Investing on risky assets, such as being long the equity or crypto market, has some pros and cons. If you have a tendency for risk aversion, seeing the daily variation of your portfolio can be very stressful. As soon as the market give back a few points, you start wondering if you should sell the entire position and wait until the market calm down to reenter your position. If, on the other side, you are a more risk taker person, you might make some money on the first few trades you make and then start becoming obsess with trading at a point where you take too much risk and lose everything. You might succeed in becoming a professional trader but it is a very complicated journey as you are competing with the most skilled people on earth.

Being expose to risky assets is a good thing on a long term perspective, because, if done correctly, it should, on average, earn you a positive yield. The purpose of this article is to explain a simple way to get some exposition to risky assets on a long term perspective while reducing the risk of your investment portfolio. We will introduce different dollar cost averaging methods for investing in volatile investments.

Dollar cost averaging is the process of buying periodically a given amount of a target asset. The most popular way of doing so is to invest, for instance 100$, of your monthly income in this asset. The method has been popularized by Benjamin Graham in 1949 in his book The Intelligent Investor. It has been then reused and discussed by one of the biggest investor in the financial industry: Warren Buffett. The strategy is suitable for any kind of investors and especially any kind of budget. If you have a huge sum of money to invest, if you use DCA, it will lower the downside risk because you average your buying price and reduce the risk of entering at the peak of the market. If you do not have money to invest but receive a monthly income and want to invest, this is the best way to regularly build a strong position on a long term basis.

Now let us dive into the strategy. We are going to study the past performance of 2 DCA strategies on 3 risky assets, the SP500 Index and the two biggest cryptocurrency, the Bitcoin and the Ethereum (both against the dollar). The 2 strategies are the following:

- A strategy where we invest a fix amount of money every month. Let’s say 300$.

- A strategy which invest every month an amount of money depending on the maximum drawdown observed on the asset over the past year. We can floor and cap the amount invested (let s say between 300$ and 1000$). The purpose of this strategy is to improve the first one by investing more on the asset when it has slumped from its 1 year high. There are various way of defining this monthly allocation function of the drawdown. Let us use a simple linear function. For instance if the maximum drawdown is -50% from its 1 year high we will invest 300$ + (1000$-300$)*50% = 650$. The amount will depend on the current drawdown every month.

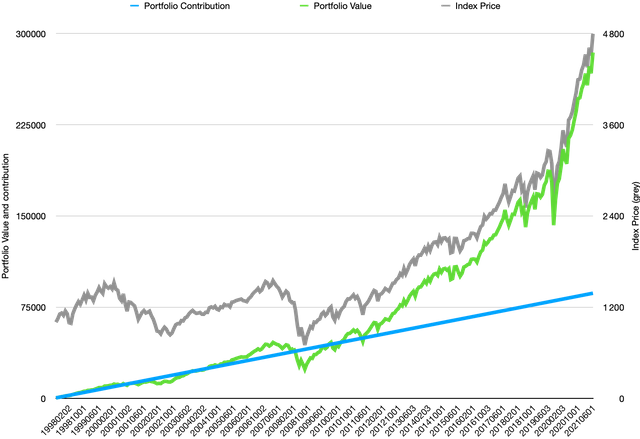

For each strategy, we decide to invest on the first day of the month (this is arbitrary, we might change this rule later). First let’s check at the performance of these strategies on a long term perspective on the SP500 Index. On the graph below, I plotted the evolution of a portfolio of strategy 1 from the start of 1998 to the end of 2021. The blue line is the total contribution, the green is the portfolio value evolution and the grey is the index evolution.

The strategy ends up with 86 400$ contributed (300$ each month for the 23 year period) and the portfolio value at the end of the period is 284 400$ which makes a 198 000$ profit. The average buy price on the index is 1731 $. The first remark to make is that the strategy works well if the underlying in what you invest takes value on the long run. If we take a closer look at the first 10 year period (until 2009-2010) the strategy does not earn you money. At the bottom of the market in march 2009, you had contributed 40 200$ and your portfolio was worth 23 900$ making a 16 300$ loss on your portfolio. As a consequence, bear in mind that this strategy can be tough to cope with on big market downturn. One of the prerequisite for this strategy is to invest on an asset that will increase in value on the long run.

Another characteristic of the strategy is its inertia. You can see it on the second period (2010-2021) which has been particularly bullish for equity markets. The time to recover from your 16k loss was very quick, as you only had to wait 1 year to become PnL flat, where the green and blue line cross paths (march 2010). After this period, as you stacked a lot of money around 1200$ (average of the SP500 price over the 1998 to 2010) period, your PnL starts showing interesting figures. One of the other aspect to keep in mind is that big PnL will start to appear after a sufficient amount of time (or stacked money) if the assets keep going up in value.

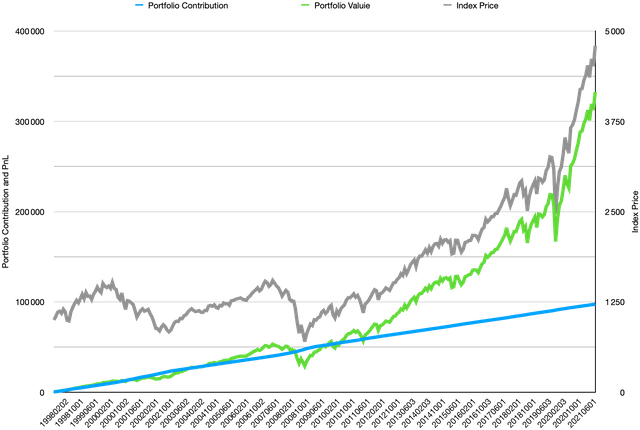

If we look at the result for strategy n°2, here are the results:

The strategy yields similar results except that you invested more capital when the SP500 was down from its 1 year historical high. For instance in march 2009, when the equity index was down -50%, you invested 650$. Obviously you could have invested more at that period, but remember that we want to build a strategy that regularly invest in an asset without knowing what are the lows and highs to come. Your maximum loss on the period was -18k$ in march 2009. Note however that your portfolio was down -35% at this time while the SP500 was down -50% from its high of 2007. At the end of the period, your portfolio is worth 332k$ for a total invested capital of 97.5k$. Imagine if you raise the upper boundary of your monthly contribution (5000$ instead of 1000$), you could have ended up with a portfolio with much higher value. But again, remember you are taking more risk and if your asset is going down long term, you are screwed.

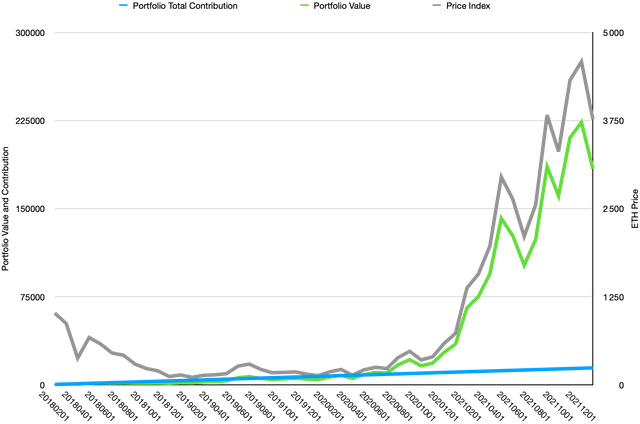

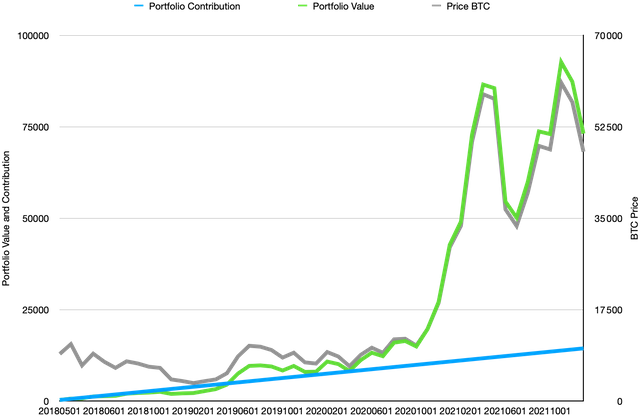

Now let ‘s have a look at these strategies on a shorter time frame and on a riskier asset class: cryptocurrencies. Bitcoin and Ethereum are known to be more volatile than the broader equity markets and equity indices like the SP500. As of january 2022, BTC and ETH have a yearly volatility of around 50% for BTC and 60% for ETH which is less than it used to be but still more than the volatility of the main equity indices. We are going to backtest our 2 strategies on a the recent history of these 2 cryptocurrencies: End of 2017 – 2022.

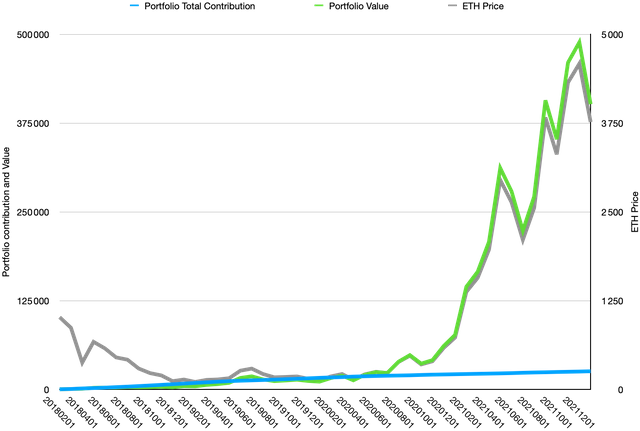

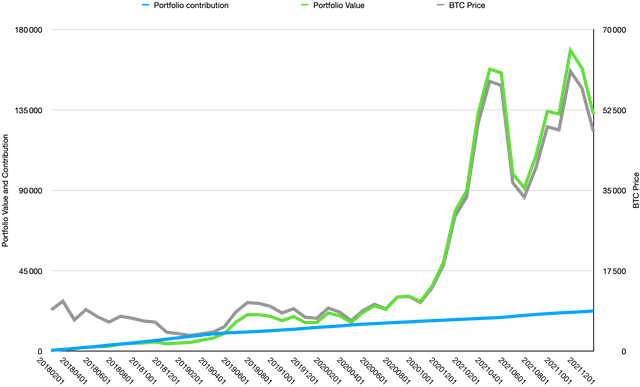

The results of strategy n°1 is quite impressive on the period, even if we have started at the worst possible time as it was near the high of the market. This is an important aspect of the strategy compared to a direct investment. If you directly invest your lump sum at the wrong time, you might suffer bigger drawdowns. For the ETH case, you would have lost 90% of your value. On the other hand, with the DCA approach, your max loss was bounded to 50% as when the market goes down sharply, you keep investing at lower prices, making your average buy price much lower. Note that you will also recover quickly to breakeven (when your PnL starts becoming positive again) than if you had invested everything at the beginning and wait for the price to raise back your initial entry point. As of January 2022, the strategy n°1 on ETH had a 184k$ value for a 14.4k$ committed capital. The BTC portfolio for strategy n°1 had a 74k$ value for a 14.4k$ invested in total.

We now plot the same result for the enhanced strategy n°2:

Results are improved on both assets as the strategy n°2 makes your monthly contribution higher and these higher amount are invested at lower levels. On the ethereum, this strategy made you commit 25.6k$ splitted on monthly contributions and your portfolio was worth 402k$ at the end of the period. On the BTC, you contributed 22.5k$ for a total portfolio value of 132.5k at the end of the period. On the ETH, strategy n°1 did x12.7 on your capital whereas strategy n°2 did x15.7. On BTC strategy n°1 did x5.1 on your capital and strategy n°2 did x5.8.

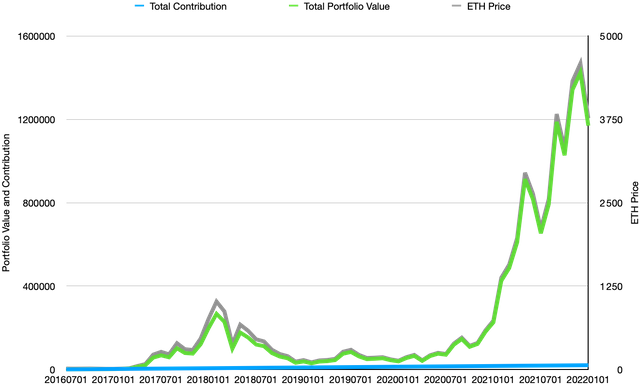

If you want to be a crypto millionaire, well, you had to be an early bird in crypto investing and keep your buying rate the same every month. Check out the result of strategy n°1 on ETH if you had started a year and a half before the end of 2017 peak in crypto markets:

Your total wealth at the beginning of 2022 would have been 1.2M$ for only 20k $ committed (300 $ each month since july 2016). You would have multiplied your capital by x60.

DCA strategies are far from being perfect investment solutions, they have pros and cons. The key to build wealth on this strategy is to chose correctly an asset that has a long term increasing value. This is the most fundamental rule to succeed with the strategy. The second point is to maintain its pace of contribution to the strategy no matter how the asset is moving. It means that you might suffer from drawdowns at some points, and see your portfolio with some bad PnL figures but you will lose less than the overall market as seen in the ETH case in 2018. If you keep believing on the long term perspective of your asset, the path to recovery should be quicker than the market itself because the investment decisions you take at market lows will make your future wealth. If you want to build an astonishing wealth over time with the strategy, you need to either be an early investor on an asset that will increase at abnormal pace (as investing slowly in ETH from july 2016) or you need to increase your contribution at time of market distress. But again, timing the low of a market can be a tough game and you might suffer even more than you did. Remember to always do the job, research on your asset and find what intrinsic value does it have. Always ask yourself what is the long term outlook for the asset you are investing it.

If you have any questions, feel free to drop a message below or send me a mail at [email protected]

Cheers!

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://steemit.com/fyrstikken/@sqube/3dhq8e-i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit