Bitcoin price decline is on hold as the market chooses the upside. Is this the start of a new advance, or merely advance in a correction?This analysis is provided by xbt.social with a 3-hour delay. Read the full analysis here. Not a member? Join now.

Bitcoin Price Analysis

Time of analysis: 15h00 UTC

Bitstamp 1-Hour Candle Chart

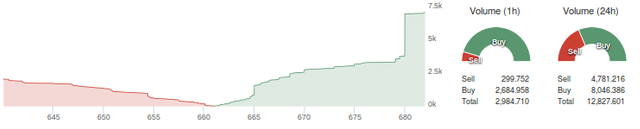

From the analysis pages of xbt.social, earlier today:Bitcoin price spent the past 24 hours in a sideways holding pattern. At the time of writing a surge higher began from the day’s hourly candle closing low.The Elliott wave count from the recent top is labeled and the present upside wave remains consistent with an ABC correction.If this wave count is correct, then we’d expect wave C to target the 1.618 Fib extension of wave A at $664. This will also be the approximate level of the 1hr 200MA, as well as a 50% retracement of the decline since 18 July.From this level, the decline implied by the 4hr and 1day candle charts can resume. If price continues higher, toward the 2.618 Fib extension then the bearish chart indications would become invalidated, across timeframes, and $680 resistance will be the focus once more.For now, the assumption is that the market is targeting the 1hr 200MA and that lack of institutional support will see the move reverse and fall back into decline. Bear in mind that the largest players did not help the market across $680, last week.

Summary

Despite bearish bias in the 1day and 4hr timeframe charts, the market is pushing higher from the past week’s low. At the time of writing the upside looks like a correction of the decline from $680. If this turns out to be the case then a potential corrective target is at $664 (Bitstamp). If price continues higher above this level then the market may be looking to reattempt $680 and advance, although this will only become the favored outlook if 4hr and 1day indicators turn bullish.

Click here for the CCN.LA interactive bitcoin-price chart.

What do readers think? Please comment below.This analysis is provided by xbt.social with a 3-hour delay. Read the full analysis here. Not a member? Join now and receive a $29 discount using the code CCN29.Readers can follow Bitcoin price analysis updates every day on CCN.LA. A Global Economic Outlook report is published every Monday.DisclaimerThe writer trades Bitcoin. Trade and Investment is risky. CCN.LA accepts no liability for losses incurred as a result of anything written in this Bitcoin price analysis report.Bitcoin price charts from TradingView.

Image from Shutterstock.