source

- Update - Coinbase Custodial Services: 10 new clients have joined since it's opening.

Important details about accounts that customers must enter with a minimum of 10m,

and there is a 100k startup fee. Source

Trading Section

- BTC Macro: Weekly chart has me a little bullish off of MACD & StochRSI. Still waiting for a cross of the MACD.

Currently watching this push upwards off of the support zone from that exists from 5 - 5.8k.

There's enough factors to give us a bullish scenario in the works, however I'm not going to be set on anything bullish until we break upward through the downtrend we've been in since December.

Area to break through is 7600 for next week.

- ETH: Ethereum has been very apparent in leading the trend over these past 6 months acting many times as an indicator for the alt market surges, and sometimes as a leading indicator for BTC.

As such it's nice to poke in on the higher time frames for it from time to time.

Here on the weekly we're seeing an oversold StochRSI, and the possibility of a new emerging trend line.

The dotted blue line represents the invalidated upward trend we were following since mid-2017,

the solid green line represents the possibility of a new trend line the end of the, and

the solid blue line sloping downward shows us a pennant that's been forming since the start of the year.

I'm going to be looking to trade the breakout on this pennant. Generally speaking a pennant is a continuation pattern from the last 'large' movement.

I'm anticipating a breakout upwards, however that doesn't necessarily mean it will go that way as there is still room in the StochRSI for downward movement.

If you'd like to read more about pennants as a TA event you can here.

Thank you for taking the time to read.

If you'd like to support the Daily Dimes news publish please upvote me on STEEMIT.

Or you may drop 20 cents to either of the ETH or BTC addresses below to support today's publish.

BTC: 19kL29drp1gun7CSpJRL6XKYUZJbPWMP3r

ETH: 0x1D04D21C53211c336F703ddf11be4B53FF8F8358

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

if u like my blog then plz upvote and comment link is down

https://steemit.com/cryptocurrency/@mayankpatel9998/bitscreener

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit