#All you need to know about bitcoin, kryptovalutan, who sprawled 1500 percent this year.

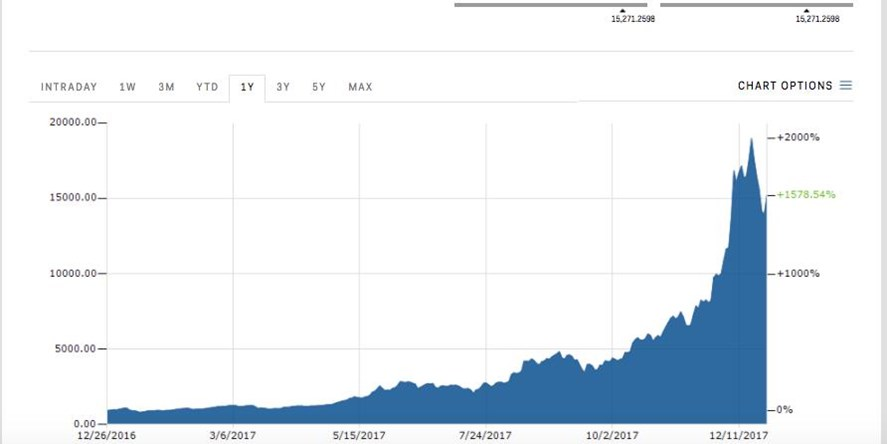

Bitcoin has rushed more than 1500 percent this year.

In addition to Trumps escapades, fake news and hurricanes, the progress of bitcoins and cryptovalutors is the great news when 2017 is summarized.

Bitcoin was a long time just as well well-known and the cryptoanists were cared for. But with the rocket-like upturn, the world's media, banks and small savers have opened their eyes to what was launched in 2008 by a mythical programmer who called himself Satoshi Nakamoto (more in the background at the bottom).

The subject of cryptovalutor leaves hardly anyone untouched. Wall Street executives at Citi to JP Morgan to Vanguard are talking about clever currency as a "plague", "a fraud", something "for criminals" while tech magnates like Bill Gates see the potential of bitcoin and its underlying technology - the block chain - which is believed to be a of the coming decade's major breakthrough.

At the same time, bitcoin has no underlying value; few understand how it works; It is completely unregulated, and can fluctuate in price by tens of percent within a day.

Is this 2000's tulip bubble, or a revival of the IT boom? Or are we witnessing the beginning of a totally digitized economy?

Hang on the thriller that was 2017 and take on the unprecedented course of events that made the cryptovalutts mainstream.

- Bitcoin 15 doubles its value

Markets Insider

In January, a bitcoin hosted around $ 1000 dollars. Praying with strong speculation in the fall, a coin twisted this week $ 20,000 before a sharp fall just before Christmas. At present, the annual return on bitcoin is more than 1500 percent. Its first step had the bitcoin peak peak at around a thousand dollars a coin a few years earlier.

- People get rich overnight

( )

)

Crypto craters. With the unprecedented rise in prices has made a small clique early bitcoin investors substantially wealthy - at least for the moment. It is estimated that about 1000 people own 40 percent of all bitcoin ; corresponding to a total of nearly 900 billion by end rate.

Among the richest bitcoinmagnaterna are twins Tyler and Cameron Winklevoss - best known for the dispute with Mark Zuckerberg about the copyright to this (filmed in Social Network).

The two brothers were given proper compensation in the lawsuit against Zuckerberg and invested 11 million US dollars early in bitcoin - an investment that has grown to $ 1.3 billion today. "We will not sell until bitcoin is worth at least as much as gold, or about $ 380,000 US dollars per coin," said Tyler Winklevoss the New York Times recently. "If even then."

Even in Sweden, cryptographic host lens Nouveu riche. For example, the VA Finance previously noticed, the programming expert Alexander Bottema increased the value of their life savings - all of which was used to great shopping of bitcoin - thousands of percent from in 2013.

Bitcoins father Satoshi Nakamoto, whoever he is, is estimated to own bitcoin for the equivalent of $ 20 billion.

- Alternative coin explodes

ICO Bonanza. In the wake of bitcoin has many other crypto entrepreneurs created their own coins, and these have been released to the public through the Initial Coin Offerings (ICO). A surge of money has flooded into these alternative crypto currencies, "altcoins" and made the ICO this year exceeded the amount of money invested by the world's venture capitalists.

Among the approximately 1360 different altcoins available today is the best-known upstarts Ethereum, Ripple, Bitcoin Cash, Dash and Zcash - most are variations on bitcoin. The differences between the coins are mainly technical, and differ regarding things like smart contract, the amount of coins, the size of the memory block where the transactions are stored on.

Bitcoin is by far the biggest crypto currency today, and account for about 265 billion of cryptocurrency total market capitalization of $ 600 billion (5 trillion crowns), according Coinmarketcap.com .

- Bitcoin breeding progeny

![]

![]

Bitcoin Cash. After unsuccessful attempts to fix Bitcoins slow transaction times and high costs, was launched in August a "hard fork" of bitcoin, bitcoin spin off cash. The new crypto-currency obtained as a kind of new issue: Anyone who took 100 bitcoin suddenly 100 in bitcoin cash.

It is during the fall caused a political war between bitcoin, and bitcoin cash camps, especially after the Swedish bitcoin veteran and co-founder bitcoin.com Emil Oldenburg revealed to Breakit he sold all bitcoin to completely switch to bitcoin cash (bitcoin.com advocates today bitcoin cash). Bitcoin cash is currently the fourth most valuable currency, and recently experienced a strong rebound after Coinbase, the leading crypto-currency broker, made the currency available for trading.

- Finance Small disagree ... but not all

"Avoid like the plague." Many are the Wall Street veterans who feel the threat of crypto-currencies and gone to the fierce attack in the fall. "Avoid like the plague" said Vanguard founder Jack Bogle, while Jamie Dimon, CEO of JP Morgan, said he bitcoin is "a fraud", and promised to give the boot to the trader who traded with them.

Even at home, Nordea manager Casper von Kosull Fost distrust of bitcoin: bitcoin He called recently for "an absurd construction" and pointed to the risks it may rub off on the financial system.

On the academic front, the Nobel Prize winners Joseph Stiglitz and Paul Krugman, given the currency a good throw, and aimed at the fact that bitcoin is completely unregulated.

After slightly more cautious initial comments from Goldman Sachs boss Lloyd Blankfein, the news came haromveckan: investment bank to open a trading desk for crypto currencies.

- Bitcoins steam: Asia

Bitcoin bonanza in the east . Bitcoin and crypto currency is controlled largely by what is happening in Asian. (Yes, even Alexander Bard has noted it in this column .)

South Korea accounts for as much as a fifth of global trade and is one of the world's premier venues for crypto currencies.

Deutsche Bank estimates that about 40 percent of all trade in crypto-currencies during the autumn, the Japanese men in the 30 to 50 years old.

When you look at the actual extraction of bitcoin China is dominant. More than 70 percent of Bitcoin "mining pools", computer network that solves the algorithms that give rise to new bitcoin, sits today in China, according to Jordan Rochester at investment bank Nomura.

- What the hell is a bitcoin really?

The discussion goes. Is it a value? A commodity? An asset? A digital means of storing value?

What bitcoin really should be a relevant question for all who put their savings in the wet. We know that it is not directly underlying value - but it is the money we use today, nor for that matter, many people believe.

Although called bitcoin digital currency, its properties according to many experts more similarities to gold than SEK and USD. It is precisely because it is difficult to accept bitcoin as a payment means. Morgan Stanley wrote in a recent analysis that Bitcoins real value "may well be zero" for that very reason. The bank acknowledged, however, that bitcoin is subject to a digital medium for storing value.

Many insiders in the industry, including Christopher de Geer, founder of the Swedish bitcoinmäklaren BTCX - recently in Di Digital responded, Nordea chief von Koskull - believe, like many of his colleagues in the industry, the crypto-currencies is primarily a protocol like the Internet.

Among Swedish Bitcoin community, where the frontman's YouTube star Ivan Liljeqvist, takes spekuleringen in bitcoin away attention from its greater potential. According Liljeqvist can bitcoin currencies, which are not controlled by states and applies everywhere on earth, be it that give the poor a voice in the financial markets.

- A cup of coffee for 250 bucks?

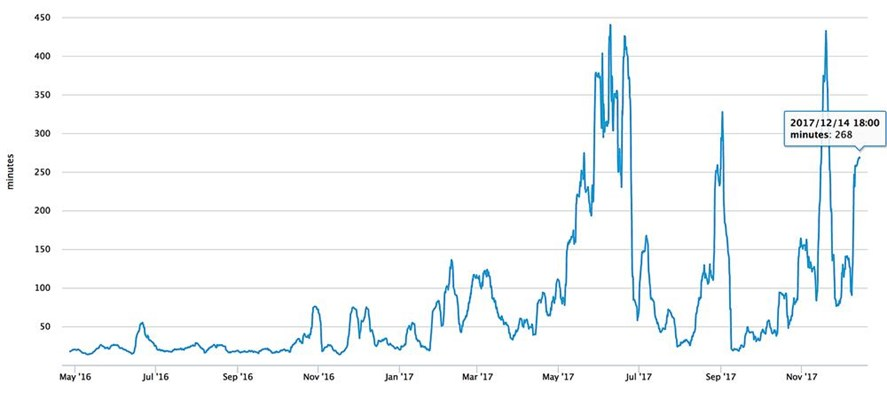

Transaction costs. As trade in bitcoin increased, it has increasingly become slower and more expensive to buy and sell coins. According to Business Insider, it takes an average of 4.5 hours to register a bitcoin transaction block chain, while it can cost upwards of 250 crowns to make a transaction.

It has been well blockkedje expert Magnus Kempe and bitcoin.com-founder Emil Oldenburg emphasized. Similar problems affect course other crypto currencies. Early Bitcoin developer Jeff Garzik recently told Di Bitcoins to "teething problems" should be addressed, and therefore he launched in December a new altcoin shorter transaction times: united bitcoin.

Business Insider British chief editor Jim Edwards writes that Bitcoins "illiquidity can be a huge problem when the bubble bursts." When all investors at the same time by an extremely narrow emergency exit, there will be panic, he says. The graph below shows how waiting times for operations has increased as bitcoinpriset.

( )

)

- Bitcoin> Denmark

Environmental villain. According Bitcoin Energy Consumption Index, which measures the amount of energy needed to urvinna, or "mine", bitcoin, devour crypto currency is now more energy than 19 different European countries, including Denmark.

The reason the amounts of energy are the complex algorithms that Bitcoin "miners" have to solve, requiring more and more computer capacity.

Other problem areas have spun out during the year, not least hacker attacks against large bitcoinmäklare - which resulted in thousands of people lost their holdings in the currency.

- Crypto Currency trading is spreading to institutions

Time for the ETF. Whatever the bank tops Wall Street says, interest among investors and professional exchanges worldwide flourished this year. There are now hundreds of hedge funds that actively speculate in bitcoin.

Earlier in December launched Chicago-based brokerage house CBOE world's first bitcoin futures contracts ( "futures"), ie securities that let people speculate kryptovalutans price movements without actually owning them. The interest should have been great, but many are those who ask themselves what would happen if a bubble fueled by a derivatives market in the style of the Lehman 2008 may be many times worse consequences of a possible price crash.

The week after the CBOE broker CME Group followed up with their own futures.

CBOE has recently followed up their futures launch the application with the Securities and Exchange Commission (SEC) to release six different ETF instruments will shadow bitcoin futures.

- US stock exchanges is expected to launch bitcoin ETFs in 2018

Show me the money. Where the money is, there is Wall Street; and crypto-currencies are no exception. New York Stock Exchange recently submitted an application with the SEC for permission to launch two exchange-traded funds, ETFs, which will shadow bitcoin futures give investors the opportunity to both shiny and invest in crypto currency without direct ownership, reported Business Insider.

Earlier this year, the brothers Winklevoss filed for authorization to launch a bitcoin ETFs through their brokerage startup Gemini, but was denied.

- How do I get Bitcoins? Or is it all just a big "scam"?

Gold Rush or bankruptcy? When it comes down to it, hangs Bitcoins fate in 2018 on private investors' willingness to push money in good faith - regardless of any question marks. Why scrape together a return of 3 percent of boring listed companies when you can win 1500 percent in a month? At the same time, the risk equal to everything falls apart and it becomes a "crypto winter," Jeff Garzik, an early pioneer bitcoin, recently predicted to Dagens Industri.

Trading Platforms Coinbase, eToro and Gemini are increasingly popular when the hype begins.

Bitcoinfebern came to Sweden in the autumn, when the company XBT Providers bitcoin certificate in December was among the most traded securities on the Avanza and Nordnet. Now estimated about 40,000 Swedes take bitcoin to a value of approximately SEK 2 billion, according to Claes Hemberg, savings economist at Avanza.

How crypto currencies:

The key building blocks in the bitcoin and other crypto currencies is that they are decentralized, anonymous and without transaction costs (the latter has come under attack for years).

All built based on the technique 'chain block', or block chain - a digital log book notes each transaction in a long chain of code which in turn consists of encrypted blocks. When bitcoin changes hands, creates a traceable "record" that can not be changed afterwards. Satoshi Nakamotos great genius is considered to be in that he blocks chain solves the "double spending" problem, ie the same bitcoin can not possibly be spent twice.

In addition, limited Nakamoto proportion Bitcoins to 21 million, and created smart incentive for programmers to urvinna - and awarded - Bitcoins by solving algorithms by so-called "proof-of-work '. Right now halved the proportion of Bitcoins according to a fixed schedule, which makes the last coin will be recovered in 2140. It is this system, with a fixed number of coins, which made the crypto currency is talk of a 'digital gold' - an alternative way to store value (assuming that enough people really gives value to the bitcoin).

how do you upload your profile picture?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

check it here. https://www.google.com/url?q=https://steemit.com/steemit/%40ilyastarar/how-to-add-profile-picture-and-set-up-steemit-profile-newbies-guide&sa=U&ved=0ahUKEwjB4tLtwbPYAhVkDZoKHQx2AHEQFggEMAA&client=internal-uds-cse&cx=011445933062884569876:-jmpkfnkicw&usg=AOvVaw2Wo_luLkrduUr5Bquy2HJM

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by beulahlandeu from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews/crimsonclad, and netuoso. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP. Be sure to leave at least 50SP undelegated on your account.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit