What determines the price of cryptocurrencies like Bitcoin?-Because cryptocurrencies cost so much money?

In terms of cryptocurrencies and especially Bitcoin, the price is one of the aspects in the market that takes more relevance because of the enormous volatility that characterizes it. From the increase that it maintained after its launch until the collapse that it suffered at the end of last year, it has become a frequent topic of discussion among the members of the community.

Many users follow the forecasts of the trends that may suffer the price of cryptocurrencies, but few are aware of how it is actually determined. The cryptocurrency market maintains its own elements that distinguish it from a traditional one where shares and basic products are quoted, including the way in which its price is calculated.

In this opportunity we will see how the price of a cryptocurrency is established and the elements that influence its fixation within the market.

What is meant by "price" of a cryptocurrency?

The price of something, be it a good or a service, usually refers to the amount of money needed to buy it. However, despite not having much difference in its meaning, in the case of Bitcoin, as well as in the rest of the cryptocurrencies, that amount is referred to the last amount for which it has been negotiated in one of the main exchange houses or an averaged amount among several of them.

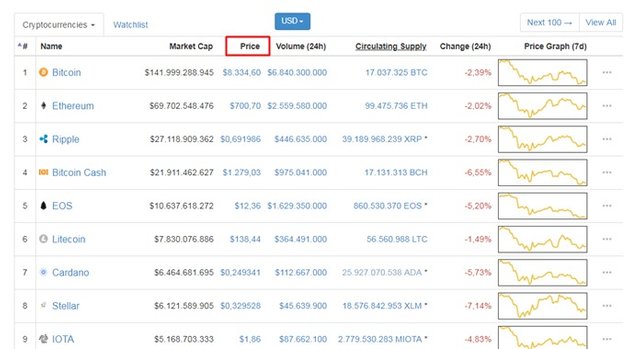

In the first case, we can find references in exchanges such as Binance or Bitfinex, which are currently two of the largest and most popular and in the case of weightings although there are several alternatives, which is positioned as the first option among users of The community for tracking cryptocurrencies is CoinMarketCap.

The decentralization aspect of Bitcoin has the consequence that Bitcoin does not maintain a fixed amount in its price. Its commercialization is carried out in many exchange houses as well as among a large number of users in different countries, which makes it impossible to establish a single price.

On the other hand, although the market is guided under these conditions in its operation, the price gap that may exist between different exchange houses or that a group of people can negotiate independently is not wide and is that the same of some way it stays coordinated in all operations.

What are the ways in which the price is determined?

Agreeing the specific price of a cryptocurrency, it passes obligatorily through the process in which the buyers and sellers make a negotiation, either between themselves or in a house of change, which allows them to agree on a specific amount before executing the transaction .

For this, there are several ways and situations in which both parties can consent to a specific price and specify the operation.

The book of orders as a guide

In most of the platforms of exchange houses of cryptoactives information related to the offers of purchase and sale in a section called "Book of orders" is shown, in the same can be seen the execution of orders made by users who wish to buy or sell cryptocurrencies in the market.

The book maintains on the one hand all the offers of purchase with their respective price denominated "bids" and on the other hand, are the offers of sale also with the price established by the own users, called "asks".

In the interface of the exchanges you can also find this information contained in graphs, allowing you to evaluate the latest movements in the market and know what the trends in the price of cryptocurrencies have been. In the same way it is also possible to verify the transaction history with the number of currencies negotiated and at what price, establishing this last transaction as the reference for the next operations.

The willingness to pay the spread of the bidders and borrowers

In general, it is believed that the price of Bitcoin or another cryptocurrency is affected by the number of buyers and sellers, which raises its price to the extent that there are few users willing to sell or lower according to the offer of sale for increase in the market.

However, the foregoing can be somewhat uncertain considering that in each transaction there are only two parties, so the aspect that makes the difference is the desire to buy or sell to each person and how much their offer varies in relation to the last. price, this is essentially what will create the downward or upward trend in the following negotiations.

That difference between the best offer and the willingness to buy or sell is what is known as "spread". For example, in an offer of $ 100 for a cryptocurrency and a request for 105, the margin will be $ 5 and whoever makes the decisions to cover it in the negotiation will establish the price and the trend.

Influence of buyers in the market

The price of a cryptocurrency can be corrected as buyers influence the market. This is possible if a large number of them with the expectation that an option increases in price, either due to events in the ecosystem or simply under the conviction of an upward future, take any offer created by sellers who expect to obtain higher profits

Therefore, with this condition of bending to pay the differential in each transaction, the bids will increase progressively and the price of the unit will increase until the purchase intention decreases and the process is reversed. Through this activity it will be possible to demonstrate the orientation of the value of a cryptoactive in the market.

Exchanges as price indicators

As mentioned above, due to the decentralized nature of Bitcoin and other cryptocurrencies, the negotiations that designate their price are carried out in multiple exchange houses, making there is no single price established for each cryptocurrency of the ecosystem.

However, the arbitration process in the negotiation that uses the price difference of each exchange, is what helps users to reduce the risk when executing their transactions and also to create a synchronization between the amounts of each house. change.

Likewise, the main exchanges in the market due to the large number of listed cryptoactives and the large volume of transactions, generate some influence on the prices of cryptocurrencies that can be both positive and negative, thus positioning themselves in the community as main references.

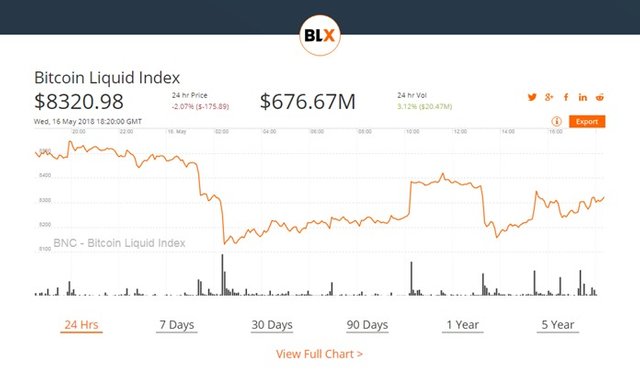

The indices as a mechanism to set a price

The price indexes of cryptocurrencies arise due to the absence of an official or only price that serves as a guide for the users of the ecosystem, and although a kind of synchronization can be generated between those who maintain exchange houses through the aforementioned arbitration process , the indexes seek to provide a weighted number of the different references that are part of the market and create an average indicator.

One of the advantages of these indices is to soften the distortions that may occur in the face of large user transactions in some important exchange, maintaining a healthier level in terms of variation due to the consequences of this type of transactions.

Conclusions

The volatility of cryptocurrencies produces a market with high levels of activity, which may be affected by different factors that result in a greater or lesser movement in the price of digital assets.

Although evolution never stops in an ecosystem of this type, perhaps later on they can be more or less influences on the price according to the development that it acquires, also affecting the levels of stability that it can offer to the users.

Finally, aspects such as innovations in current options, new technologies and possibly some regulations, also affect in the future the setting of prices for cryptoactives.

Thanks For Read :3

Like it or not, cryptos still adhere to the standard economic principle. The supply and demand sides will determine the crypto prices.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's the reality :,v

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by MABRAPER from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit