Some Features Of Radar Globe

A unique feature of the Radar protocol is the Proof of Return system. This is a feature that allows investors to see how their funds are performing. Besides this, investors can also target certain sub-categories of preference, which further enhances the security of funds. In addition to this, RADAR has partnered with insurance services and other related services, which ensure that their funds are well-protected.

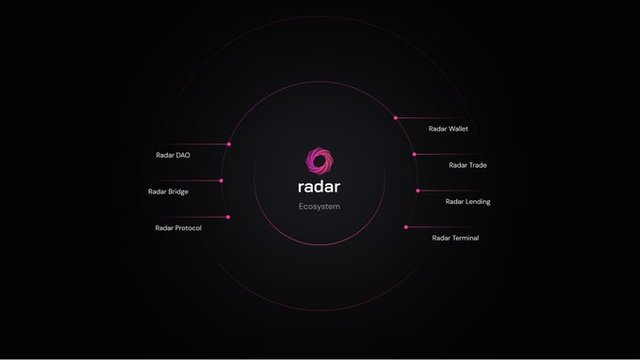

The platform was designed to improve on the existing financial template, bringing together all the DeFi projects. The platform has a number of unique features, which makes it an ideal choice for both beginners and seasoned cryptocurrency investors. It provides cost-effective wealth enhancement to both sides of the investment transaction. This means that it is a perfect solution for those looking for a safe and reliable investment option.

Lending & Borrowing

The Radar AAM supports lending and borrowing natively, in order to give users more options on one hand and to allow vault managers and asset allocators who have locked up capital to use it as collateral for approval on borrowing something. Users will be able to place their positions within a vault as collateral and continue to earn yield on those assets while also having access to capital.

Auto-Allocated Capital

The Radar AAM also features an extra feature which we’ve briefly described in the introduction. Users who do not have the time or knowledge to choose the proper vaults in which to allocate capital, can configure a general list of settings and permissions they would agree with, as well as some limitations and then they can grant that capital to the protocol itself. The protocol then decides on some weighted averages and allocates said capital into various vaults from the Radar AAM or simply uses it in lending or staking or the dozen other options which are available. The purpose of the auto-allocated capital is to ease up the work of an average user, even beyond what already exists while minimising risk.platform has taken steps to ensure fund security is related to insurance services. The Radar Protocol will use decentralized insurance protocols to insure all the protocols and guarantee the safety of investors’ funds, in addition to high-quality code, comprehensive testing, industry-proven security standards and auditing. Concurrently Radar Protocol will offer fund-specific insurance options that investors can choose to acquire and/or to hedge against any risks linked with the fund investment.

AAM vault creation

The asset manager initializes a smart contract, deposits an initial amount, and then he has to set up the initial opening parameters of the vaults, which can include but are not limited to name, accepted assets and asset types, supported chains, rules of conduct and other such examples. Once the initial parameters are set and the vault is published, asset allocators who fulfill the necessary requirements can use the vault on the condition that they agree with the parameters set forth and the overall fund vision and generated returns. After allocating assets to the vault they receive the corresponding rFund token which can be redeemed for the underlying assets. While the severity depends on the permissions of an individual vault, an asset manager might need to get approval from the allocators vault-level governance. Some specific settings require a vote by default, such as changing the permissions.

Hashtags: #crypto #radarglobal #radar #trade #invest #ethereum

Learn More

• Website: https://radar.global

• Twitter: https://twitter.com/radarprotocol

• Telegram: https://t.me/radarprotocol

• Medium: https://radar.blog/

• Radar Token Explorer:https://etherscan.io/token/0xf9fbe825bfb2bf3e387af0dc18cac8d87f29dea8

Author

• bct user name: artaks

• bct profile link:https:https://bitcointalk.org/index.php?action=profile;u=2252746;sa=summary

• Telegram: @artaks33

• Binance Smart Chain(BEP20) wallet address: 0x9684d15706a591D7c8E3aaaC67a2515B9EC4192B