Hey everyone, this is the first in a series of posts I intend to write on an introduction into portfolio theory in the context of cryptocurrencies. Please feel free to reach out to me or leave comments and please check out the brilliant work we are doing over at Medicalchain.

The cryptocurrency market is nascent and has already generated an immense amount of wealth. As of the time of writing, the total cryptocurrency market capitalization has surged to 17 times what it was at the beginning of January. People are, for better or worse, scrambling to gain exposure to cryptocurrencies. Case and point: Coinbase has more users than Wallstreet brokerage firm Charles Schwab and recently topped the trending apps list during the latest Bitcoin rally.

This article is an attempt to explain why and how people diversify their assets to optimize their returns. It is similar to the content you would learn in a college finance course. By all means, apply these concepts in your investing, but please don’t interpret any specific finding as investment advice.

Diversification is your friend

If you take away one thing from this article it should be this: diversification is good. I’ll try to explain why.

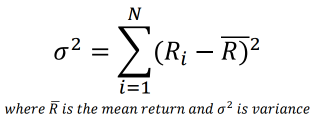

We measure the risk of a particular asset based off of its variance or, put simply, how much a stock deviates from it’s average. Variance is calculated like this:

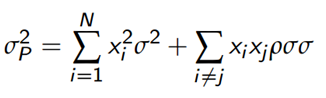

If you have N assets in your portfolio with weight x, and a correlation between two assets of p then the variance of your portfolio’s return is calculated like this:

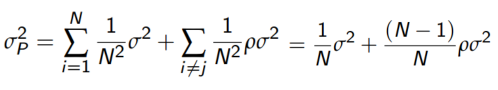

To simplify we will assume our portfolio is equally weighted. With N assets this means our weights will all be 1/N, or x = 1/N.

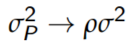

Lastly, if we let the number of stocks in our portfolio tend to infinity we arrive at the following:

What this tells us is the following:

- In large portfolios correlations are really important

- You can drastically decrease your portfolio variance but only to a certain degree.

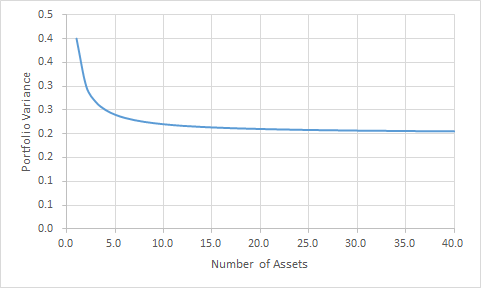

Below I’ve made a graph demonstrating a simplified portfolio full of equally weighted assets with equal variance (0.4) and correlations (0.5). Almost all of the reduction in portfolio variance takes place in the first 10 assets.

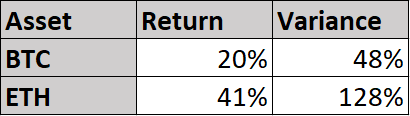

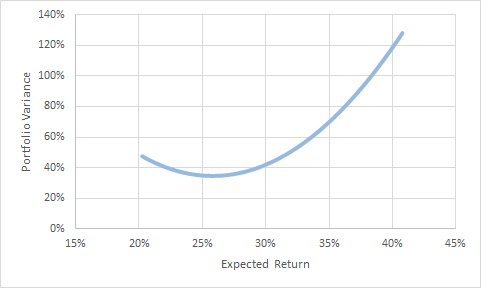

Moreover, even if we reduce our scope to only 2 assets, we can create a portfolio that is more efficient. That is, we can construct a portfolio of two assets with equal variance and a higher expected return than just holding one asset. As an example, let’s look at BTC and ETH. These statistics are calculated with 1 year of past data, using the average annualized monthly variance.

Using the above formula for portfolio variance and by varying the weights for BTC and ETH in our portfolio we arrive at the following table and corresponding graph:

Weight ETH = 1 — Weight BTC and vice versa

The far left side represents a portfolio of only BTC and the far right represents a portfolio of only ETH. Returns and variance are calculated using the past year’s data.

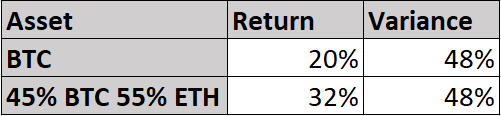

Here is an important finding. If we take the far left point of 100% BTC and it’s corresponding variance, we can find a point to the right with the same variance but higher expected return.

Disclaimer: these numbers reflect expected return.

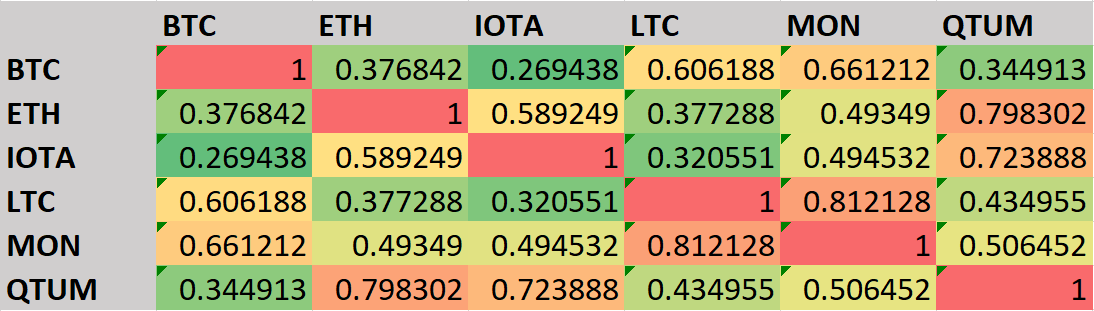

It’s possible to introduce other assets to get even better results. I’ll explore this concept in a later post. For now, if you’re interested, here is a table of asset correlations in the past year I’ve made. You might find it useful in thinking about how you construct your portfolio.

Calculated using available data from the past year.

View the original on Medium here: https://medium.com/@bertcmiller/part-1-diversification-is-your-friend-24f0297a9ead

Congratulations @bertcmiller! You received a personal award!

Click here to view your Board of Honor

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @bertcmiller! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit