This is a "guide" to help you get started with crypto. I decide to break it down into digestible parts. Those are mere my thoughts and observations from experience when i first started dabbling with cryptocurrencies but more on why I decided to invest in crypto in another post.

Disclaimer, I am not a financial advisor, I am merely a helicopter pilot. Always do your own research and be extra cautious to where you invest your money.

Part 2: Return of investment – ROI

This is the second part for my crypto newbie guide and today we are going to deal with our return on our investment, aka, the gains.

The safer an asset is, the less return it will produce. Simple right? For you to understand what the return will be in crypto, it is imperative to understand the market cap of an asset. Market cap in crypto is the total amount in price of the asset that has been mined. This is the true value of an asset, and not the spot price you see on it.

Market Cap = Price x Circulating Supply

Crypto assets with large market cap are a “safer” investment, generally speaking, and most of those in the top 10-15 are considered to be “crypto blue chips”. The lower the market cap the more room for growth exists.

Back to Bitcoin, and our ROI. Bitcoin tends to trend up with time, given time. If you are into the crypto market to make a quick buck and then get out, this guide isn’t for you and you’re probably a gambler that will lose everything at some point because you have the mentality of one. The first thing to do when hopping into the cryptospace, is to perceive it as an investment first, a long play hold and not a magic lottery ticket that will make you rich in a day’s pass.

If you buy bitcoin now, supposedly you can expect a 3x on that as an ROI. This is speculated because bitcoin will surpass 100k this cycle – assuming we are still in a bull market.

Markets have bull and bear cycles as we stated in the previous guide and what I believe, is that this cycle has lengthened, and it will produce diminishing returns (more on that in another article). So, if we take this theory to the bank, bitcoin could do a 3x by cycles end which I calculate in late Q4 of 2022 or early Q1 in 2023. The more the cycle peak moves, the greater the price will be. A bull cycle is when we slowly trend upwards until we find a cycle top that will usher in the new bear market cycle, which is the exact opposite of a bull one. In a bear market cycle, the price tends to trend downwards, until the lowest point of that cycle is identified that will spring the price later on to new heights and provide a cycle reversal.

An altcoin will have better gains and ROI as you can already get if you understand asset market capitalization however when we look at charts, due to bitcoin being the king, it is always good to check the prices of altcoins we are interested and see how their value fairs against bitcoin. Is the asset getting destroyed by bitcoin and bleeds on its BTC pair? Or is it fairing well against it and its green candles and clear skies ahead?

I treat altcoins with the -everything is a shitcoin apart from Bitcoin- premise. I am not a bitcoin maximalist, but I do understand altcoins exist to get more gains and then funnel them into bitcoin.

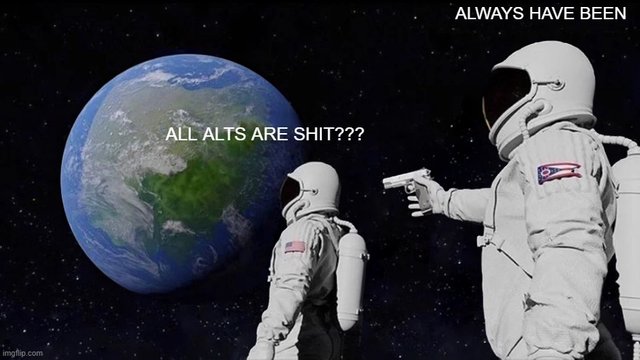

Every altcoin is a shitcoin. Yes, even your favorite ones. EVERY. SINGLE. ONE. OF. THEM.

Whenever bitcoin makes an aggressive run for the hills, it tends to make the alts bleed. But what is the first thing that should come into our heads with this observation? This translates to altcoin gains are being transferred into bitcoin, hence we get a rise in the so-called Bitcoin Dominance aka capital moves from altcoins into Bitcoin. This is due to investors being bored with alts, a bull run initiation after a period of sideways or downwards movement or anything similar. Investors don’t want to miss out on a bitcoin moon mission and they transfer their big gains from much volatile assets to a stable one to keep increasing their profit.

Altcoins have their purpose but do not go the other way round as a newbie into the space. You will get rekt with mathematical precision. Make a solid portfolio first, with sound allocation in bitcoin-eth and stablecoins and then you can start your wet dream about making 100xs on shitcoin casino. Alts and shitcoins boomed, there are always going to be opportunities for massive returns on an investment. You cannot make those decisions as a newcomer. And if you dare double down on that and dare only hold shitcoins you will end up being a meme template for my pleasure.

.jpg)

Your friendly neighborhood helicopter pilot, ₿inochet

Part 3 coming next week.

.jpg)